Login to access

Want to subscribe?

This article is part of: Executive Briefing Service Executive Briefing Service

To find out more about how to join or access this report please contact us

The unique benefits of 5G could unlock $1.4tn of value in eight key industries in 2030. What steps should operators take to deliver these benefits? What business and organisational transformation must occur to unlock this opportunity?

Understanding the 5G opportunity in other industries

The aim of this report is to highlight the impact that 5G will have on global GDP between 2020 and 2030. To do this, we have focused on eight industries where we feel 5G will have the largest impact. Often when 5G is discussed, the focus is on the impact it will have on the consumer market. Here, we argue that 5G will unlock significant new revenue opportunities in the enterprise space, enabling innovative use cases that are currently impossible to scale commercially (with existing technologies).

Insight from this report is explored further in the following publications:

- 5G’s Impact On Manufacturing: $740Bn Of Benefits In 2030

- 5G’s Healthcare Impact: 1 Billion Patients With Improved Access In 2030

The document was researched and written independently by STL Partners, supported by Huawei. STL’s conclusions are entirely independent and built on ongoing research into the future of telecoms. STL Partners has written widely on the topic of 5G, including a recent two-part series into the short- and long-term opportunities unlocked by 5G, and lessons that can be learnt from early movers.

Comparing apples with apples: How to compare nascent 5G with established 4G

If you compare the technological specifications for 3GPP release 14 and 3GPP release 15 (the first 5G release), you might be underwhelmed. Despite the hype that 5G will be transformative, it does not appear to be delivering much more than incremental increases in speed and reliability. But, of course, 4G is now a mature form of connectivity (having been in-life for 6+ years) whereas 5G is still nascent.

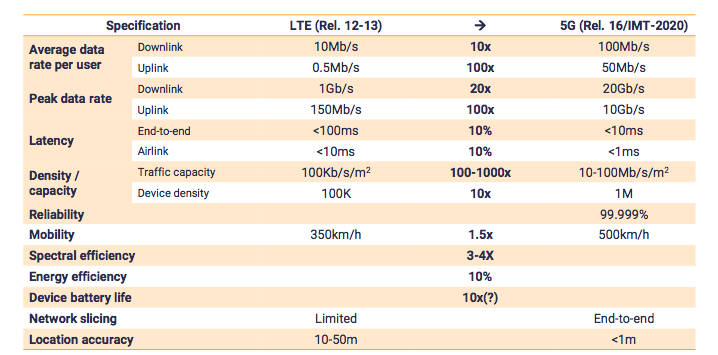

To compare apples with apples, it makes sense to compare 5G release 16, where capabilities such as ultra-reliable low-latency and network slicing are being added, with LTE today.

Mature 5G benchmarked against the capabilities of mature 4G

Source: ITU, Nokia, ublox, gps world

Of course, these figures represent a best-case scenario occurring in a laboratory environment. This is true for both the 4G and 5G numbers. It’s also true that, in reality, it will take time before we see commercialised rollout of enhanced mobile broadband (“pure 5G”) rather than enhanced mobile broadband with 4G fall-back alongside fixed wireless access. Despite this, these figures make clear that when 5G reaches maturity, it will far outstrip the capabilities of 4G, and unlock new use cases.

Our assumption is that by 2025 5G technology will be mature, enabling massive M2M / IoT use cases as well as those that require ultra-reliable low-latency communications. Several of the 5G use cases we’ll go on to explore in more detail are reliant on this technology, so it is important to acknowledge that their commercialisation is only likely to start from around 2023 and in many markets they still won’t be fully deployed in 2030.

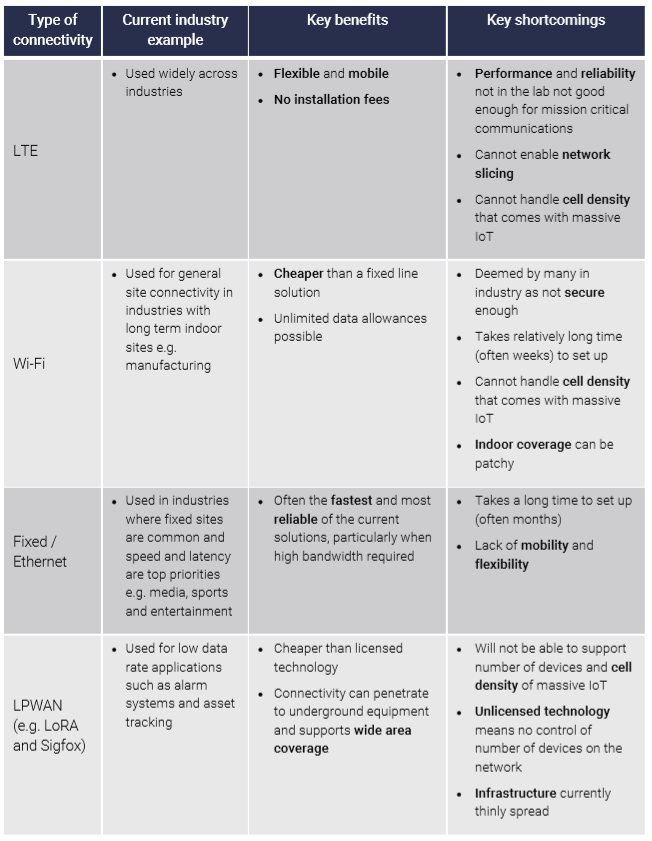

It’s not all about LTE: 5G must be compared to all available technology

Mobile is not the only form of connectivity used by enterprises. Plenty of industries are also making use of Wi-Fi, LPWAN, Zigbee, Bluetooth and fixed connectivity as part of their overall connectivity solution. When 5G is rolled out, in some cases, it will need to integrate with these existing technologies rather than replace them. The table below summarises some of the key benefits and shortcomings of current technologies, including highlighting the sorts of situations in which industries are making use of them.

Current technologies will not be entirely replaced by 5G, but it can address some of they key shortcomings

There are clear scenarios where 5G will be superior to existing technologies and bring significant benefits to industrial users. Ultimately, in particular, 5G will enable:

- Low latency and high bandwidth requirements for wireless connectivity

- Massive IoT through ability to handle high cell density

- Ultra-reliable and secure connectivity.

Table of Contents

- Preface

- Executive Summary

- 5G enabled solutions are estimated to add c.$1.4 trillion to global GDP in 2030

- Operators must embrace new business models to unlock significant revenues with 5G

- Recommendations for operators: how to capitalise on the 5G opportunity

- Introduction

- Background

- Comparing apples with apples: how to compare nascent 5G with established 4G

- It’s not all about LTE: 5G must be compared to all available technology

- 5G deployment: 5G will mature over the next ten years

- 5G will add more than $1.4 trillion to the global economy by 2030

- Mobile network operator strategic options with 5G

- 5G alone will not change the game for operators

- Strategic options for operators to add more value with 5G

- 5G-enabled digital transformation in healthcare

- Example 5G use case: Remote patient monitoring

- Implications for telcos

- 5G-enabled digital transformation in manufacturing

- 5G can create $740bn in additional GDP by 2030

- Example 5G use case: Advanced predictive maintenance

- Implications for telcos

- Conclusions for operators: how to capitalise on the 5G opportunity

Table of Figures

- Figure 1: Mature 5G benchmarked against the capabilities of mature 4G

- Figure 2: Current technologies will not be entirely replaced by 5G, but it can address some of their key shortcomings

- Figure 3: Forecast of 5G deployment in major regions

- Figure 4: Responses from industry surveys

- Figure 5: 5G will contribute ~$1.4 trillion to global GDP by 2030

- Figure 6: Manufacturing, energy & extractives and media, sports & entertainment industries will see the largest upticks to their industry thanks to 5G use cases

- Figure 7: In 2030, manufacturing and construction will be the largest industry sectors (in 2030)

- Figure 8: High income countries will see almost 75% of the benefit of 5G in 2025, but the share is more even across all geographies by 2030

- Figure 9: 4G rollout did not produce sustainable revenue increase

- Figure 10: What should telcos’ role be in 5G B2B?

- Figure 11: As telcos move beyond just connectivity, they can increase their share of the wallet

- Figure 12: Telcos must focus efforts in specific verticals – some are already doing this

- Figure 13: Global impact of 5G on healthcare across four key contact points

- Figure 14: Remote patient monitoring enables wearables to send data about the patient to the hospital for monitoring

- Figure 15: Estimated impact of 5G-enabled remote patient monitoring

- Figure 16: The potential roles for telcos can within healthcare

- Figure 17: The TELUS Health Exchange as a point of coordination

- Figure 18: There is opportunity for telcos’ to play multiple roles higher up the value chain in healthcare

- Figure 19: Estimated impact of 5G on manufacturing GDP (USD Billions) by use case

- Figure 20: Advanced predictive maintenance enables many sensors to send data about machinery for monitoring and optimisation