Introduction

In 2006, STL Partners came up with a bold new vision for the telecoms industry to use its communications, connectivity, and other capabilities (such as billing, identity, authentication, security, analytics) to build a two-sided platform that enables enterprises to interact with each other and consumers more effectively. We dubbed this Telco 2.0 and the last version of the Telco 2.0 manifesto we published can be found here – we feel it was prescient and that many of the points we made still resonate today. Indeed, many telecoms operators have embraced the Telco 2.0 two-sided business model over the last ten years.

Nevertheless, technological developments in the last few years are heralding a new era for society and telecoms, one which we have termed ‘The Coordination Age’ first described in our report The Coordination Age: A third age of telecoms in 2018.

We believe that faster networks which can connect tens of billions of sensors coupled with advances in analytics and process digitisation and automation means that there are opportunities for telecoms players to offer more than connectivity.

A successful telecoms operator in the Coordination Age will profitably contribute to improving society by enabling governments, enterprises and consumers to collaborate in such a way that precious resources – labour, knowledge, energy, power, products, housing, and so forth – are managed and allocated more efficiently and effectively than ever before. This should have major positive economic and social benefits. To do this, telecoms operators will need to move beyond providing core communications services. If they don’t choose this path, they are likely to be left fighting for a share of an increasingly small ‘telecoms pie’.

We outline our thesis for this below.

Context

Telecoms industry is seeking growth

Mobile telephony and fixed and mobile broadband means that telecoms operators have enjoyed 20 years of strong growth in all major markets. That growth has stalled. It happened in Japan and Korea as early as 2005, in Europe from 2012 or so and, market by market, others have followed. STL Partners forecasts that, apart from Africa, all regions will see a compound annual growth rate (CAGR) below 3% for both fixed and mobile services for the next three years. Globally, we forecast a CAGR of less than 1% per annum globally. This amounts to a decline in real terms.

Source: Company accounts from 165 operator groups; STL Partners forecasts

The telecoms industry’s response to this slowdown has been to continue to invest capital in better networks – fibre, 4G, 5G – to differentiate and secure more customers and higher revenues. Unfortunately, network leadership is becoming harder to achieve as competitors also upgrade their networks and the next ‘G’ becomes the new normal. Networks have become commoditised as value has shifted to the network-independent services that run on them.

In other words, the advantage that telcos had when only telecoms services could run on telecoms networks has gone: the defensive moat from owning fibre or spectrum has been breached. Value comes from service innovation not from capital expenditure. The chart below sums the problem up: 7 internet players generate around 35% of the revenue generated by 165 operators but have a bigger combined market capitalisation. This is because the capital markets believe that revenue and profit growth will accrue to these service innovators rather than telecoms operators.

Revenue and market capitalisation, 2019, Telco vs Internet

Source: Company accounts from 165 operator groups and 7 internet players; STL Partners analysis

Society is facing some major social and economic challenges

Governments, enterprises and consumers are facing unprecedented demands to manage resources of all kinds more efficiently and effectively than ever before. Why? Reasons vary by country, but readers will recognise some of the examples below:

1. Aging populations mean that long-term chronic conditions are increasing (diabetes, heart disease, Alzheimer’s, and so forth) placing greater burden on consumers, insurers, and governments to cover the cost.

2. The internet has enabled capital to flow quickly across borders but accompanying flows of labour and the associated need for more infrastructure and education tends to lag.

3. Consumers and businesses are using more and more resources and there is a need both to generate power sustainably but also to make it available where it is needed.

4. The corollary of point 3 is the need to reduce waste, re-use materials, and tackle climate change and pollution associated with inefficient exploitation of resources.

5. Telcos, manufacturers and other industrial players are struggling to attract the right labour skills to run their businesses effectively at the same time as being under huge pressure to reduce costs and improve productivity in the face of global competition.

Not addressing these challenges is not a viable option. Economically, socially, environmentally, and politically these challenges are growing increasingly serious and there is a sense that something must be done quickly to avoid a potentially catastrophic tipping point.

Addressing society’s (and the telecoms industry’s) challenges

The challenges above require the better matching of resource supply and demand – so that what is needed is provided quickly and efficiently where it is needed. This in turn requires governments, enterprises, and consumers to coordinate activities more effectively so they can make effective decisions faster. Solutions that deliver this coordinated activity require real-time communications and information exchange, real-time analytics to extract insights from the information, and real-time action to ensure that necessary changes to supply or demand are made.

Coordinating complex ecosystems requires three key capabilities

STL Partners contends that the technologies that enable these core capabilities of the Coordination Age fall into three segments:

1. Maturing: Fibre and 4G, Internet

2. Developing: 5G, Consumer and Industrial IoT, Analytics, Digitisation;

3. Emerging: Artificial Intelligence, Automation.

While some technologies are at an early stage of development, the common theme among all of them is that they now exist – something which was not true until recently. This means that the ability to coordinate resources real-time is becoming possible for the first time.

The Coordination Age

Right here, right now

STL Partners believes society is on the cusp of a new technology age.

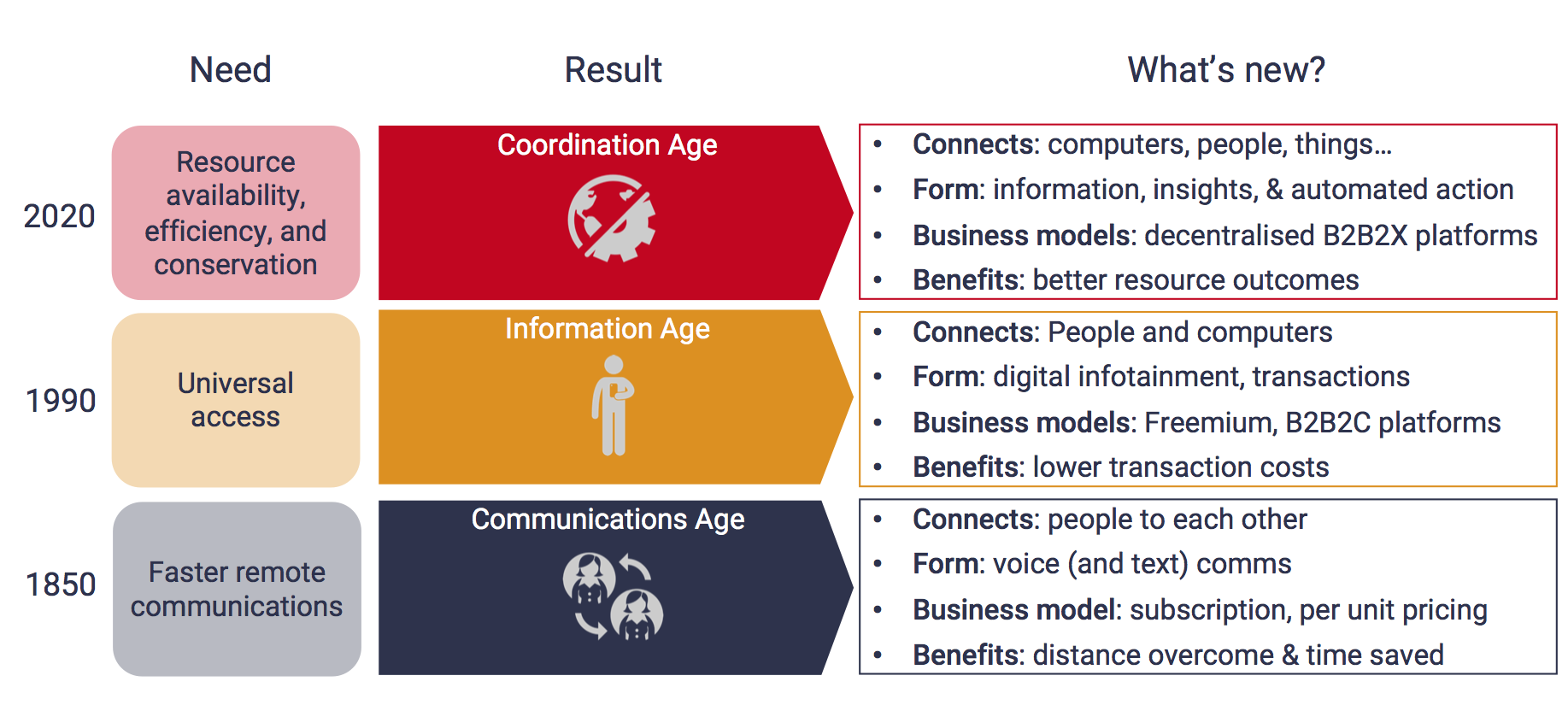

From 1850s until around 1990 or so the Communications Age was dominate. The telegraph and then telephony enabled people to communicate instantly over long distances and overcome geographic boundaries. The telecoms business model of subscription and per unit pricing was established.

In the 1990s the Internet emerged. This heralded the Information Age in which people could connect to computers directly. A new range of communications, such as social media, have been enabled. In addition, new non-telecommunications players have been able to provide traditional voice communication services. The Internet has also allowed information and entertainment to be accessed instantly – first via a PC and, increasingly, from mobile devices anywhere. We call this the Information Age, but it is not just about exchanging information: people can now transact instantly – buying and selling stocks, products, and services at the touch of button. New internet players have sprung up that manage dominant B2B2C platforms – Google, Amazon, Facebook, Baidu, Spotify – usually with a freemium business model where basic services are free, and users pay for premium services and/or when transactions are made via a commission fee. The result has been vastly more communication between humans than ever before and a dramatic lowering in (many) product and service transaction costs. For example, where only 20 years’ ago, having 100 vinyl LPs was a big music collection, now consumers can access every song ever recorded instantly whenever they want.

In the upcoming Coordination Age, people will connect with computers and, increasingly, with ‘things’ – machines, products, buildings, processes. Tens or hundreds of billions of connections will exponentially increase the volume of analysable data available. And, by leveraging advanced analytics and artificial intelligence, governments and enterprises and consumers will, therefore, be able to understand the way the world works better than ever before. More importantly, they will be able to determine how it should work: they will be able to optimise individual components, discrete assets, and entire systems instantly based on continuously crunching this data. The system will self-analyse but, even more importantly, as components, assets, and processes are digitised so it will be possible to automate ‘corrective actions’ so that improvements are also continuously made. The system (or ecosystem) learns and acts (semi-) autonomously in a coordinated way so that precious resources are managed efficiently and effectively.

Source: STL Partners

How would the Coordination Age work in healthcare, for example?

The description of the Coordination Age above may sound theoretical and futuristic, but we are already starting to see how connectivity + analytics + action is making a difference to industries. In healthcare, artificial intelligence applied to lung scan images can already predict the future development of cancer more accurate than specialist doctors viewing a scan. Similarly, remote monitoring of patients in their homes is already giving doctors (and patients themselves) valuable insight into specific chronic diseases and so enabling better patient care and saving valuable hospital resources.

In the Coordination Age, with the ability to have hundreds of sensors monitoring patients, rather than the handful used today, the healthcare industry will have a much better understanding of how to treat a patient.

But benefits won’t simply be confined to the patient, healthcare professional and hospital. Providers of healthcare solutions will have better insight into the performance of their solutions and be able to improve them faster. Insurers and governments will be able to treat more patients with higher care than ever before and aggregated data will enable advances in epidemiology so that public health policies are improved.

More and better information coupled with faster actions will enable everyone in the healthcare ecosystem to benefit. But this will need the coordination of a complex network of relationships in which most stakeholders both contribute – data, money, time, expertise – and receive – insights, care, time or money savings. Everyone is both a ‘buyer’ and a ‘seller’ in this new world.

Source: STL Partners

Coordination Age complexity will require a new ecosystem approach

A new model compared to the Information Age

We’ve touched on how Internet players, with dominant centralised B2B2C platforms, sprung up during the Information Age. We are not suggesting that these platforms will disappear in the Coordination Age but they are unlikely, on their own, to be suitable vehicles for coordinating the needs of so many parties. For example, in healthcare, it is unlikely that national governments would be happy placing so much power in the hands of companies which are domiciled in other counties and which have already clashed with authorities (in Europe at least) over data protection and tax. Furthermore, technologies such as blockchain mean that it is easier to decentralise the functions of a platform so that no single entity controls identify, authorisation, security, and so forth.

New opportunities for telcos?

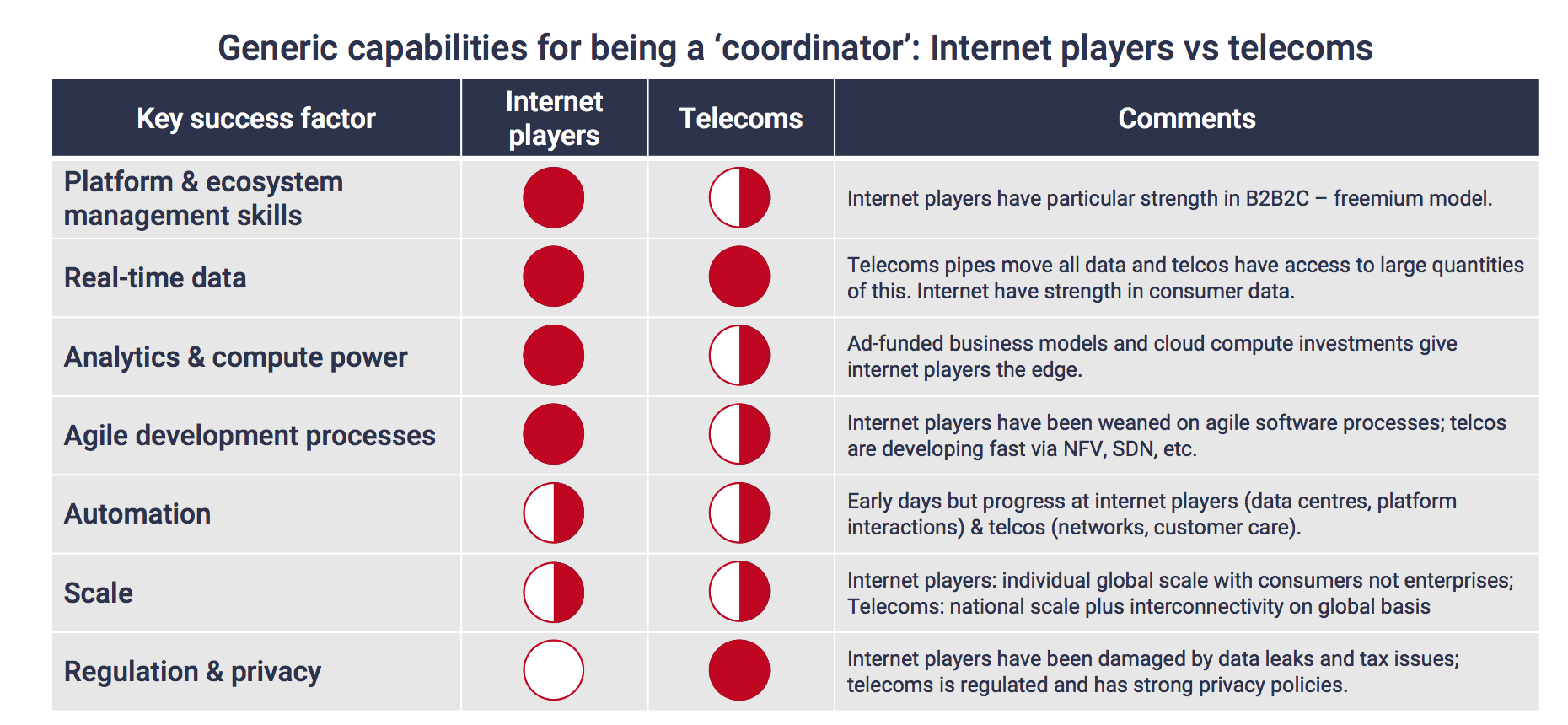

So, in the Coordination Age there is unlikely to be a single dominant coordinator for most ecosystems. Instead, coordination will be decentralised among several players. How this will manifest itself is not yet clear. It could be a series of federated platforms or it could be a platform that consists of different players contributing their own expertise (or both). But the important thing for the telecoms industry is that it won’t necessarily follow the Information Age model, and this gives operators the chance to take on a more meaningful role. And, while the telecoms industry may not have all the required skills to play an important coordinator role, especially compared to the Internet giants, they do have the advantage of being regulated and trusted in their local markets.

Source: STL Partners

The telecoms industry’s role in the Coordination Age

New vision needed…

If the telecoms industry is going to move beyond ‘connecting’ people and things to ‘coordinating’ them, this requires a fundamental shift in corporate vision.

Management teams need to embrace a new corporate purpose and communicate this to their organisations. Currently, most telecoms operators and vendors present themselves internally and externally as enablers of communication. This is fine as far as it goes but is not enough to achieve growth in a world where connectivity and communications challenges are being increasingly well addressed by all manner of enterprises. One or two operators have started to redefine their purpose – at least for specific divisions within their organisations – but most remain firmly entrenched in 20th century Communications Age thinking. Put simply, the telecommunications industry will never be able to do and be more to customers if management lack the vision and belief that their organisations can do and be more.

Source: company websites and annual reports

…and new strategy too

Part and parcel of establishing a new purpose is identifying who that purpose is for. Historically, operators have served all customers – consumers and SMBs and larger enterprises from all verticals – with a set of simple ‘horizontal’ solutions (voice, messaging, connectivity). If operators want to move beyond these services, then they will need to develop deep sector specialism. Individual operators cannot play a meaningful coordination role in lots of verticals – they do not have the scale, skills, and resources to do this. For the first time in their histories, operators will need to pick their battles and choose which customer groups they will seek to support with their coordinating capabilities.

And once a vertical has been targeted, operators need to determine how they will support the ecosystem in becoming more coordinated. As we show in the graphic below, STL Partners envisages three generic ‘layers’ in which telecoms operators and vendors can play:

1. With the increased flexibility offered by 5G, network virtualisation, and cloudified IT systems, operators will increasingly offer Network-as-a-service – with customers being able to demand specific network capabilities and capacity on demand. This will be table stakes for operators in any vertical and with consumers – customers will demand more technical and commercial flexibility from their provider of core telecoms services.

2. For some operators it will be enough to provide Network-as-a-service solutions to customers. Others may wish to provide additional value to chosen verticals. Some may offer Application enablement where they aggregate applications and data from ecosystem players and provide enablement services such as data management, transactions, analytics, billing, device and revenue management and so forth.

3. Independently or in conjunction with this, operators may wish to extend into Solutions & applications in which they customised end-to-end solutions and/or scalable applications.

Whatever their aspirations in a vertical, operators will need to consider their entry strategies carefully. How will they move from a horizontal player providing commoditised communications services to a vertical player offering platform services and differentiated applications and solutions?

Source: STL Partners

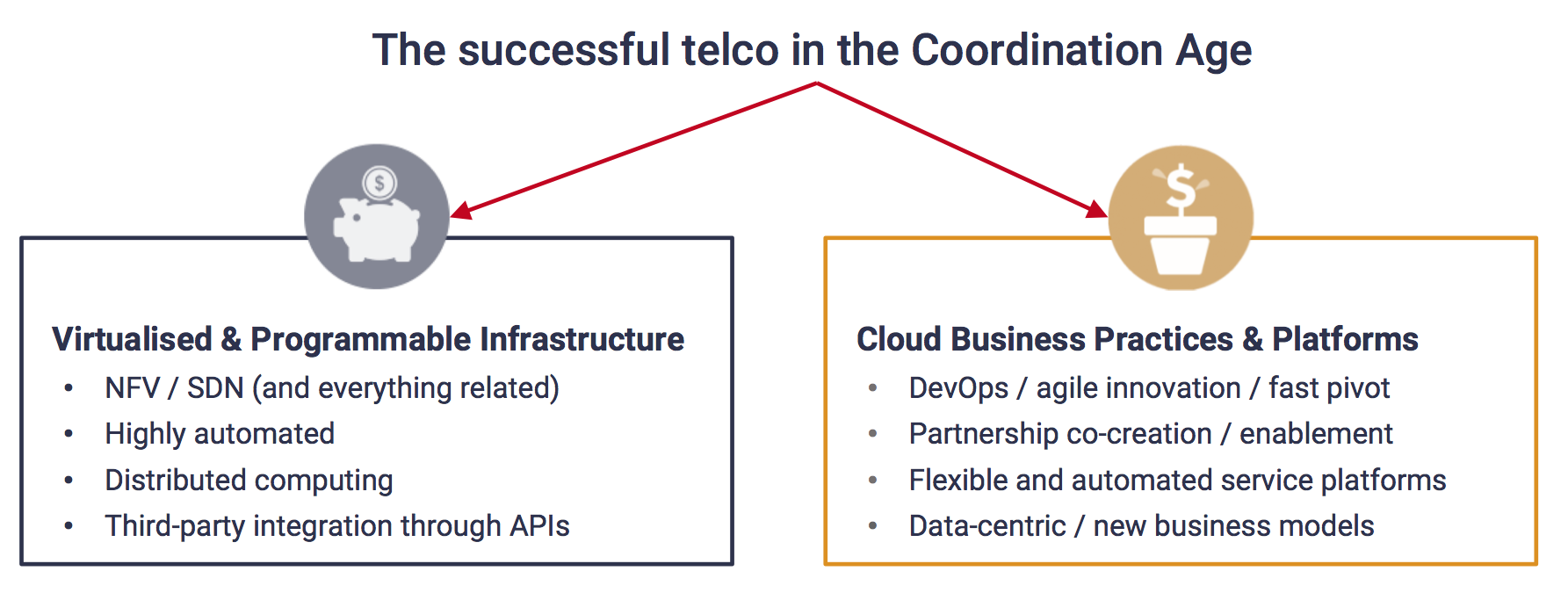

A new vision & strategy mean nothing without a change in investment model

Operators have been aspiring to digitise their operations and services for several years. But changes have been slow, and it is difficult to point to many ‘poster child’ operators that demonstrated a move beyond pure telecommunications. Partly this is due to a mismatch between corporate announcements and their investment policies. Too often we hear CEOs express a desire to change their organisations and that they intend to offer a host of exciting new services only to see that aspiration not borne out when CFOs allocate resources. Where other tech companies make substantial investments in R&D and product development, operators continue to invest miniscule amounts (especially in comparison to what is poured into the network itself).

Source: Company accounts; STL Partners analysis

Indeed, the average mobile operator invests around 16% of revenue in capital expenditure and less than 1% of revenue in R&D. If operators are going to develop new platforms and services – and so be important players in the Coordination Age – they will need to change this investment profile.

STL Partners argues that CFOs need to allocate resources differently. They must reduce capital expenditure and redirect resources towards developing platforms and services that deliver value to other enterprises. This is not easy and cannot be done overnight. Instead, it will take 10 years of change throughout the 5G investment cycle. Google changed its business model and drastically increased capital expenditure in cloud computing as it scaled, whereas operators must do the reverse as their businesses come under pressure.

CFOs should set clear targets for capital expenditure reductions each year and set aside savings for investment in either organic- or acquisition-driven growth in the verticals chosen for expansion beyond Network-as-a-service offerings. In conjunction with this, operational and financial metrics will need to be remodelled to reflect changes in the operational and financial business model.

Source: Google accounts; STL Partners analysis

New investments and a new operational model

If operators successfully free up resources to invest in innovation, what should they do beyond buying platform and services companies in their target verticals?

STL Partners believes that many of the network-related activities that will enable them to reduce capital expenditure (eventually), such as network virtualisation, will also give them to automate and integrate processes and systems so they are more flexible and agile. So, an agile software-oriented infrastructure will drive changes in core business processes such as product development and product management, partnering, and customer care if management invests resources in these areas.

Source: STL Partners

Our belief is that financial and operational developments need to happen in unison and operators need to nudge themselves towards a new modus operandi and culture through gradual and continuous movement rather than a single radical ‘transformation programme’.

Understanding the ‘interconnectedness’ of the organisation is important for success. For example, introducing an agile organisation model makes sense in a time of disruption since there is a need for multiple functions to work on problems. But moving to tribes, chapters, and squads will only work if the incentive and management development programmes are also overhauled. Without changes in the latter, executives face being asked to behave in a new way while being managed and rewarded via the old one. Even small developments, therefore, have knock-on effects and this ‘ripple effect’ needs to be considered so that ‘nudges’ are effective. Management need to believe in and communicate a big vision to their organisation, partners, and customers, and manage the required changes incrementally. If they do this, then the telecoms industry still faces a bright future.

STL Partners is committed to working with executives who share this ambitious vision for the industry and on working with clients on the ‘nudges’ which create the big changes.

October 2019