Are telcos smart enough to make money work?

Mobile operators have many of the assets and capabilities required to become a major force in financial services, but they will also need to tap expertise in data analytics/machine learning.

Mobile operators have many of the assets and capabilities required to become a major force in financial services, but they will also need to tap expertise in data analytics/machine learning.

AI, coupled with a data-centric approach and automation, looks like it is starting to pay back the operators who have led in this field. Where can industry leaders go next, and what are the key lessons for others on how to ‘jump the curve’?

Telefónica’s systematic and sustained push into personal data management holds valuable lessons for other telcos about building trust and credibility. The report also covers personal cloud / data plays by NTT DOCOMO and financial services company Mint.

With iPhone sales apparently peaking, Apple is looking to double its revenue from services over the next four years to approximately US$50 billion, taking it deeper into adjacent markets, such as entertainment, financial services and communications. However, Apple trails behind Google in developing artificial intelligence and needs to extend the reach of its services to capture more behavioural data. If Apple decides to decouple more of its key services from its hardware, that would have major ramifications for Google, Amazon, Facebook and many of the world’s leading telcos.

To find new revenues, some telcos are competing head-on with the major internet players in the digital communications, content and commerce markets. Although telcos’ track record in digital services is poor, some are gaining traction. AT&T, Axiata, Reliance Jio and Turkcell are each pursuing very different digital services strategies, and we believe these potentially disruptive moves offer valuable lessons for other telcos and their partners.

The rapid growth of Facebook, WhatsApp, WeChat and other Internet-based services has prompted some commentators to write off telcos in the consumer communications market. But many mobile operators retain surprisingly large voice and messaging businesses and still have several strategic options. Indeed, there is much telcos can learn from the leading Internet players’ evolving communications propositions and their attempts to integrate them into broad commerce and content platforms. In this report we examine what opportunities still exist for telcos in this strategically important sector.

Artificial intelligence (AI) is improving rapidly thanks to the growing use of deep neural networks to teach computers how to interpret the real world (deep learning). These networks use vast amounts of detailed data to enable machines to learn. What are the potential benefits for telcos, and what do they need to do to make this happen?

Amazon, Facebook and Google are engaged in a global contest to become the pre-eminent broker of digital commerce between merchants and consumers. Google controls the leading digital platform – the Android smartphone. And Facebook dominates mobile messaging. But new digital platforms are emerging – the growing popularity of smart speakers, which rely on cloud-based artificial intelligence, could help Amazon, the original online chameleon, to bolster its fast-evolving ecosystem at the expense of Google and Facebook. As the digital food chain evolves, opportunities will open up for telcos, but only if the smart home market remains heterogeneous and very competitive.

Mobile messaging is fast becoming a key platform for digital commerce, mounting a challenge to Google Search, Amazon’s Marketplace and other two-sided platforms. As Facebook gears up to take advantage of this opportunity, some of the world’s largest telcos are working with Google to develop and deploy multimedia communications services that will work across networks and will replace SMS. But will it be too little, too late?

The spread of 3G and 4G mobile networks in Africa and developing Asia, together with the growing adoption of low cost smartphones, is helping Facebook, YouTube, Netflix and other global online entertainment platforms gain traction in emerging markets. But some major international telcos, such as Vodafone and MTN, also have well-established and multi-faceted online entertainment offerings in Africa and developing Asia. How robust are these telcos’ entertainment services? Can they fend off the mounting challenge from global Internet players? What is working for Vodafone India and MTN and what needs a rethink?

Some of the world’s largest telcos see the fast-growing demand for online entertainment as a golden opportunity to shore up their revenues and relevance. BT, Telefónica and Verizon are among the major telcos pumping billions of dollars into building end-to-end entertainment offerings that can compete with those of the major Internet platforms. But how well prepared are telcos to respond to the forces set to disrupt this fast-changing market?

Messaging services are increasingly enabling interactions and transactions between consumers and businesses. Largely pioneered by WeChat in China, the growing integration of digital communications and commerce services looks like a multi-billion dollar boon for Facebook and a major headache for Amazon, eBay and Google. It also poses a strategic dilemma for Apple and telcos: Can they turn their communications apps into shopping channels while championing privacy and security?

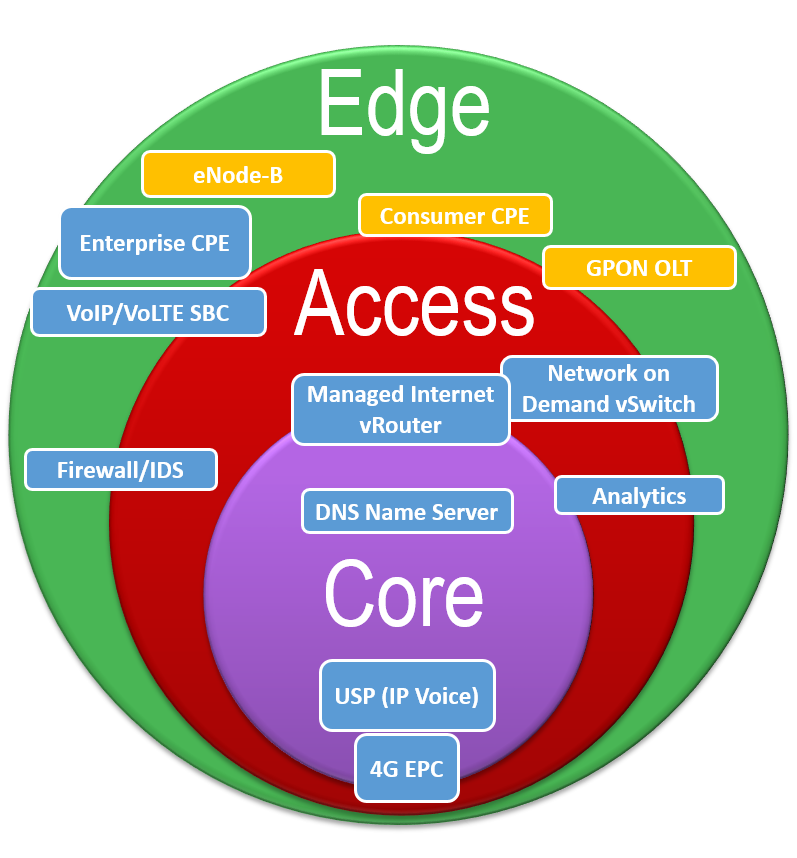

In 2014, AT&T launched its Domain 2.0 Programme to virtualise 75% of its network functions by 2020. So how is it going, and what are the lessons for others on the complex journey to the virtualised / agile Telco 2.0 digital vision?

Digital commerce continues to be held back by the lack of straightforward and consistent mechanisms for consumers to authenticate and identify themselves, share information and complete transactions with merchants. Telcos could address this fragmentation by creating a single framework through which individuals could interact with merchants, content companies and other service providers. Such a move would shore up telcos’ relevance and could ultimately increase their revenues. We show how, and review case studies from Deutsche Telekom (DTAG), Vodafone and KDDI.

Online entertainment is increasingly dominated by 5 big platforms but 6 forces are likely to shape the market going forward and could have profound effects on the dominant platforms. We analyse the relative strengths and weaknesses of each player and explore the potential opportunities for telcos to compete and collaborate.

Baidu, China’s answer to Google, is one of the world’s leading Internet companies by market capitalisation. But can Baidu break out of the Middle Kingdom? Fast-growing smartphone maker, Xiaomi, is building a multi-faceted ecosystem and a tribal brand among young people. What impact will Xiaomi have in Western Europe and North America? DJI, the world’s leading drone manufacturer, could become an anchor for a major ecosystem in the consumer robotics arena. But several obstacles may knock DJI off course.

Both Alibaba and Tencent have created formidable Internet ecosystems within China. However, the increasingly competitive Chinese economy is now slowing, and their continued growth depends on weakening the control of Google, Facebook and Amazon over the global digital commerce market. In the first of two reports on China, we examine Alibaba and Tencent’s services, business models, and aspirations, and explain how and why telcos should support their international expansion.