Login to access

Want to subscribe?

This article is part of: Executive Briefing Service, Network Innovation

To find out more about how to join or access this report please contact us

The telecoms industry often puts so-called OTT (over-the-top) players like Google and Facebook at the forefront of its concerns, as they pose new competition for services and applications. But what about encroachment of companies “underneath” the telcos, displacing them from their core asset, the network? Telco 2.0 examines the strategic threats and opportunities from wholesale providers, outsourcers and government-run broadband networks. (January 2012, Executive Briefing Service, Future of the Networks Stream). UTF Image Jan 2012

Introduction

The ‘smart pipe’ imperative

In some quarters of the telecoms industry, the received wisdom is that the network itself is merely an undifferentiated “pipe”, providing commodity connectivity, especially for data services. The value, many assert, is in providing higher-tier services, content and applications, either to end-users, or as value-added B2B services to other parties. The Telco 2.0 view is subtly different. We maintain that:

- Increasingly valuable services will be provided by third-parties but that operators can provide a few end-user services themselves. They will, for example, continue to offer voice and messaging services for the foreseeable future.

- Operators still have an opportunity to offer enabling services to ‘upstream’ service providers such as personalisation and targeting (of marketing and services) via use of their customer data, payments, identity and authentication and customer care.

- Even if operators fail (or choose not to pursue) options 1 and 2 above, the network must be ‘smart’ and all operators will pursue at least a ‘smart network’ or ‘Happy Pipe’ strategy. This will enable operators to achieve three things.

- To ensure that data is transported efficiently so that capital and operating costs are minimised and the Internet and other networks remain cheap methods of distribution.

- To improve user experience by matching the performance of the network to the nature of the application or service being used – or indeed vice versa, adapting the application to the actual constraints of the network. ‘Best efforts’ is fine for asynchronous communication, such as email or text, but unacceptable for traditional voice telephony. A video call or streamed movie could exploit guaranteed bandwidth if possible / available, or else they could self-optimise to conditions of network congestion or poor coverage, if well-understood. Other services have different criteria – for example, real-time gaming demands ultra-low latency, while corporate applications may demand the most secure and reliable path through the network.

- To charge appropriately for access to and/or use of the network. It is becoming increasingly clear that the Telco 1.0 business model – that of charging the end-user per minute or per Megabyte – is under pressure as new business models for the distribution of content and transportation of data are being developed. Operators will need to be capable of charging different players – end-users, service providers, third-parties (such as advertisers) – on a real-time basis for provision of broadband and maybe various types or tiers of quality of service (QoS). They may also need to offer SLAs (service level agreements), monitor and report actual “as-experienced” quality metrics or expose information about network congestion and availability.

Under the floor players threaten control (and smartness)

Either through deliberate actions such as outsourcing, or through external agency (Government, greenfield competition etc), we see the network-part of the telco universe suffering from a creeping loss of control and ownership. There is a steady move towards outsourced networks, as they are shared, or built around the concept of open-access and wholesale. While this would be fine if the telcos themselves remained in control of this trend (we see significant opportunities in wholesale and infrastructure services), in many cases the opposite is occurring. Telcos are losing control, and in our view losing influence over their core asset – the network. They are worrying so much about competing with so-called OTT providers that they are missing the threat from below.

At the point at which many operators, at least in Europe and North America, are seeing the services opportunity ebb away, and ever-greater dependency on new models of data connectivity provision, they are potentially cutting off (or being cut off from) one of their real differentiators.

Given the uncertainties around both fixed and mobile broadband business models, it is sensible for operators to retain as many business model options as possible. Operators are battling with significant commercial and technical questions such as:

- Can upstream monetisation really work?

- Will regulators permit priority services under Net Neutrality regulations?

- What forms of network policy and traffic management are practical, realistic and responsive?

Answers to these and other questions remain opaque. However, it is clear that many of the potential future business models will require networks to be physically or logically re-engineered, as well as flexible back-office functions, like billing and OSS, to be closely integrated with the network.

Outsourcing networks to third-party vendors, particularly when such a network is shared with other operators is dangerous in these circumstances. Partners that today agree on the principles for network-sharing may have very different strategic views and goals in two years’ time, especially given the unknown use-cases for new technologies like LTE.

This report considers all these issues and gives guidance to operators who may not have considered all the various ways in which network control is being eroded, from Government-run networks through to outsourcing services from the larger equipment providers.

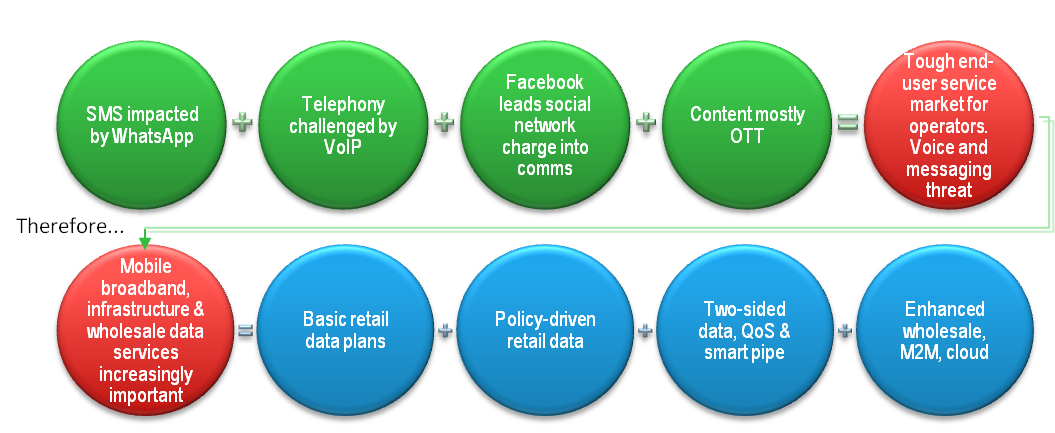

Figure 1 – Competition in the services layer means defending network capabilities is increasingly important for operators

Source: STL Partners

Industry structure is being reshaped

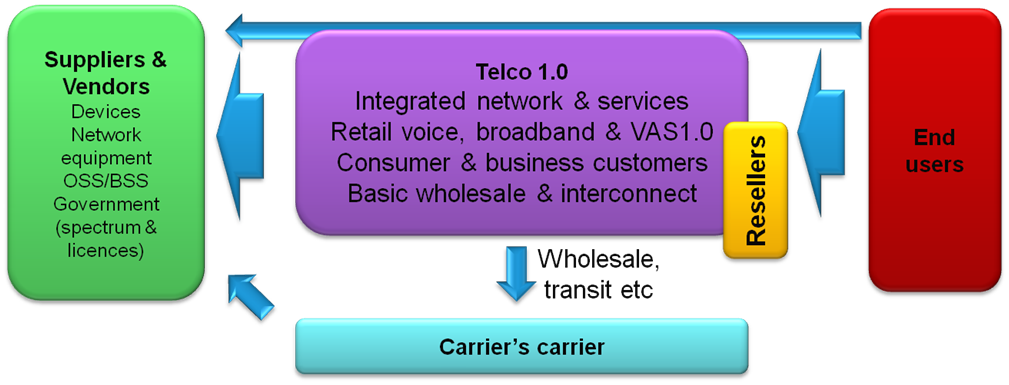

Over the last year, Telco 2.0 has updated its overall map of the telecom industry, to reflect ongoing dynamics seen in both fixed and mobile arenas. In our strategic research reports on Broadband Business Models, and the Roadmap for Telco 2.0 Operators, we have explored the emergence of various new “buckets” of opportunity, such as verticalised service offerings, two-sided opportunities and enhanced variants of traditional retail propositions.

In parallel to this, we’ve also looked again at some changes in the traditional wholesale and infrastructure layers of the telecoms industry. Historically, this has largely comprised basic capacity resale and some “behind the scenes” use of carriers-carrier services (roaming hubs, satellite / sub-oceanic transit etc).

Figure 2 – Telco 1.0 Wholesale & Infrastructure structure

Source: STL Partners

Content

- Revising & extending the industry map

- ‘Network Infrastructure Services’ or UTF?

- UTF market drivers

- Implications of the growing trend in ‘under-the-floor’ network service providers

- Networks must be smart and controlling them is smart too

- No such thing as a dumb network

- Controlling the network will remain a key competitive advantage

- UTF enablers: LTE, WiFi & carrier ethernet

- UTF players could reduce network flexibility and control for operators

- The dangers of ceding control to third-parties

- No single answer for all operators but ‘outsourcer beware’

- Network outsourcing & the changing face of major vendors

- Why become an under-the-floor player?

- Categorising under-the-floor services

- Pure under-the-floor: the outsourced network

- Under-the-floor ‘lite’: bilateral or multilateral network-sharing

- Selective under-the-floor: Commercial open-access/wholesale networks

- Mandated under-the-floor: Government networks

- Summary categorisation of under-the-floor services

- Next steps for operators

- Build scale and a more sophisticated partnership approach

- Final thoughts

- Index

- Figure 1 – Competition in the services layer means defending network capabilities is increasingly important for operators

- Figure 2 – Telco 1.0 Wholesale & Infrastructure structure

- Figure 3 – The battle over infrastructure services is intensifying

- Figure 4 – Examples of network-sharing arrangements

- Figure 5 – Examples of Government-run/influenced networks

- Figure 6 – Four under-the-floor service categories

- Figure 7: The need for operator collaboration & co-opetition strategies