Login to access

Want to subscribe?

This article is part of: Executive Briefing Service, Consumer

To find out more about how to join or access this report please contact us

Connected cars are set to revolutionise the automotive industry as we know it, turning the car into the ‘ultimate mobile device’ and driving the growth of M2M in a big way. With Apple, Google, telcos and many others in the chase, we analyse the growth drivers, value chain, and key battles for control of this increasingly complex ecosystem, and outline a new connected car services framework.

Introduction: Putting the Car in Context

A growing mythology around M2M and the Internet of Things

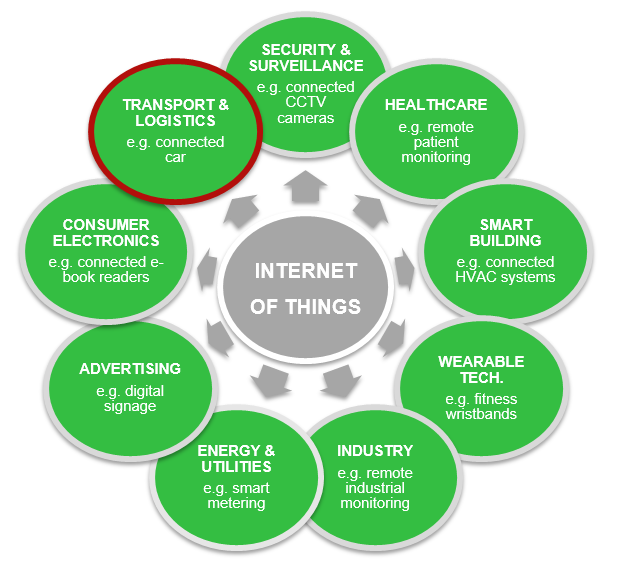

The ‘Internet of Things’, which is sometimes used interchangeably with ‘machine-to-machine’ communication (M2M), is not a new idea: as a term, it was coined by Kevin Ashton as early as 1999. Although initially focused on industrial applications, such as the use of RFID for tagging items in the supply chain, usage of the term has now evolved to more broadly describe the embedding of sensors, connectivity and (to varying degrees) intelligence into traditionally ‘dumb’ environments. Figure 1 below outlines some of the service areas potentially disrupted, enabled or enhanced by the Internet of Things (IoT):

Figure 1: Selected Internet of Things service areas

Source: STL Partners

To put the IoT in context, one can conceive of the Internet as having experienced three key generations to date. The first generation dates back to the 1970s, which involved ARPANET and the interconnection of various military, government and educational institutions around the United States. The second, beginning in the 1990s, can be thought of as the ‘AOL phase’, with email and web browsing becoming mainstream. Today’s generation is dominated by ‘mobile’ and ‘social’, with the two inextricably linked. The fourth generation will be signified by the arrival of the Internet of Things, in which the majority of internet traffic is generated by ‘things’ rather than humans.

The enormous growth of networks, cheaper connectivity, proliferation of smart devices, more efficient wireless protocols (e.g. ZigBee) and various government incentives/regulations have led many to confidently predict that the fourth generation of the Internet – the Internet of Things – will soon be upon us. Visions include the “Internet of Everything” (Cisco) or a “connected future” with 50 billion connected devices by 2020 (Ericsson). Similarly rapid growth is also forecasted by the MIT Technology Review, as detailed below:

Figure 2: Representative connected devices forecast, 2010-20

Source: MIT Technology Review

This optimism is reflected in broader market excitement, which has been intensified by such headline-grabbing announcements as Google’s $3.2bn acquisition of Nest Labs (discussed in depth in the Connected Home EB) and Apple’s recently announced Watch. Data extracted from Google Trends (Figure 3) shows that the popularity of ‘Internet of Things’ as a search term has increased fivefold since 2012:

Figure 3: The popularity of ‘Internet of Things’ as a search term on Google since 2004

Source: Google Trends

However, the IoT to date has predominantly been a case study in hype vs. reality. Technologists have argued for more than a decade about when the army of connected devices will arrive, as well as what we should be calling this phenomenon, and with this a mythology has grown around the Internet of Things: widespread disruption was promised, but it has not yet materialised. To many consumers the IoT can sound all too far-fetched: do I really need a refrigerator with a web browser?

Yet for every ‘killer app’ that wasn’t we are now seeing inroads being made elsewhere. Smart meters are being deployed in large numbers around the world, wearable technology is rapidly increasing in popularity, and many are hailing the connected car as the ‘next big thing’. Looking at the connected car, for example, 2013 saw a dramatic increase in the amount of VC funding it received:

Figure 4: Connected car VC activity, 2010-13

Source: CB Insights Venture Capital Database

The Internet of Things is potentially an important phenomenon for all, but it is of particular relevance to mobile network operators (MNOs) and network equipment providers. Beyond providing cellular connectivity to many of these devices, the theory is that MNOs can expand across the value chain and generate material and sustainable new revenues as their core business continues to decline (for more, see the ‘M2M 2.0: New Approaches Needed’ Executive Briefing).

Nevertheless, the temptation is always to focus on the grandiose but less well-defined opportunities of the future (e.g. smart grids, smart cities) rather than the less expansive but more easily monetised ones of today. It is easy to forget that MNOs have been active to varying degrees in this space for some time: for example, O2 UK had a surprisingly large business serving fleet operators with the 9.6Kbps Mobitex data network for much of the 2000s. To further substantiate this context, we will address three initial questions:

- Is there a difference between M2M and the Internet of Things?

- Which geographies are currently seeing the most traction?

- Which verticals are currently seeing the most traction?

These are now addressed in turn…

- Executive Summary

- Introduction: Putting the Car in Context

- A growing mythology around M2M and the Internet of Things

- The Internet of Things: a vision of what M2M can become

- M2M today: driven by specific geographies and verticals

- Background: History and Growth Drivers

- History: from luxury models to mass market deployment

- Growth drivers: macroeconomics, regulation, technology and the ‘connected consumer’

- Ecosystem: Services and Value Chain

- Service areas: data flows vs. consumer value proposition

- Value chain: increasingly complex with two key battlegrounds

- Markets: Key Geographies Today

- Conclusions

- Figure 1: Selected Internet of Things service areas

- Figure 2: Representative connected devices forecast, 2010-20

- Figure 3: The popularity of ‘Internet of Things’ as a search term on Google since 2004

- Figure 4: Connected car VC activity, 2010-13

- Figure 5: Candidate differences between M2M and the Internet of Things

- Figure 6: Selected leading MNOs by M2M connections globally

- Figure 7: M2M market maturity vs. growth by geographic region

- Figure 8: Global M2M connections by vertical, 2013-20

- Figure 9: Global passenger car profit by geography, 2007-12

- Figure 10: A connected car services framework

- Figure 11: Ericsson’s vision of the connected car’s integration with the IoT

- Figure 12: The emerging connected car value chain

- Figure 13: Different sources of in-car connectivity

- Figure 14: New passenger car sales vs. consumer electronics spending by market

- Figure 15: Index of digital content spending (aggregate and per capita), 2013

- Figure 16: OEM embedded modem shipments by region, 2014-20

- Figure 17: Telco 2.0™ ‘two-sided’ telecoms business model