How BT beat Apple and Google over 5 years

Over 5 years, BT Group’s share price has more than tripled, outperforming Apple’s and Google’s, while its revenues have shrunk. Why, and what can other telcos learn from its success?

Over 5 years, BT Group’s share price has more than tripled, outperforming Apple’s and Google’s, while its revenues have shrunk. Why, and what can other telcos learn from its success?

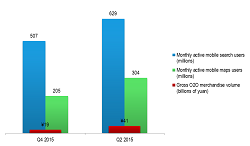

Baidu, China’s answer to Google, is one of the world’s leading Internet companies by market capitalisation. But can Baidu break out of the Middle Kingdom? Fast-growing smartphone maker, Xiaomi, is building a multi-faceted ecosystem and a tribal brand among young people. What impact will Xiaomi have in Western Europe and North America? DJI, the world’s leading drone manufacturer, could become an anchor for a major ecosystem in the consumer robotics arena. But several obstacles may knock DJI off course.

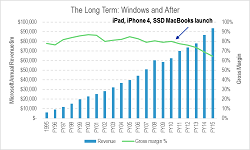

Microsoft faces the post-monopoly era, having had to write off its $8bn adventure in mobile and cope with significant disruption across the piece. Collaboration and communications are key to its new strategy, leading to significant implications for telcos and others.

We believe that the global telecoms market is approaching a critical moment of change, as strategic drivers and enablers are combining to open the door to a fundamental shift in the industry. We show how and why with highlights of our recent research, and set the scene for a new vision for Telco 2.0 – what telcos should be in the future, and how to get there.

Both Alibaba and Tencent have created formidable Internet ecosystems within China. However, the increasingly competitive Chinese economy is now slowing, and their continued growth depends on weakening the control of Google, Facebook and Amazon over the global digital commerce market. In the first of two reports on China, we examine Alibaba and Tencent’s services, business models, and aspirations, and explain how and why telcos should support their international expansion.

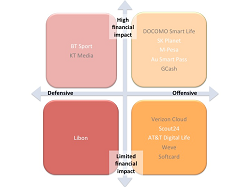

As they seek new sources of revenue, many telcos around the world are attempting to disrupt adjacent markets, such as digital commerce, IT, entertainment and financial services. While many of these moves have proved to be too little, too late, several disruptive plays have had a significant impact on both the telco’s revenues and relevance. These include NTT DOCOMO’s Smart Life portfolio, Globe Telecom’s GCash service and KT’s media business. Why do some disruptive moves by telcos succeed and others fail?

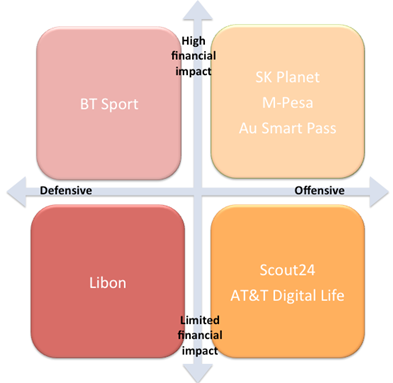

Although telcos aren’t generally associated with disruption, many operators around the world have attempted to disrupt adjacent markets, such as digital commerce, entertainment and financial services. In some cases, telcos have even disrupted their core broadband and communications markets. While many of these moves have fizzled out or have flown below investors’ radar screens, several have had a major impact on both the telco’s revenues and relevance. These include SK Planet, M-Pesa, Au Smart Pass and BT Sport. Why do some disruptive moves by telcos succeed and others fail?

The unveiling of Apple Pay and unravelling of Weve (the UK operators’ payments venture) looked like bad news for telcos’ ambitions in mobile payments in some markets, and highlighted challenges to Google and others’ models. Yet there are already successful telco models and favourable market trends that telcos should exploit. So what are the opportunities now?

Facing lockout from a growing chunk of the Internet and mounting competition from the Facebook-Microsoft alliance and Amazon, Google’s core business is under intense pressure. The search giant’s response is to innovate, offering consumers proactive recommendations, as well as reactive search results. Once an interesting sideline, Google Now has become fundamental to the Mountain View company’s future. Is the suggestion service good enough to maintain Google’s position as the world’s leading big data company?

The advent of smartphones and tablets is disrupting the $10Bn+ loyalty market by opening up new ways for brands and retailers to engage with their customers in a highly interactive fashion. This briefing analyses that market, why mobile is a compelling medium in it, key mobile app types, and leading edge strategies used by online players and traditional retailers. It concludes by outlining the strategies telcos need to employ to add value and exploit their assets and capabilities to play a major role in the value chain. (July 2013, Executive Briefing Service, Dealing with Disruption Stream.)

Loyalty and Mobile Venn Diagram 2013

The mobile commerce market is going through a critical ‘land-grab’ phase. This report reviews the strategies and tactics of the leading telcos and Internet players in Asia, Europe and North America as they seek to use the mobile medium to become an intermediary between buyers and sellers. It considers the pivotal role of the digital wallet, ‘big data’, the race to acquire merchants and the key alliances between telcos, banks, payment networks and Internet players (December 2012, Executive Briefing Service, Dealing with Disruption Stream)

Digital Commerce Flywheel December 2012

In Amazon, Apple, Facebook, Google, Skype – the Great Game. Presentation by Horace Dediu, Senior Analyst, STL Partners, covering OS market shares, dynamics, and catalysts of change. Presented at EMEA Brainstorm, November 2011.

OS Wars small STL Partners Nov 2011

In Amazon, Apple, Facebook, Google, Skype – the Great Game. Presentation by Keith McMahon, Senior Analyst, STL Partners, covering key patent wars between the leading technology players and telcos. Presented at EMEA Brainstorm, November 2011.

Cloud EMEA Nov 2011 BT Financial Sector

In Amazon, Apple, Facebook, Google, Skype – the Great Game. Presentation by Chris Barraclough, Chief Strategist and MD STL Partners, covering some of the key insights from the Telco 2.0 Strategy Report Dealing with the ‘Disruptors’: Google, Apple, Facebook, Microsoft/Skype and Amazon. Presented at EMEA Brainstorm, November 2011.

Cloud EMEA Nov 2011 BT Financial Sector

M2M 2.0: Service Enablers – New Business Models Needed, Presentation by Sven Krey, Head of Sales Development, M2M Competence Centre, Deutsche Telekom. Business model challenges facing operators in M2M and how DTAG is facing them. Presented at EMEA Brainstorm, November 2011.

M2M connections explode, prices plunge

M2M 2.0: Strategies and Business Models, Presentation by Helene Hartlief, M2M Marketing Manager, KPN. Describes KPN’s approach to monetising their investments in M2M. Presented at EMEA Brainstorm, November 2011.

Cloud EMEA Nov 2011 Colt integrated experience

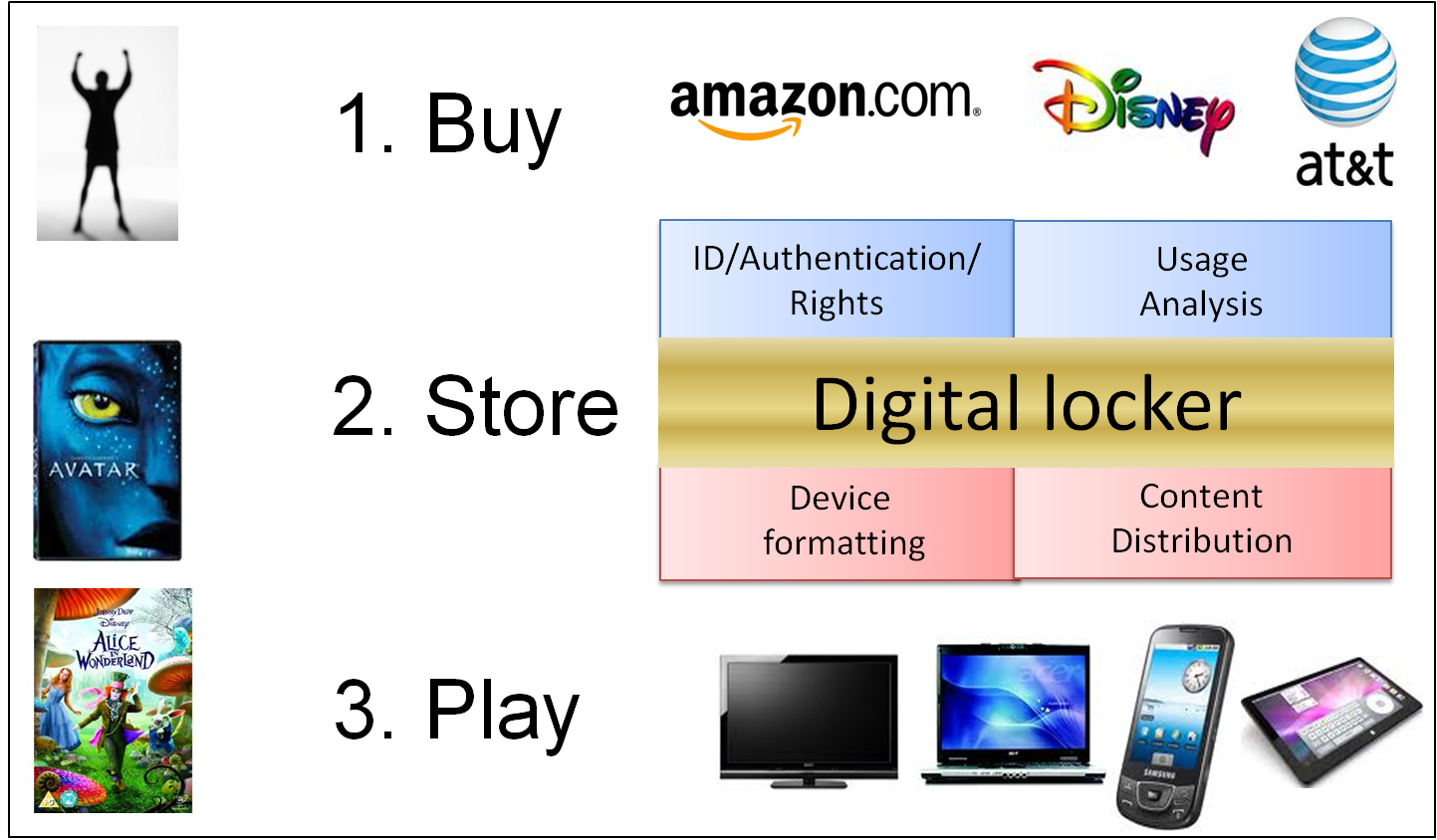

Telco assets and capabilities could be used much more to help Film, TV and Gaming companies optimize their beleaguered business model. An extract from our new 38 page Executive Briefing report examining the opportunities for ‘Hollywood’ and telcos. (Executive Briefing, August 2010)