Why the consumer IoT is stuck in the slow lane

For uptake of Massive IoT connectivity to meet expectations in the B2C and B2B2C markets, telcos will need to dramatically improve coverage and simplify their propositions.

For uptake of Massive IoT connectivity to meet expectations in the B2C and B2B2C markets, telcos will need to dramatically improve coverage and simplify their propositions.

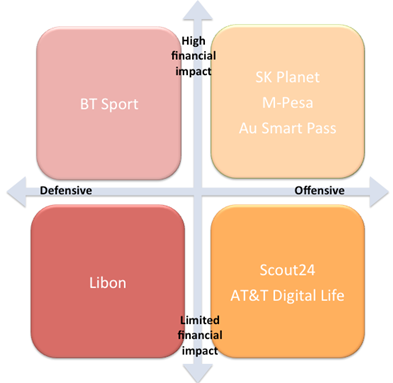

Although telcos aren’t generally associated with disruption, many operators around the world have attempted to disrupt adjacent markets, such as digital commerce, entertainment and financial services. In some cases, telcos have even disrupted their core broadband and communications markets. While many of these moves have fizzled out or have flown below investors’ radar screens, several have had a major impact on both the telco’s revenues and relevance. These include SK Planet, M-Pesa, Au Smart Pass and BT Sport. Why do some disruptive moves by telcos succeed and others fail?

Key trends, tactics, and technologies for mobile broadband networks and services that will influence mid-term revenue opportunities, cost structures and competitive threats. Includes consideration of LTE, network sharing, WiFi, next-gen IP (EPC), small cells, CDNs, policy control, business model enablers and more. (March 2012, Executive Briefing Service, Future of the Networks Stream).

Trends in European data usage