STL INSIGHTS

Snapshots from our analyst team’s latest research

STL Insights

Top five telcos for sustainability in path to net-zero

STL Partners’ 2022 telecom’s sustainability scorecard benchmarked performance of 45 companies (telecoms operators’ and a selection of adjacent market companies)

Telco cloud will drive network evolution

One of the core value propositions of telco cloud platform providers is that they offer to deliver to telcos a

Telcos face challenges in being loved brands

Loved brands create strong emotional bonds with their customers, through a set of values and beliefsthat customers can identify with

Policy & Charging in the 5G era

5G charging and policy network function will be fundamental to driving greater revenue, speed and control for operators.

Open RAN and vRAN deployments by operators

STL Partners updated (April 2022) its Telco Cloud Deployment Tracker with a more granular focus on Open RAN tracking the

Live events: An opportunity for telcos

For telcos, live events present specific challenges and opportunities. Providing millions of people with high quality images and audio simultaneously

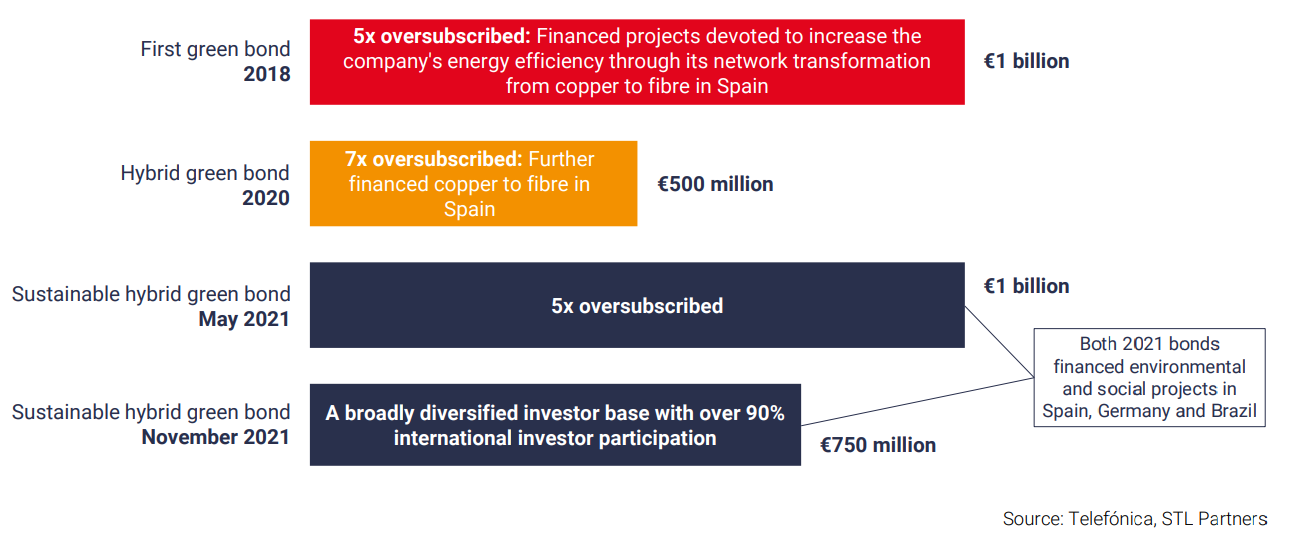

Sustainable financing: A pioneer in telecoms

In 2018, the environmental team started considering sustainability from a finance perspective, and the finance team started to incorporate ESG

Reluctance to deploy VNFs on the cloud reflects a persistent, legacy concept of the telco

VNFs on public cloud: Opportunity, not threat There have been very few significant deployments of VNFs on the public cloud,

Stakeholders: turn growth killers into growth makers

The seven stakeholder groups This report identifies seven stakeholder groups, and the ideal relationships within each group that lead to

AI and automation priorities in customer care since the pandemic

This January 2022, STL Partners has updated its 2020 report A3 for telcos: Mapping the financial value, published in May

Telco edge computing data centres: 3 approach factors

Telecoms operators want to build their network edges where there is demand. In other words, where there is a sufficient

Save energy and extend network coverage

Stratospheric Platforms Limited (SPL) has developed an alternative to traditional, terrestrial cell sites as a means of achieving network coverage