Telco network edge computing: Lessons from early movers

Drawing from the experience of Lumen, SK Telecom, Telefónica, Verizon and Vodafone, this report identifies the steps, partnerships and expectations of a successful telco edge strategy.

Drawing from the experience of Lumen, SK Telecom, Telefónica, Verizon and Vodafone, this report identifies the steps, partnerships and expectations of a successful telco edge strategy.

The rapid rise in energy prices mean consumers and businesses are now much more conscious of how much power they are using and what it is costing them. As energy moves up everyone’s agenda, some telcos are pushing deep into the electricity market, investing in renewable power, storage and retail propositions.

We spoke to Telefónica about its 10 year experience of building a data monetisation business (previously called LUCA). This deep dive into its strategy, organisational structure and the products developed highlights what it takes to succeed in this challenging market.

As analytics, AI and automation (A3) technologies mature, we explore nine potential A3 capabilities telcos could offer to their enterprise customers. We identify the sweet spots for telcos by assessing the importance of each of the nine capabilities across 14 industry verticals and mapping them against telcos’ existing levels of expertise.

It has been six years since telcos began introducing data and analytics products into their portfolio of enterprise services. This report assesses the potential value of data monetisation across 13 verticals, and by type of data analytics product.

The unique benefits of 5G could unlock $1.4tn of value in eight key industries in 2030. What steps should operators take to deliver these benefits? What business and organisational transformation must occur to unlock this opportunity?

We outline three potential roles for telcos in the IoT, describing twelve potential application areas and forty use cases, as well as the structure and trends driving change. Looking beyond this we ask which market areas are most attractive, and what should telcos do within them?

The advent of smartphones and tablets is disrupting the $10Bn+ loyalty market by opening up new ways for brands and retailers to engage with their customers in a highly interactive fashion. This briefing analyses that market, why mobile is a compelling medium in it, key mobile app types, and leading edge strategies used by online players and traditional retailers. It concludes by outlining the strategies telcos need to employ to add value and exploit their assets and capabilities to play a major role in the value chain. (July 2013, Executive Briefing Service, Dealing with Disruption Stream.)

Loyalty and Mobile Venn Diagram 2013

The ‘Mobile/Digital Wallet’ needs to evolve to support authentication, search and discovery, as well as payments, vouchers, tickets and loyalty programmes. Moreover, consumers will want to be able to tailor the functionality of this “commerce assistant” or “commerce agent” to fit with their own interests and preferences. Our report and analysis of the Digital Commerce 2.0 Executive Brainstorm, 20 March 2013, part of the New Digital Economics Silicon Valley event. (April 2013, Executive Briefing Service, Dealing with Disruption Stream.)

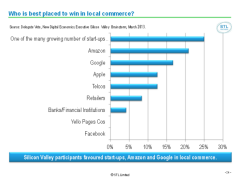

Who is best placed to win in local commerce April 2013

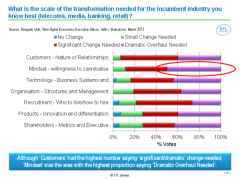

Value is squeezed out of industries as they become increasingly digital – i.e. accessed by mobile and online, driven by data and defined by software. We call the collective economic impact of this pressure ‘The Great Compression’. But which companies will survive and prosper – and how? 90% of the Execs at our Silicon Valley brainstorm identified ‘management mindset’ as a key factor in Telecoms, Media, Finance and Retail. Our analysis and a detailed report of the findings of the Digital Economy session at the NDE Executive Brainstorm, Silicon Valley, held at the InterContinental Hotel, San Francisco on the 19th March 2013. (May 2013, Executive Briefing Service, Transformation Stream).

Scale of Transformation Needed April 2013

Telco 2.0 presents a new strategy report examining the evolution of cloud services; the current opportunities for vendors and Telcos in the Cloud market, plus a penetrating analysis on the positioning Telcos need to adapt in order to take advantage of the potential $200Bn global Cloud services market. This report offers over 140 pages of insightful commentary from those who’ve been working at the cutting edge, and includes an introduction to the sector’s key technologies and emerging trends, as well as detailed recommendations for Telcos and vendors. (December 2012, Strategy Report, Cloud and Enterprise ICT Stream.)

Cloud Strategy Report Image

A write up and analysis of new research plus participants’ and speakers’ views at the May 2009 Telco 2.0 Executive Brainstorm exploring the challenges of making telcos better retailers. (May 2009)

Summary: This report examines future retail and wholesale business models for fixed and mobile operators offering high speed packet data services. This includes – but is not limited to – providing Internet access.

The report charts the next 10 years for fixed and mobile telecoms network operators as the viability of the current broadband business model is threatened by intense competition and falling prices in maturing markets, changing usage patterns, and the adaptation of new technologies. The report identifies and profiles a new $250Bn content delivery market opportunity. (April 2008)