Breaking down silos for telco adaptability

Our analysis of five telco case studies highlights the challenge for telcos looking to introduce cross-silo working and how approaches are being adapted to fit the organisation and access business benefits.

Our analysis of five telco case studies highlights the challenge for telcos looking to introduce cross-silo working and how approaches are being adapted to fit the organisation and access business benefits.

The world is entering the post-pandemic era of hybrid working. This report dissects enterprise perceptions of hybrid working and argues that operators have a crucial role to play in building a thriving hybrid working environment for enterprise customers.

Many telcos have visited the Valley in search of new and “open” innovation opportunities, but the returns often seem fleeting. We talked with a 20-year veteran of the circuit to understand why, and what needs to change if they are to embed and operationalise such innovation.

This is part 2 of a 3-part series taking an in-depth look at how 5G pioneers have evolved their approaches to commercialisation since launch, navigating a maze of factors such as handset availability, technology immaturity and more. What should others take from their experience to date?

We review telcos’ current strategies to drive revenue streams beyond connectivity and enhance their role in the Coordination Age, and explore how they can better leverage 5G and other core capabilities to provide unique value in a B2B2X environment.

Telcos (and others) have had mixed results from their experience of ecosystems. We look at AT&T Community, DTAG’s Qivicon, GSMA Mobile Connect, TIP and Android to analyse success factors and approaches to maximise the potential of future ecosystem initiatives.

Edge computing is a strategic opportunity for telcos. We examine the driving needs and applications for telco edge computing, describe the market and the options for telcos, discuss their partnerships with hyperscalers and recommend key actions.

In our first report, we covered eight of the most exciting blockchain applications for telcos. In this report, we look at what else can it be used for. It explores 36 potential blockchain use cases for telecoms, identifying the current pain point, how blockchain could help, the business driver for telcos, and real world examples.

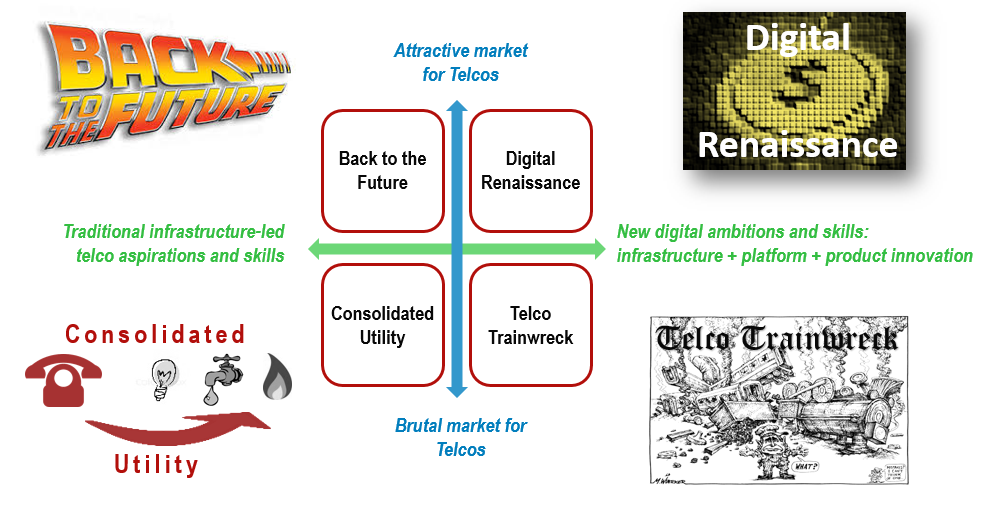

Seven predictions and four scenarios for how the industry might play out in Europe in the next 5 years: ‘Digital Renaissance’, ‘Back to the Future’, ‘Commoditised Utility’ and ‘Telco Trainwreck’. Plus what are the take-outs for other markets?