Login to access

Want to subscribe?

This article is part of: Consumer

To find out more about how to join or access this report please contact us

For uptake of Massive IoT connectivity to meet expectations in the B2C and B2B2C markets, telcos will need to dramatically improve coverage and simplify their propositions.

A slow start for NB-IoT and LTE-M

For telcos around the world, the Internet of Things (IoT) has long represented one of the most promising growth opportunities. Yet for most telcos, the IoT still only accounts for a low single digit percentage of their overall revenue. One of the stumbling blocks has been relatively low demand for IoT solutions in the consumer market. This report considers why that is and whether low cost connectivity technologies specifically-designed for the IoT (such as NB-IoT and LTE-M) will ultimately change this dynamic.

NB-IoT and LTE-M are often referred to as Massive IoT technologies because they are designed to support large numbers of connections, which periodically transmit small amounts of data. They can be distinguished from broadband IoT connections, which carry more demanding applications, such as video content, and critical IoT connections that need to be always available and ultra-reliable.

The initial standards for both technologies were completed by 3GPP in 2016, but adoption has been relatively modest. This report considers the key B2C and B2B2C use cases for Massive IoT technologies and the prospects for widespread adoption. It also outlines how NB-IoT and LTE-M are evolving and the implications for telcos’ strategies.

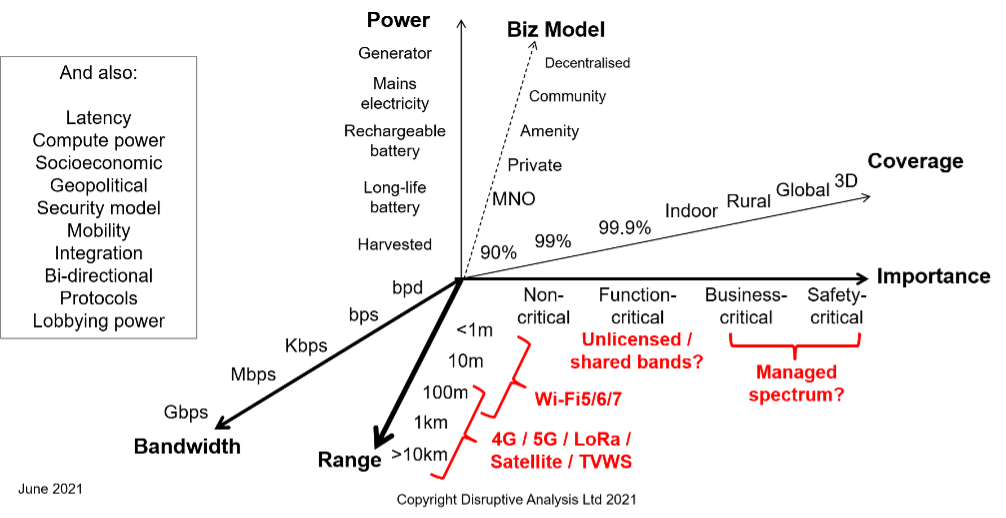

This builds on previous STL Partners’ research, including LPWA: Which way to go for IoT? and Can telcos create a compelling smart home?. The LPWA report explained why IoT networks need to be considered across multiple generations, including coverage, reliability, power consumption, range and bandwidth. Cellular technologies tend to be best suited to wide area applications for which very reliable connectivity is required (see Figure below).

IoT networks should be considered across multiple dimensions

Enter your details below to request an extract of the report

The smart home report outlined how consumers could use both cellular and short-range connectivity to bolster security, improve energy efficiency, charge electric cars and increasingly automate appliances. One of the biggest underlying drivers in the smart home sector is peace of mind – householders want to protect their properties and their assets, as rising population growth and inequality fuels fear of crime.

That report contended that householders might be prepared to pay for a simple and integrated way to monitor and remotely control all their assets, from door locks and televisions to solar panels and vehicles. Ideally, a dashboard would show the status and location of everything an individual cares about. Such a dashboard could show the energy usage and running cost of each appliance in real-time, giving householders fingertip control over their possessions. They could use the resulting information to help them source appropriate insurance and utility supply.

Indeed, STL Partners believes telcos have a broad opportunity to help coordinate better use of the world’s resources and assets, as outlined in the report: The Coordination Age: A third age of telecoms. Reliable and ubiquitous connectivity is a key enabler of the emerging sharing economy in which people use digital technologies to easily rent the use of assets, such as properties and vehicles, to others. The data collected by connected appliances and sensors could be used to help safeguard a property against misuse and source appropriate insurance covering third party rentals.

Do consumers need Massive IoT?

Whereas some IoT applications, such as connected security cameras and drones, require high-speed and very responsive connectivity, most do not. Connected devices that are designed to collect and relay small amounts of data, such as location, temperature, power consumption or movement, don’t need a high-speed connection.

To support these devices, the cellular industry has developed two key technologies – LTE-M (LTE for Machines, sometimes referred to as Cat M) and NB-IoT (Narrowband IoT). In theory, they can be deployed through a straightforward upgrade to existing LTE base stations. Although these technologies don’t offer the capacity, throughput or responsiveness of conventional LTE, they do support the low power wide area connectivity required for what is known as Massive IoT – the deployment of large numbers of low cost sensors and actuators.

For mobile operators, the deployment of NB-IoT and LTE-M can be quite straightforward. If they have relatively modern LTE base stations, then NB-IoT can be enabled via a software upgrade. If their existing LTE network is reasonably dense, there is no need to deploy additional sites – NB-IoT, and to a lesser extent LTE-M, are designed to penetrate deep inside buildings. Still, individual base stations may need to be optimised on a site-by-site basis to ensure that they get the full benefit of NB-IoT’s low power levels, according to a report by The Mobile Network, which notes that operators also need to invest in systems that can provide third parties with visibility and control of IoT devices, usage and costs.

There are a number of potential use cases for Massive IoT in the consumer market:

- Asset tracking: pets, bikes, scooters, vehicles, keys, wallets, passport, phones, laptops, tablets etc.

- Vulnerable persontracking: children and the elderly

- Health wearables: wristbands, smart watches

- Metering and monitoring: power, water, garden,

- Alarms and security: smoke alarms, carbon monoxide, intrusion

- Digital homes: automation of temperature and lighting in line with occupancy

In the rest of this report we consider the key drivers and barriers to take-up of NB-IoT and LTE-M for these consumer use cases.

Table of Contents

- Executive Summary

- Introduction

- Do consumers need Massive IoT?

- The role of eSIMs

- Takeaways

- Market trends

- IoT revenues: Small, but growing

- Consumer use cases for cellular IoT

- Amazon’s consumer IoT play

- Asset tracking: Demand is growing

- Connecting e-bikes and scooters

- Slow progress in healthcare

- Smart metering gains momentum

- Supporting micro-generation and storage

- Digital buildings: A regulatory play?

- Managing household appliances

- Technological advances

- Network coverage

- Conclusions: Strategic implications for telcos