Enterprise networking challenges: How can SD-WAN help?

We highlight the main networking challenges that SD-WAN is designed to address. Part 1 of a three-part mini-series exploring SD-WAN technology from an enterprise perspective.

We highlight the main networking challenges that SD-WAN is designed to address. Part 1 of a three-part mini-series exploring SD-WAN technology from an enterprise perspective.

Telcos must adapt to virtualisation and changing customer needs in the Coordination Age. Our three new telecoms business models offer a realistic agenda for telcos to build up the stack into the IT layer – either by themselves or through partnerships.

SDN and NFV deployment is growing deeper but not broader: the long tail lags behind the pioneers.

This update to our ‘NFV Deployment Tracker’ series focuses on Asia-Pacific, alongside European and North American data to March 2018. Telcos in developed Asian markets have made a great start, and the region has outstripped Europe and North America in live SDN / NFV deployments – but can NFV scale to Asia as a whole?

This update to our ‘NFV Deployment Tracker’ series focuses on North America, alongside additional European data. 2016/7 has seen the rise of SD-WAN, enabling smaller operators to compete in the WAN market with NFV leaders AT&T, Verizon, Masergy, CenturyLink, etc. By contrast, fewer consumer use cases for NFV have yet been established.

STL Partners has compiled a new quarterly-updated tracker service of commercial deployments of NFV and SDN by leading telcos worldwide, providing an Excel database accompanied by an analytical report. The first update, devoted to Europe, found operators and vendors focusing on core network virtualisation and SDN/SD-WAN have so far led the way, as timelines on more systematic transformation programmes have been extended.

Building a telco based on ‘free’ open source software is theoretically highly attractive to telcos, particularly those looking to increase their control over innovation and differentiation, and/or where cost reduction is critical. This report looks at how to address the challenges, identifies practical options and choices, and how, when and why to go about open source transformation in the real world.

Changing telcos’ systems from a legacy to a virtualised model is a bit like building an autonomous car from a moving steam locomotive. In this report, we look at the relationship between NFV (Network Functions Virtualization) and OSS (Operations Support Systems), and the difficulties that operators and the developer community are facing in migrating from legacy OSS to NFV-based methods for delivering and managing communications services.

The early high hopes for SDN and NFV have given way to the realization that the road to cloud-telco ‘heaven’ is strewn with ‘infernal’ rocks and pitfalls. We present the “devil’s advocate’s” (i.e. an extremely sceptical) view of NFV set out in eight indictments. We then examine the argument for the defence.

Metrics are an integral component of telcos’ digital and overall transformation. But what metrics are telcos using, and what metrics should they use, to measure the progress and success of their transformation initiatives? STL Partners has looked at metrics in use by three of the most advanced telcos in the world, including AT&T and Telstra, and identified the 20 that matter most.

Software-Defined Wide Area Networks (SD-WANs) have catapulted to prominence in the enterprise networking world in the last 12 months, driven by the growth of demand for access to cloud applications, and businesses’ desire to control WAN costs and complexity. SD-WAN may be a new “intermediary” layer in the network which has the potential to disrupt telcos’ enterprise aspirations, particularly given that it is dominated by vendors and specialist providers rather than telcos. SD-WAN may reduce operators’ MPLS and WAN services revenues and could potentially restrict future NFV/SDN opportunities. But SD-WAN also offers opportunities, where it is embraced – tactically – as part of operators’ enterprise portfolios.

Becoming a Telco Cloud Service Provider (TCSP) is a new vision for the future of telecoms operators, which promises hugely improved agility, a fundamentally new business model, new services, and new growth. What is this vision, how would it work, and how can it overcome the barriers to change that have thwarted most previous efforts?

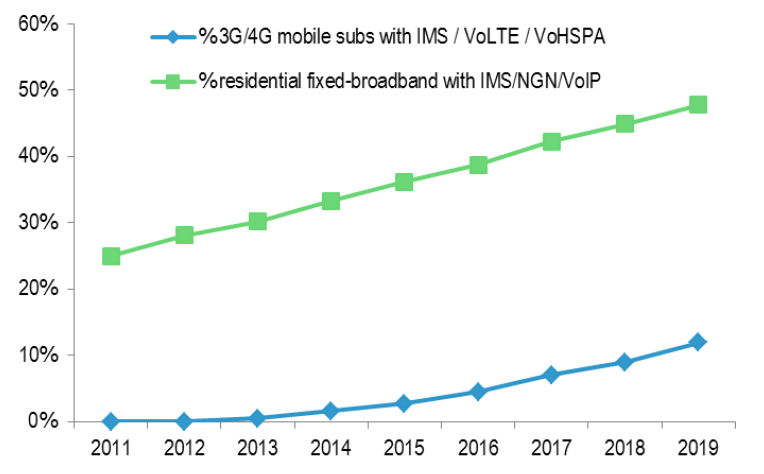

To date, discussions of the benefits to telcos of NFV and SDN have mainly focused on reducing operating and capital costs, while the impact on future telco revenues has been somewhat sketchy. In order to fill this gap, this report outlines a comprehensive set of potential new “telco cloud” services, and forecasts associated revenue growth.

What was hot at MWC? We round up the action around cloud, SDN, and NFV – and discuss the impact of open-source.

5G. SDN/NFV. Gigabit cable. WiFi. IoT. Spectrum policy. Vendor consolidation. Despite carefully-constructed business cases for future network investment, the goal-posts are always moving, and even the best-laid plans face possible disruptions – positive or negative. To kick off our ‘Future of the Network’ research stream, we outlined the key questions determining the business case for future investments in the network. This is Part 2, which covers critical network-technology disruptions, the impact of government and regulation, and the shifting vendor landscape.

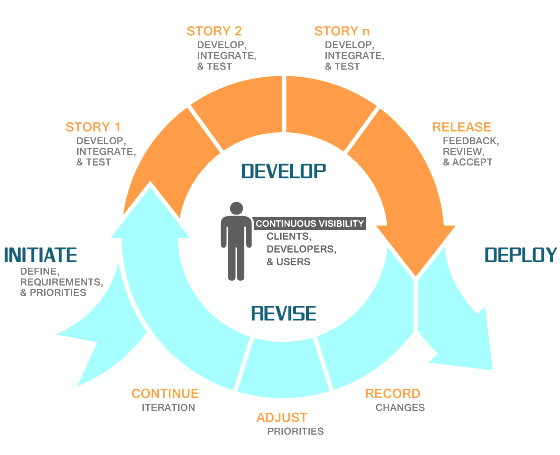

What is ‘agility’ and what makes it meaningful to operators? We explored the concept and characteristics of ‘operator agility’ through 29 interviews with telco senior executives, found three main barriers and five key opportunity areas, and identified some surprising and important conclusions about both what it means and the key steps needed to achieve it.

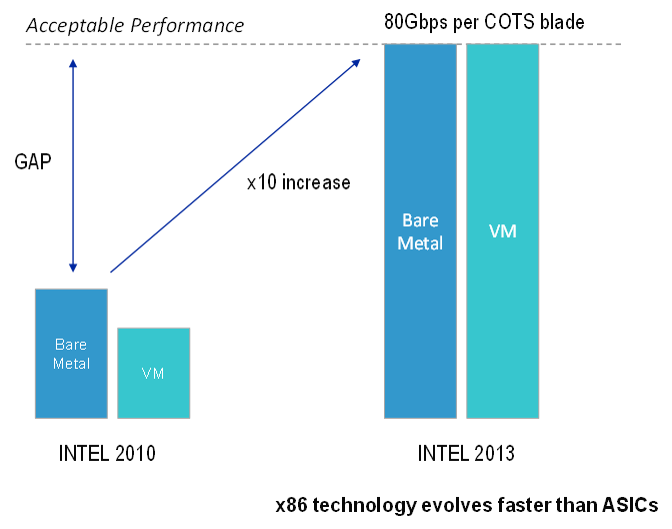

NFV (Network Functions Virtualisation) potentially offers operators benefits of up to 80% network opex reduction and significant improvements in agility, and threatens a shake-up of the vendor landscape. What are the challenges to making it happen, and what do telcos and vendors need to do to succeed?