Telecoms 2030 Part 1: The telecoms industry problem

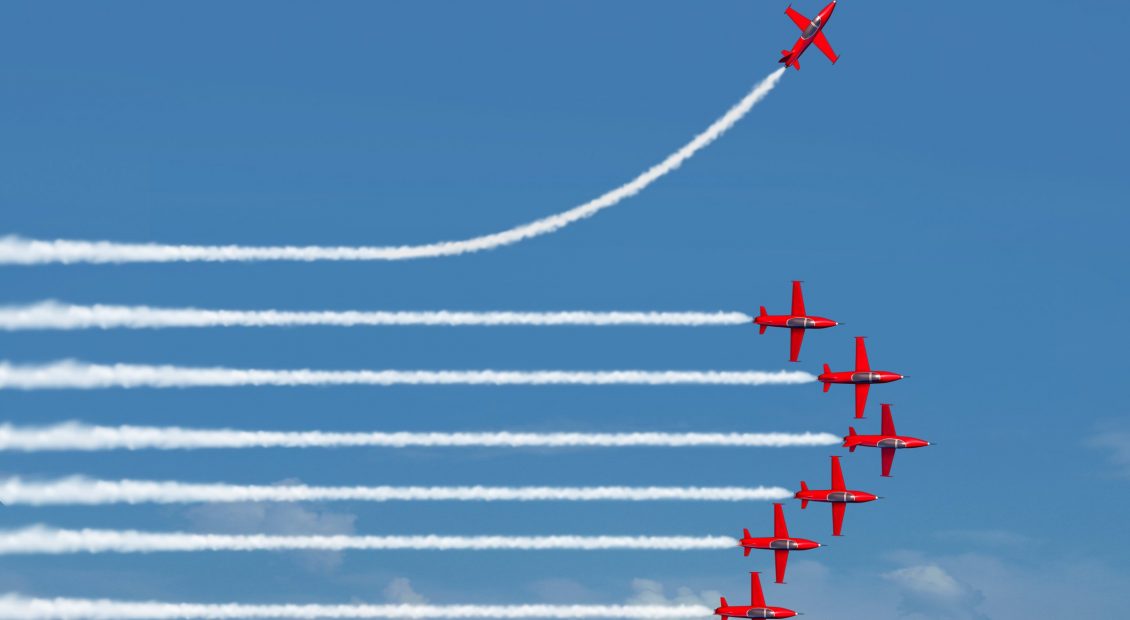

The traditional “moat-building” business model adopted by telcos is no longer viable. If telcos are to compete with internet giants in 2030, they must fundamentally change as organisations. Part 1 of our Telecoms 2030 series outlines this need for change, providing three possible business models for the telco of 2030 – Servco, Infraco and Techco.