Login to access

Want to subscribe?

This article is part of: Enterprise Platforms

To find out more about how to join or access this report please contact us

We review telcos’ current strategies to drive revenue streams beyond connectivity and enhance their role in the Coordination Age, and explore how they can better leverage 5G and other core capabilities to provide unique value in a B2B2X environment.

==================================================================================

Download the additional file on the left for the PPT chart pack accompanying this report

==================================================================================

The telecoms industry is looking to revive growth

Telecoms operators have enjoyed 30 years of strong growth in all major markets. However, the core telecoms industry is showing signs of slowing. Connectivity revenue growth is declining and according to our research, annual growth in mobile operator revenues pre-COVID were converging to 1% across Asia Pacific, North America, and Western Europe. To help reverse this trend, telecoms operators’ have been investing in upgrading networks (fibre, 4G, 5G), enabling them to offer ever-increasing data speeds/plans to gain more customers and at least sustain ARPUs. However, this has resulted in the increasing commoditisation of connectivity as competitors also upgrade their networks. The costs to upgrade networks coupled with reducing margins from commoditisation have made it difficult for operators to invest in new revenue streams beyond core connectivity.

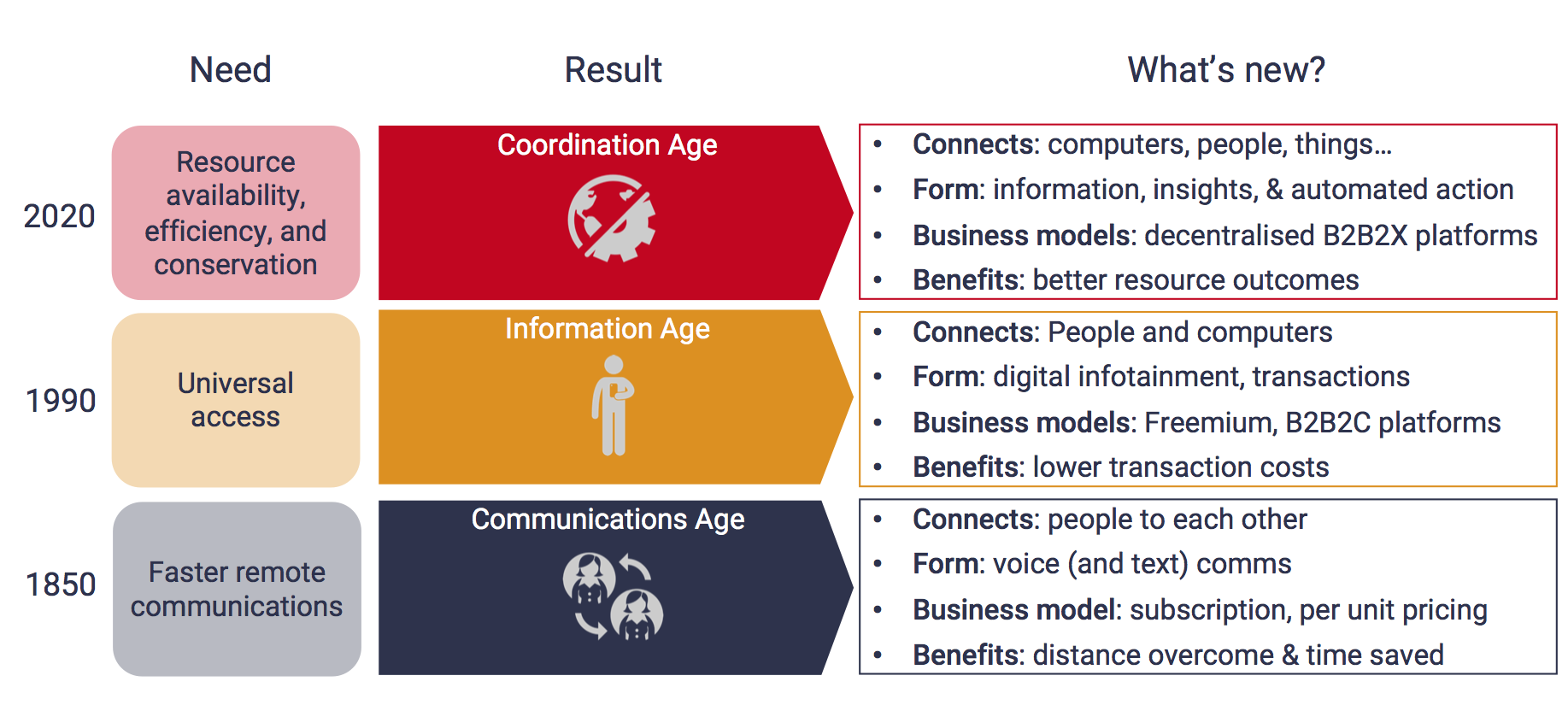

While connectivity remains an essential component in consumer and enterprises’ technology mix, on its own, it no longer solves our most pressing challenges. When the telecoms industry was first founded, over 150 years ago, operators were set up to solve the main challenge of the day, which was overcoming time and distance between people. Starting in the 1990s, alongside the creation of the internet and development of more powerful data networks, today’s global internet players set out to solve the next big challenge – affordable access to information and entertainment. Today, our biggest challenge is the need to make more efficient use of our resources, whether that’s time, assets, knowledge, raw material, etc. Achieving this requires not only connectivity and information, but also a high level of coordination across multiple organisations and systems to get it to the right place, at the right time. We therefore call this the Coordination Age.

Figure 1: New challenges for telecoms in the Coordination Age

Source: STL Partners

In the Coordination Age, ‘things’ – machines, products, buildings, grids, processes – are increasingly connecting with each other as IoT and cloud-based applications become ubiquitous. This is creating an exponential increase in the volume of data available to drive development of advanced analytics and artificial intelligence, which combined with automation can improve productivity and resource efficiency. There are major socioeconomic challenges that society is facing that require better matching of supply and demand, which not only needs real-time communications and information exchange, but also insights and action.

In the Coordination Age, there is unlikely to be a single dominant coordinator for most ecosystems. While telecoms operators may not have all the capabilities and assets to play an important coordination role, especially compared to the Internet giants, they do have the advantage of being regulated and trusted in their local markets. This presents new opportunities for telecom operators in industries with stronger national boundaries. As such, there is a role for telcos to play in other parts of the value chain which will ultimately enable them to unlock new revenue growth (e.g. TELUS Health and Elisa Smart Factory).

New purpose, new role

The Coordination Age has added increased complexity and new B2B2X business model challenges for operators. They are no longer the monopolies of the past, but one of many important players in an increasingly ecosystem-based economy. This requires telcos to take a different approach: one with new purpose, culture, and ways of working. To move beyond purely connecting people and devices to enabling coordination, telcos will need a fundamental shift in vision. Management teams will need to embrace a new corporate purpose aligned with the outcomes their customers are looking for (i.e. greater resource efficiency), and drive this throughout their organisations.

Historically, operators have served all customers – consumers, small and medium-sized enterprises (SMEs), larger enterprises from all verticals and other operators – with a set of horizontal services (voice, messaging, connectivity). If operators want to move beyond these services, then they will need to develop deep sector expertise. Indeed, telcos are increasingly seeking to play higher up the value chain and leveraging their core assets and capabilities provides an opportunity to do so.

However, in order to drive new revenues beyond connectivity and add value in other parts of the solution stack, telcos need to be able to select their battles carefully because they do not have the scale, expertise or resources to do it all.

Figure 2: Potential telco roles beyond traditional connectivity

Source: STL Partners

Enter your details below to request an extract of the report

Clearer on the vision, unclear on the execution

Many telcos have a relatively clear idea of where they want to drive new streams of revenue beyond traditional connectivity services. However, they face various technical, strategic and organisational challenges that have inhibited this vision from reaching fruition and have unanswered questions about how they can overcome these. This lack of clarity is further evident by the fact that some telcos have yet to set explicit revenue targets or KPIs for non-connectivity revenue, and those that have set clear quantifiable objectives struggle to define their execution plan or go-to-market strategy. Even operators that have been most successful in building new revenue streams, such as TELUS and Elisa, do not share targets or revenues for their new businesses publicly. This is likely to protect them from short-term demands of most telecoms shareholders, and because, even when profitable, they may not yet be seen as valuable enough to move the needle.

This report focuses not just on telco ambitions in driving B2B2X revenues beyond core connectivity and the different roles they want to play in the value chain, but more importantly on what strategies telcos are adopting to fulfil their ambitions. Within this research, we explore what is required to succeed from both a technological and organisational standpoint. Our findings are based on an interview programme with over 23 operators globally, conducted from June to August 2020. Our participant group spans across different operator types, geographies, and types of roles within the organisation, ensuring we gain insight into a range of unique perspectives.

In this report, we define B2B2X as a business model which supports the dynamic creation and delivery of new services by multiple parties (the Bs) for any type of end-customer (the X), whether they be enterprises or consumers. The complexity of the value chains within B2B2X models requires more openness and flexibility from party providers, given that any provider could be the first or second ‘B’ in the B2B2X acronym. This research is primarily focused on B2B2X strategies for serving enterprise customers.

In essence, our research is focused on answering the following key question: how can operators grow their B2B2X revenues when traditional core connectivity is in decline?

Table of Contents

- Executive Summary

- Introduction

- The telecoms industry is looking to revive growth

- New purpose, new role

- Clearer on the vision, unclear on the execution

- Beyond connectivity, but where to?

- “Selling the service sandwich”

- Horizontal play: Being the best application enabler

- The vertical-specific digital services provider

- There is no “best” approach: Some will work better for different operators in different situations

- 5G is a trigger but not the only one

- Accelerating the shift towards partnerships and ecosystems

- Some operator ‘ecosystems’ look more like partnerships

- Not all telcos define ‘ecosystems’ the same way

- Most telcos focusing on ecosystems want to orchestrate and influence the proposition

- Many see ecosystems as a key potential route but ecosystems come with new requirements

- The market is ripe for telco ecosystems

- The interest in network intelligence is not new but this time is different

- Telcos can provide unique value by making their networks more accessible

- But so far, telcos have not fully embraced this vision yet

- Conclusions and recommendations