Fibre for 5G and edge: Who does it and how to build it?

There is now a valuable but specialised opportunity in building out fibre to support small 5G cells in high value areas. Which players should address it and how?

There is now a valuable but specialised opportunity in building out fibre to support small 5G cells in high value areas. Which players should address it and how?

There are troubling signals in the business environment. Consumer confidence is at an all-time low due to inflation, conflict, Covid and climate change. What are the consequences for telecoms, and what should telcos, vendors, policymakers and others in the ecosystem do?

In the first of two reports we examine the macro forces and outline three key steps to reshape priorities and the strategy agenda.

In this update, we present granular data on the 5G core, tracking the progress of deployments of both Non-standalone (NSA) and Standalone (SA) network cores. We recorded 49 5G core deployments so far in 2022, 24 of which are SA launches.

In this update we present more granular data into the RAN to track the shift towards disaggregation across vendor ecosystems. It is still very early days with open RAN and vRAN, with 33 deployments in total, but we expect this to accelerate over the coming year.

As standards for Wi-Fi and cellular become increasingly entwined, there has never been a greater technical possibility for convergence. This report explores the market view of future convergence from both supply and demand side perspectives.

The forces of divergence and convergence have shifted in favour of the latter, with the move to cloud native and software-defined networking. We evaluate how operators can take advantage of convergence to drive greater efficiencies, scale economies and service innovation.

New growth from 5G standalone, RAN and SASE is getting underway, amidst maturity and decline in foundational deployments.

SDN and NFV deployment is growing deeper but not broader: the long tail lags behind the pioneers.

This update to our ‘NFV Deployment Tracker’ series focuses on Asia-Pacific, alongside European and North American data to March 2018. Telcos in developed Asian markets have made a great start, and the region has outstripped Europe and North America in live SDN / NFV deployments – but can NFV scale to Asia as a whole?

This update to our ‘NFV Deployment Tracker’ series focuses on North America, alongside additional European data. 2016/7 has seen the rise of SD-WAN, enabling smaller operators to compete in the WAN market with NFV leaders AT&T, Verizon, Masergy, CenturyLink, etc. By contrast, fewer consumer use cases for NFV have yet been established.

Artificial intelligence (AI) is more powerful and affordable than ever, and the leading consumer-facing AI platforms – Google, Apple, Facebook and Amazon – are in an arms race to bring the technology to smartphones. AI will radically change the way people use smartphones, but what are the implications for data traffic and consumer expectations, and what role should telcos play in this evolution?

STL Partners has compiled a new quarterly-updated tracker service of commercial deployments of NFV and SDN by leading telcos worldwide, providing an Excel database accompanied by an analytical report. The first update, devoted to Europe, found operators and vendors focusing on core network virtualisation and SDN/SD-WAN have so far led the way, as timelines on more systematic transformation programmes have been extended.

5G deployments will need new allocations of radio spectrum, particularly to achieve promised speeds, and target new IoT use-cases. However, the official process for releasing new frequencies is slow and cumbersome. Some countries may short-circuit the process. At the same time, the rationale for new sharing mechanisms, that allow industrial and vertical players to acquire spectrum for their own networks, outside of MNO control, is growing. What should telcos do?

5G was one of the dominant topics at MWC 2016, and a key theme was the push by many infrastructure vendors and chipset manufacturers to bring forward the timeline for development of an early version of 5G. Some leading operators are also stepping up to support this vision. Fortunately, the “early 5G” group’s wish-list is relatively simple: it’s about capacity, cost, and carbon dioxide.

What was hot at MWC? We round up the action around cloud, SDN, and NFV – and discuss the impact of open-source.

As LTE adoption passes 50% in North America and 9% worldwide, we review the operators who did best and worst and draw conclusions for the mass adoption phase of 4G. The analysis provides a valuable template for all players in the 4G race, and has important implications for plans for 5G.

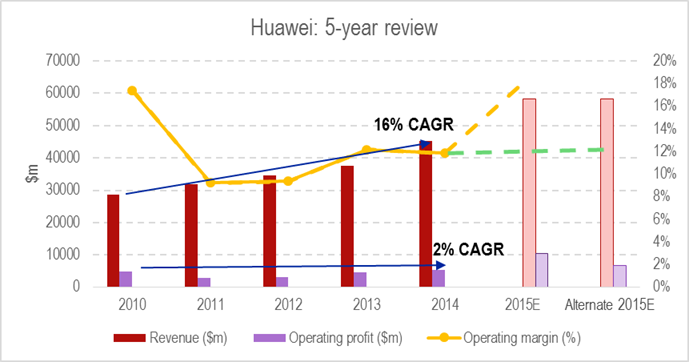

Huawei’s business performance in recent years has been impressive, based on sticking closely to what its customers wanted and making the results easy to buy. But fierce price competition will challenge near-term profit ambitions, and Huawei’s 5G vision is ahead of the market. So could things be about to change?