RCS: Walking the commerce tightrope

Can the partnership between Google and telcos strike the balance between interoperability and speed of development needed to challenge Facebook and Tencent in conversational commerce?

Can the partnership between Google and telcos strike the balance between interoperability and speed of development needed to challenge Facebook and Tencent in conversational commerce?

Some telcos are hoping that mobile data growth will resurge and transform their fortunes, though STL Partners has previously argued that data growth will not be enough. In this report we re-examine this argument looking at global trends and present the insights and lessons from six operator case-studies including DNA Finland, T-Mobile US and Reliance Jio.

The rapid growth of Facebook, WhatsApp, WeChat and other Internet-based services has prompted some commentators to write off telcos in the consumer communications market. But many mobile operators retain surprisingly large voice and messaging businesses and still have several strategic options. Indeed, there is much telcos can learn from the leading Internet players’ evolving communications propositions and their attempts to integrate them into broad commerce and content platforms. In this report we examine what opportunities still exist for telcos in this strategically important sector.

Mobile messaging is fast becoming a key platform for digital commerce, mounting a challenge to Google Search, Amazon’s Marketplace and other two-sided platforms. As Facebook gears up to take advantage of this opportunity, some of the world’s largest telcos are working with Google to develop and deploy multimedia communications services that will work across networks and will replace SMS. But will it be too little, too late?

Messaging services are increasingly enabling interactions and transactions between consumers and businesses. Largely pioneered by WeChat in China, the growing integration of digital communications and commerce services looks like a multi-billion dollar boon for Facebook and a major headache for Amazon, eBay and Google. It also poses a strategic dilemma for Apple and telcos: Can they turn their communications apps into shopping channels while championing privacy and security?

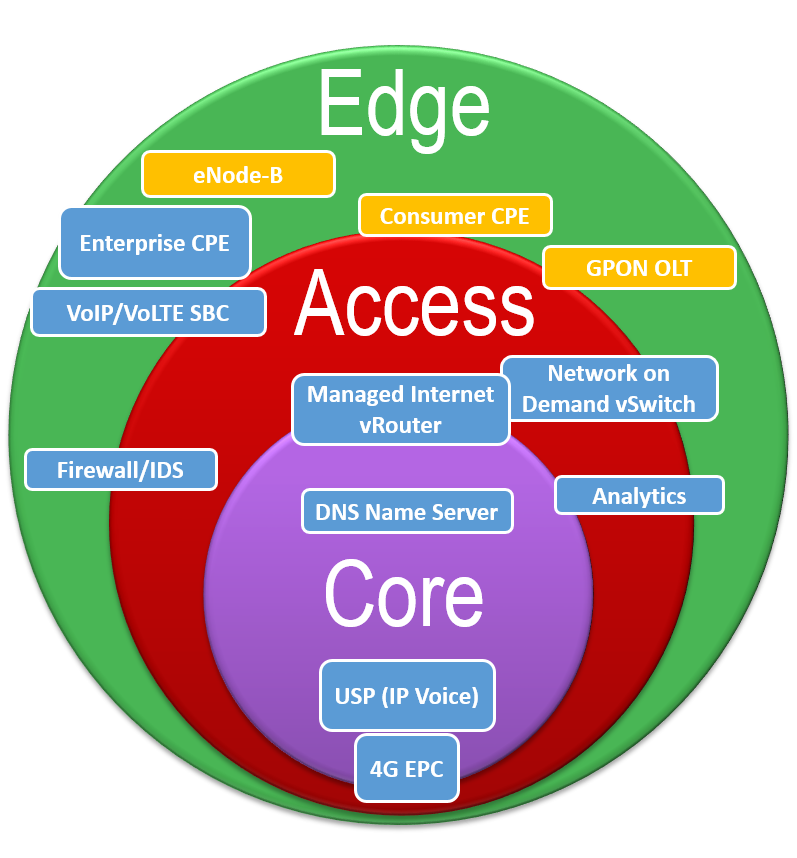

In 2014, AT&T launched its Domain 2.0 Programme to virtualise 75% of its network functions by 2020. So how is it going, and what are the lessons for others on the complex journey to the virtualised / agile Telco 2.0 digital vision?

What is disruption, when is it a good idea, and what do you do when it happens to you? We illustrate five principles of disruptive strategy based on our analysis of the telecoms and adjacent markets over the past eight years. The analysis covers both principles of creating and defending against disruption.

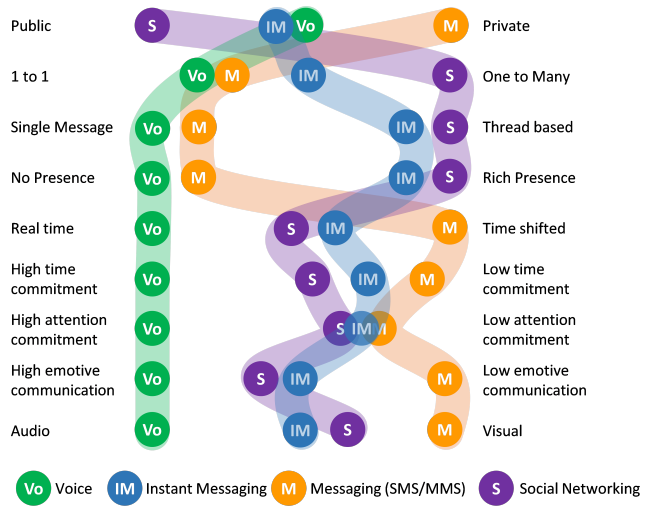

Consumer and enterprise communications behaviours are changing significantly around the globe as new solutions meet core needs more effectively and change customer expectations. This extract from our latest major report provides insight to the changes, and describes effective strategies that meet these evolving needs for both incumbents attempting to defend existing services and innovators seeking to disrupt and create new value. (December 2013, Executive Briefing Service)

Psychological and social advantages of voice, SMS, IM, and Social Media Dec 2013

An extract from our 284 page, 124 chart, strategy report that analyses the business models, markets, objectives, strategies and modus operandi of the major adjacent players, and their current and future impact on the telecoms industry. The report identifies the areas and options for competition and co-operation, and outlines potential strategies for interacting with each player. It also draws the combined activities of the digital empires – telcos, so called ‘OTT players’ and others – into the context of the new ‘Great Game’, the battle for power and value in the emerging digital economy. (Page updated February 2012, report published November 2011, Dealing with Disruption stream) Google Apple Facebook Microsoft Skype Amazon Telco 2.0 Disruptor Report Cover

From SMS, through Smartphone and browser Apps, the potential of mobile marketing has long been understood and yet unfulfilled. This new report gives our forecasts, plus how Telcos can make the most of the powerful assets available to them to take a valuable role in this market before it is too late. Report extract included here. (April 2010, Executive Briefing Service, Dealing with Disruption Stream).