The state of telco transformation

Nine change stakeholders describe their experience of telco transformation, providing insights on the change process and learnings for others that are remodelling their organisations for the future.

Nine change stakeholders describe their experience of telco transformation, providing insights on the change process and learnings for others that are remodelling their organisations for the future.

How telecoms can adapt and offer customers and other stakeholders an attractive way forward in markets facing inflation, and geopolitical and environmental challenges.

There are troubling signals in the business environment. Consumer confidence is at an all-time low due to inflation, conflict, Covid and climate change. What are the consequences for telecoms, and what should telcos, vendors, policymakers and others in the ecosystem do?

In the first of two reports we examine the macro forces and outline three key steps to reshape priorities and the strategy agenda.

Truly data-driven organisations excel at understanding their customers, driving new revenues, and evolving their business models. In order to achieve these benefits, telcos will need to create more useable data sets, accessible to all across the organisation – and to external partners in the future. What practical steps should they take to get there?

This report outlines best practice in identifying and scaling new business opportunities, in terms of how to organise, the necessary culture, where to start, who to involve, and how to exit.

Mobile operators are not the only companies that can deploy 4/5G cellular networks. The rise of IoT and 5G is driving huge new interest in running mobile infrastructure, presenting new opportunities as well as threats for telcos.

An introduction to digital twins, an approach to managing assets that is gaining increasing traction across many business sectors, and that will ultimately disrupt many industry business models.

Retail banks are threatened by a new breed of focused and fast digital firms – fintech – that offer cheaper and more tailored financial services. BBVA management saw this threat early and acted decisively to ensure it remained competitive. Telcos have much to learn from this.

Telcos can draw ten lessons around organisational structure, strategy and staying relevant with customers from AccorHotels’ rapid digital transformation. This is the second in our series of transformation case studies from outside the telecoms sector.

The music industry was one of the first sectors to be fundamentally disrupted by the Internet. Facing an epic and almost existential battle with piracy, coupled with expectations that music should be free, the record labels have tested many different business and distribution models. With sales of recorded music finally growing again, telcos and their partners can learn a lot from the music industry’s hits and misses.

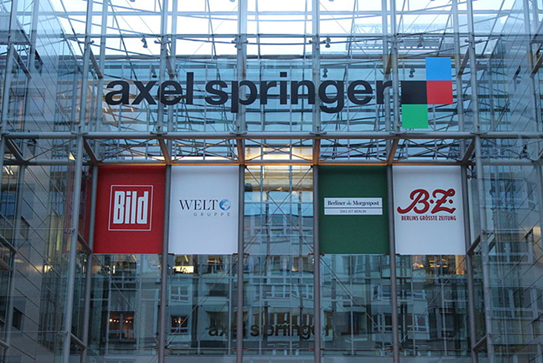

Our latest adjacent market case study analyses Axel Springer’s successful 10 year digital transformation from print to online publisher, and holds many lessons for telcos, not least of which are the pitfalls of under commitment, and the required level of investment in M&A.

Some telcos are hoping that mobile data growth will resurge and transform their fortunes, though STL Partners has previously argued that data growth will not be enough. In this report we re-examine this argument looking at global trends and present the insights and lessons from six operator case-studies including DNA Finland, T-Mobile US and Reliance Jio.

Although the B2B market could deliver significant revenue growth, most telcos’ enterprise businesses are not delivering their full potential. In this report we analyse the reasons why and outline how telcos can build a successful B2B strategy.

Investment in fintech has increased by 500% in the last 3 years. Interest and investment has spiked as fintech companies seek to leverage new sources of data to develop disruptive offerings across a broad range of financial service areas (e.g. payments, lending & funding). The scale and scope of investment and activity represents a potential paradigm shift within financial services. Telcos, who have a long history developing financial services (e.g. mobile money), need to understand this changing landscape. This report explores why fintech is happening now and maps where and how it is disrupting established financial services.

We’ve identified seven questions that are fundamental to telcos’ forward success, and compiled some of our recent research that helps address them.

Although the shape of the cloud industry turned out better than expected, most telco strategies in the cloud haven’t delivered. We investigate why, what has led to success, and what telcos need to learn to do differently.

The UK’s vote to leave the European Union came as a shock to many, and has complex ongoing consequences. We summarise briefly what happened, possible scenarios, and give our initial view on the implications for telcos, their business partners and the innovation ecosystem.