Login to access

Want to subscribe?

This article is part of: Executive Briefing Service, Network Innovation

To find out more about how to join or access this report please contact us

Free’s shock bid for T-Mobile USA will stretch its finances and management capacity to the limit. Can Free’s package of tactics, technology, and procedures work in the US context?

Free’s Bid for T-Mobile USA

The future of the US market and its 3rd and 4th operators has been a long-running saga. The market, the world’s richest, remains dominated by the duopoly of AT&T and Verizon Wireless. It was long expected that Softbank’s acquisition of Sprint heralded disruption, but in the event, T-Mobile was simply quicker to the punch.

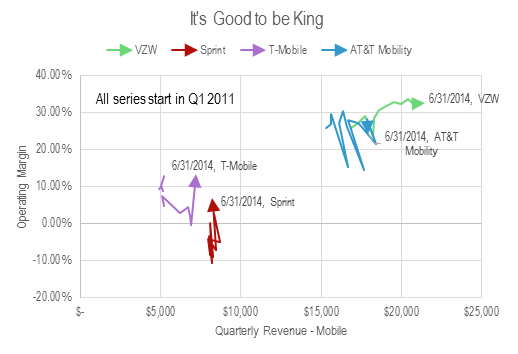

Since the launch of T-Mobile’s “uncarrier” price-war strategy, we have identified signs of a “Free Mobile-like” disruption event, for example, substantial net-adds for the disruptor, falling ARPUs, a shakeout of MVNOs and minor operators, and increased industry-wide subscriber growth. However, other key indicators like a rapid move towards profitability by the disruptor are not yet in evidence, and rather than industry-wide deflation, we observe divergence, with Verizon Wireless increasing its ARPU, revenues, and margins, while AT&T’s are flat, Sprint’s flat to falling, and T-Mobile’s plunging.

This data is summarised in Figure 1.

Figure 1: Revenue and margins in the US. The duopoly is still very much with us

Source: STL Partners, company filings

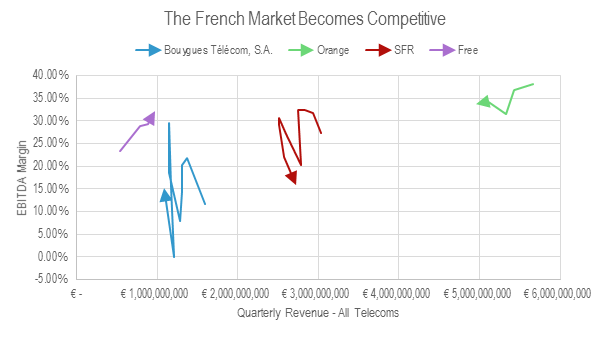

Compare and contrast Figure 2, which shows the fully developed disruption in France.

Figure 2: Fully-developed disruption. Revenue and margins in France

Source: STL Partners, company filings

T-Mobile: the state of play in Q2 2014

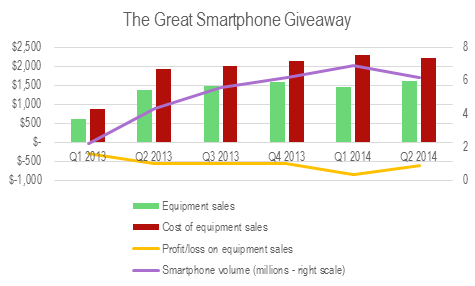

When reading Figure 1, you should note that T-Mobile’s Q2 2014 accounts contain a negative expense item of $747m, reflecting a spectrum swap with Verizon Wireless, which flatters their margin. Without it, the operating margin would be 2.99%, about a third of Sprint’s. Poor as this is, it is at least positive territory, after a Q1 in which T-Mobile lost money. It is not quite true to say that T-Mobile only made it to profitability thanks to the one-off spectrum deal; excluding it, the carrier would have made $215m in operating income in Q2, a $243m swing from the $28m net loss in Q1. This is explained by a $223m narrowing of T-Mobile’s losses on device sales, as shown in Figure 2, and may explain why the earnings release makes no mention of profits instead of adjusted EBITDA despite it being a positive quarter.

Figure 3: T-Mobile’s return to underlying profitability – caused by moderating its smartphone bonanza somewhat

Source: STL Partners, company filings

T-Mobile management likes to cite its ABPU (Average Billings per User) metric in preference to ARPU, which includes the hire-purchase charges on device sales under its quick-upgrade plans. However, as Figure 3 shows, this is less exciting than it sounds. The T-Mobile management story is that as service prices, and hence ARPU, fall in order to bring in net-adds, payments for device sales “decoupled” from service plans will rise and take up the slack. They are, so far, only just doing so. Given that T-Mobile is losing money on device pricing, this is no surprise.

- Executive Summary

- Free’s Bid for T-Mobile USA

- T-Mobile: the state of play in Q2 2014

- Free-Mobile: the financials

- Indicators of a successful LBO

- Free.fr: a modus operandi for disruption

- Surprise and audacity

- Simple products

- The technical edge

- Obstacles to the Free modus operandi

- Spectrum

- Fixed-mobile synergy

- Regulation

- Summary

- Two strategic options

- Hypothesis one: change the circumstances via a strategic deal with the cablecos

- Hypothesis two: 80s retro LBO

- Problems that bite whichever option is taken

- The other shareholders

- Free’s management capacity and experience

- Conclusion

- Figure 1: Revenue and margins in the US. The duopoly is still very much with us

- Figure 2: Fully-developed disruption. Revenue and margins in France

- Figure 3: T-Mobile’s return to underlying profitability – caused by moderating its smartphone bonanza somewhat

- Figure 4: Postpaid ARPU falling steadily, while ABPU just about keeps up

- Figure 5: T-Mobile’s supposed “decoupling” of devices from service has extended $3.5bn of credit to its customers, rising at $1bn/quarter

- Figure 6: Free’s valuation of T-Mobile is at the top end of a rising trend

- Figure 7: Example LBO

- Figure 8: Free-T-Mobile in the context of notable leveraged buyouts

- Figure 9: Free Mobile’s progress towards profitability has been even more impressive than its subscriber growth