Can telcos create a compelling smart home?

How AT&T, Deutsche Telekom and Orange are taking on GAFA (Google, Amazon, Facebook and Apple) in the fast-growing smart home market.

How AT&T, Deutsche Telekom and Orange are taking on GAFA (Google, Amazon, Facebook and Apple) in the fast-growing smart home market.

Telefónica’s systematic and sustained push into personal data management holds valuable lessons for other telcos about building trust and credibility. The report also covers personal cloud / data plays by NTT DOCOMO and financial services company Mint.

Uber and Tesla are at the forefront of a new age of personal transportation in which wireless connectivity will play a major role. Both of these disruptors could be important partners for telcos, while offering lessons about consumer engagement, relationships with regulators and strategic thinking.

Can the partnership between Google and telcos strike the balance between interoperability and speed of development needed to challenge Facebook and Tencent in conversational commerce?

Telcos and the major Internet platforms increasingly rely on each other. What kinds of agreements should operators enter into with Amazon, Apple, Facebook and Google and what should they avoid? And what are the strategic implications of supporting players who habitually use their powerful brands and software expertise to disrupt entire industries?

The music industry was one of the first sectors to be fundamentally disrupted by the Internet. Facing an epic and almost existential battle with piracy, coupled with expectations that music should be free, the record labels have tested many different business and distribution models. With sales of recorded music finally growing again, telcos and their partners can learn a lot from the music industry’s hits and misses.

US President-elect Donald Trump made many statements during the campaign, but now that he has won the election what will his administration do? In this report we look at five key areas for the TMT sector and analyse how we think Trump’s presidency is most likely to impact them.

The last few years have seen attempts by many leading telecoms operators to refresh their business model and generate new sources of growth and value. Now many digital initiatives are being scaled back. Telefonica and Telenor, two companies in the vanguard of the ‘drive to digital’ have both disbanded their digital organisations. In the first of two reports, STL Partners explores why efforts to yoke platform and product innovation businesses to a traditional infrastructure business have proved so difficult. The financial and operational constraints associated with traditional telecoms – particularly the need for long investment cycles in ‘one-function’ infrastructure – have made achieving the switch to ‘agile digital innovation’ all but impossible. But all that may be about to change and the future could be a little brighter.

Widespread use of open source software is an important enabler of agility and innovation in many of the world’s leading internet and IT players. Yet while many telcos say they crave agility, only a minority use open source to best effect. We examine the barriers and drivers, and outline six steps for telcos to safely embrace this key enabler of transformation and innovation.

Online entertainment is increasingly dominated by 5 big platforms but 6 forces are likely to shape the market going forward and could have profound effects on the dominant platforms. We analyse the relative strengths and weaknesses of each player and explore the potential opportunities for telcos to compete and collaborate.

Over 5 years, BT Group’s share price has more than tripled, outperforming Apple’s and Google’s, while its revenues have shrunk. Why, and what can other telcos learn from its success?

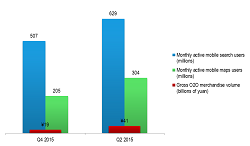

Baidu, China’s answer to Google, is one of the world’s leading Internet companies by market capitalisation. But can Baidu break out of the Middle Kingdom? Fast-growing smartphone maker, Xiaomi, is building a multi-faceted ecosystem and a tribal brand among young people. What impact will Xiaomi have in Western Europe and North America? DJI, the world’s leading drone manufacturer, could become an anchor for a major ecosystem in the consumer robotics arena. But several obstacles may knock DJI off course.

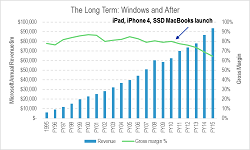

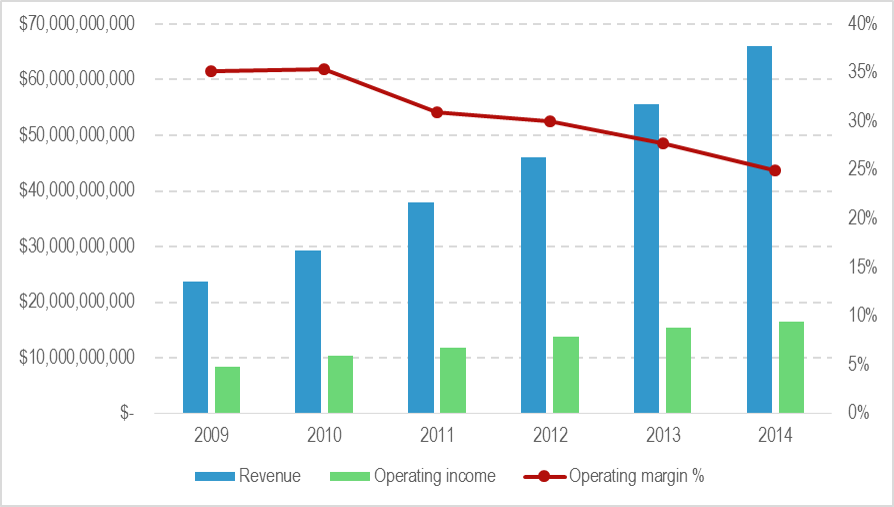

Microsoft faces the post-monopoly era, having had to write off its $8bn adventure in mobile and cope with significant disruption across the piece. Collaboration and communications are key to its new strategy, leading to significant implications for telcos and others.

How will getting into the MVNO business help Google shore up its business model? We examine Google’s objectives, how it could price the service, and the implications for telcos and other players.

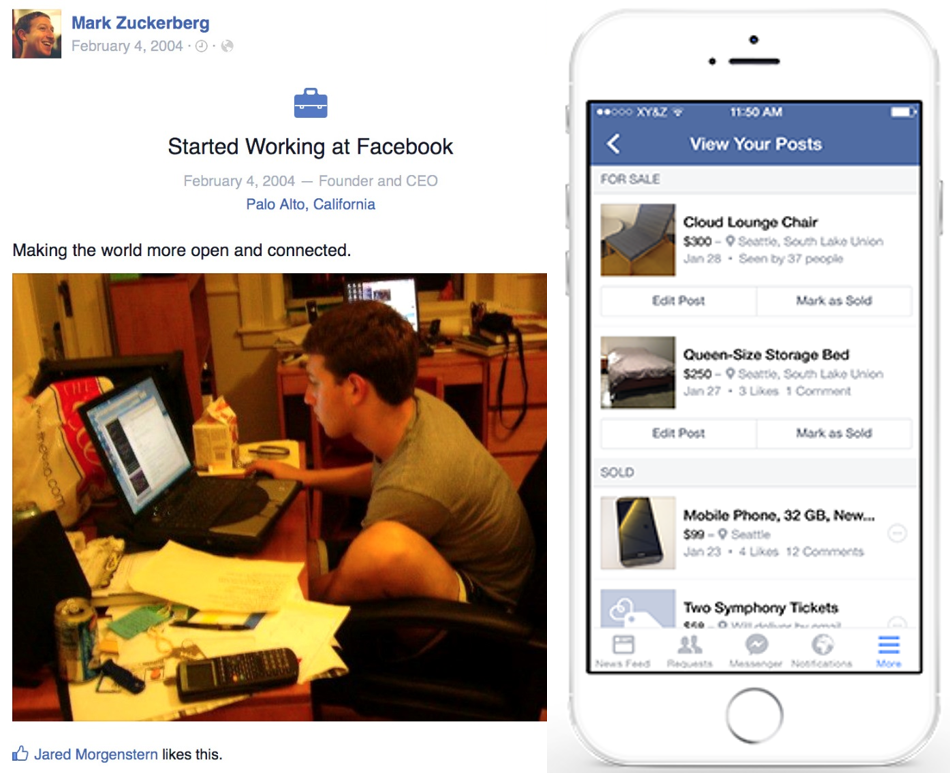

Facebook has changed substantially since we first analysed the company in 2011. In our latest major report we explore the accuracy of our 2011 predictions regarding users, revenue and strategy. We also examine Facebook’s current aspirations and challenges and explain why, where and how operators should be working with Facebook to build value.

Apple is weakening Samsung Electronics’ grip in the high-end of the handset market, lowering the Korean company’s profitability and capacity to compete effectively. After a series of largely unsuccessful attempts to break into software and services, a daring option for Samsung is to seek a strong, strategic alliance with Google to enable both companies to mount a serious challenge to Apple’s dominance in the affluent demographic. Telcos could back such an alliance in return for a profitable role in the service layer. This report analyses the strategic rationale for such an approach.

What is disruption, when is it a good idea, and what do you do when it happens to you? We illustrate five principles of disruptive strategy based on our analysis of the telecoms and adjacent markets over the past eight years. The analysis covers both principles of creating and defending against disruption.