Login to access

Want to subscribe?

This article is part of: Executive Briefing Service

To find out more about how to join or access this report please contact us

Our latest research covers industry perceptions of likely changes regarding telco investment priorities and activities in 2021. It looks at the relative importance of different technologies (e.g. 5G, automation), propositions in enterprise and consumer markets, networks, strategy and leadership.

The goal of this research is to understand how telecoms operators’ investment priorities and investments are likely to change as the COVID-19 crisis recedes. To do this, we collected 144 survey responses from participants in telecoms operators, telecoms vendors, and analysts and consultants and other groups. All responses are treated in strict personal and company confidence. Take the survey here.

This research builds on our previous content on the impact of the pandemic to the telecoms industry: COVID-19: Now, next and after (March 2020), COVID-19: Impact on telco priorities (May 2020), based on a survey undertaken in April and early May 2020 and Recovering from COVID: 5G to stimulate growth and drive productivity (August 2020). STL Partners has also hosted three webinar on the topic (March to July 2020).

This deck summarises the findings of our industry research on telecoms priorities at the start of 2021.

We explored the research in our webinar, State of the Industry: 2021 Priorities (click on the link to view the recording).

Background to the telecoms priorities survey – January 2021

The respondents were fairly evenly split between telcos, vendors, and ‘others’ (mainly analysts and consultants). This sample contained a higher proportion of European and American respondents than industry average, so is not fully globally representative. The split of company types and geography was broadly similar to the May 2020 survey, with the exception of the MENA region, where there were less than half the prior respondents – a total of 7. However those respondents were senior and well known to STL.

Who took the survey?

Source: STL telecoms priorities survey, 144 respondents, 31st January 2021

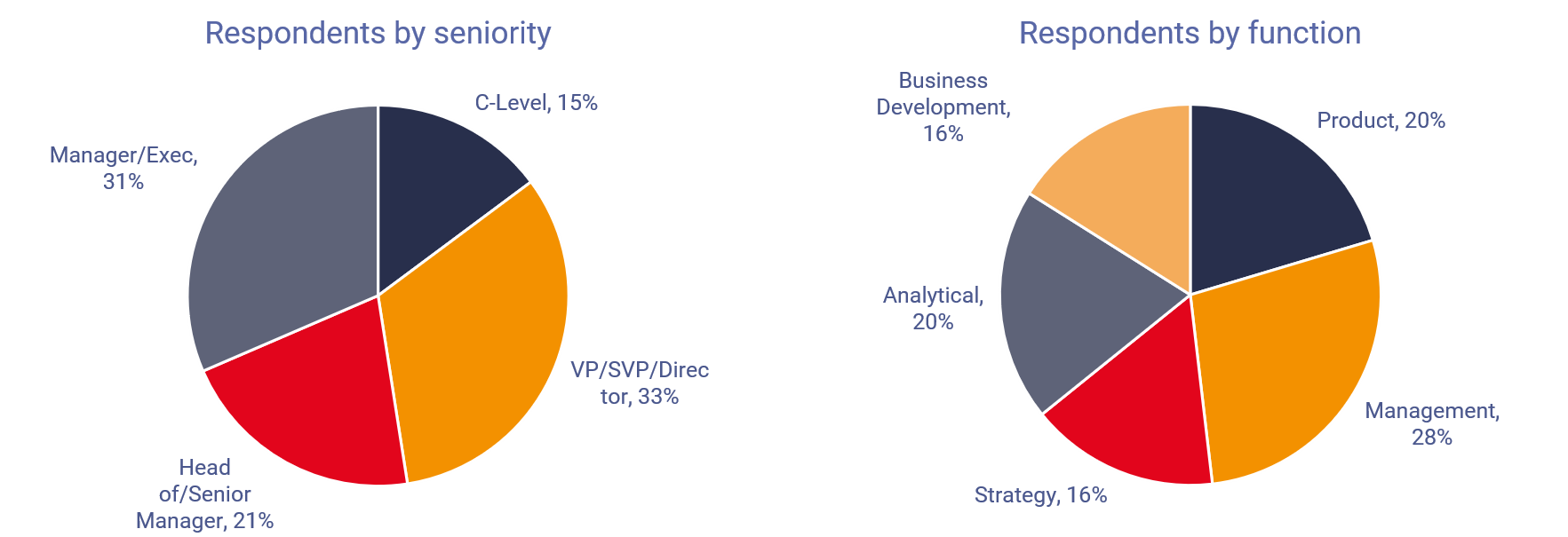

48% of respondents were C-Level/VP/SVP/Director level. Functionally, most respondents work in senior HQ and operational management areas. Compared to May 2020, there were proportionally slightly more senior respondents, and slightly less in product and strategy roles.

What are their roles?

Source: STL telecoms priorities survey, 144 respondents, 31st January 2021

How respondents perceive priorities, as the COVID threat recedes

There were increases in respondent confidence in almost every category we surveyed from May 2020 to Jan 2021.

- Telecoms automation and agility remain top priorities across the industry – and transformation has moved up the agenda.

- Appetite for 5G investments increased the most of all areas surveyed in the last 8 months.

- The ‘consumerisation’ of enterprise continues, although security and work from home (WFH) services have overtaken conferencing and VPNs in priority.

- Healthcare remains the most accelerated vertical / application opportunity of all those impacted in the current crisis.

- The priority of consumer services has significantly increased yet confidence in making any additional money in the sector is low.

- Leadership and transformation: COVID 19 has empowered an industry-wide belief that change is possible.

- Transformation and innovation are high priorities, and appetite for sustainability and recruitment has returned, but there are doubts about some telco leaders’ commitment and ability to grasp and invest in new opportunities.

STL Partners assesses the telecoms industry to be at a crunch point: COVID has injected further pace to the rapid evolution of the world economy. Telcos that have been focused on responding to immediate pandemic-induced challenges, will emerge from the crisis faced with an urgency to respond to this evolution – key choices that telcos might have had 5-10 years to ponder are being crunched into the next 0-3 years.

Our findings suggest that most telcos are only partly ready for this disruptive opportunity.

Enter your details below to request an extract of the report

Notes on interpreting the research findings

- The way research respondents perceive any given question is generally dependent on their current situation and knowledge. To get relevant answers, we asked all respondents if they were interested or involved in specific areas of interest (e.g. ‘consumer services’), and to not answer questions they couldn’t (e.g. for confidentiality reasons) or simply didn’t know or have a clear opinion.

- We saw no evidence that respondents were ‘gaming’ the results to be favourable to their interests.

- Results need to be seen in the context that telcos themselves vary widely in size, profitability and market outlook. For example, for some, 5G seems like a valid investment, whereas for others the conditions are currently much less promising. COVID-19 has clearly had some impact on these dynamics, and our analysis attempts to reflect this impact on the overall balance of opinions as well as some of the specific situations to bring greater nuance.

- In December 2020 / January 2021, the worldwide impact of COVID-19 is increasingly well understood and less of a shock than was the case in May / June 2020. Vaccines are beginning to be rolled out but it is an early stage in the process, and new variants of COVID-19 have evolved in the UK, South Africa and Brazil (and possibly elsewhere). There are geo-political wrangles on vaccine distribution, and varying views on effectiveness and the most appropriate responses. Nonetheless, respondents appear overall more optimistic, although there is still considerable uncertainty.

- We’ve interpreted the results as best we can given our knowledge of the respondents and what they told us, and added in our own insights where relevant.

- Inevitably, this is a subjective exercise, albeit based on 144 industry respondents’ views.

- Nonetheless, we hope that it brings you additional insights to the many that you already possess through your own experiences and access to data.

- Finally, things continue to change fast. We will continue to track them.

Table of contents

- Executive summary: Opportunities are in overdrive, but can telcos catch them?

- High-level findings

- Research background

- Technology impacts: Automation, cloud and edge come of age

- Network impacts: 5G is back

- Enterprise sector impacts: Healthcare still leads

- Consumer sector impacts: Mojo aplenty, money – not so much

- Leadership impacts: good talking, but enough walking?