Case study overview

Our partnering strategy approach and methodology helps clients to evaluate potential partners and narrow down the list in a systematic way. STL Partners brings innovative ‘out of the box’ thinking and objectivity in identifying and evaluating potential partners. This methodology can and has been adapted in different ways for different clients looking into partnerships across various specific domains.

STL Partners works closely with clients to undergo an iterative and staged evaluation process to identify and assess different types of evaluation criteria (e.g. deal-breakers to exclude, high, medium, low) with which potential partners are assessed on.

See how STL Partners supported a virtualisation software provider in:

- Building a long list of potential partners;

- Prioritising based on exclusion and evaluation criteria;

- Profiling shortlisted candidates and evaluating potential partnership models.

Consulting services overview

Get in touch to find out how we can help you:

- Develop and test customer propositions

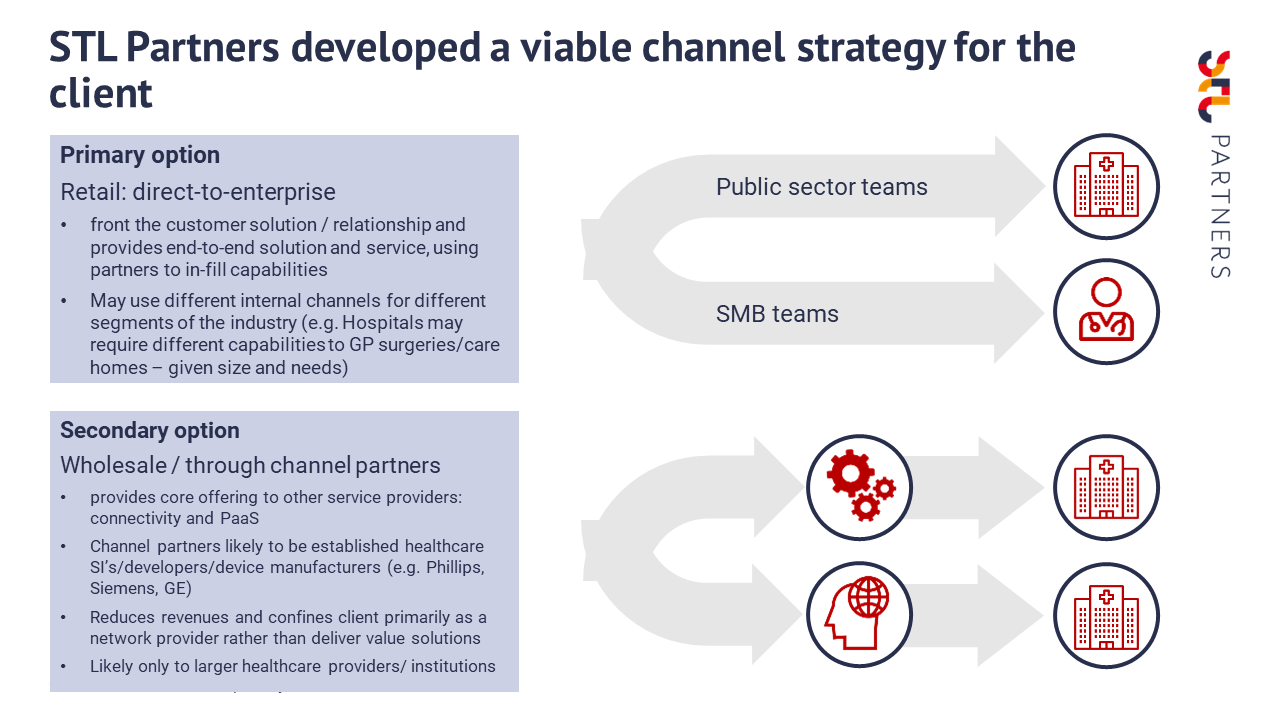

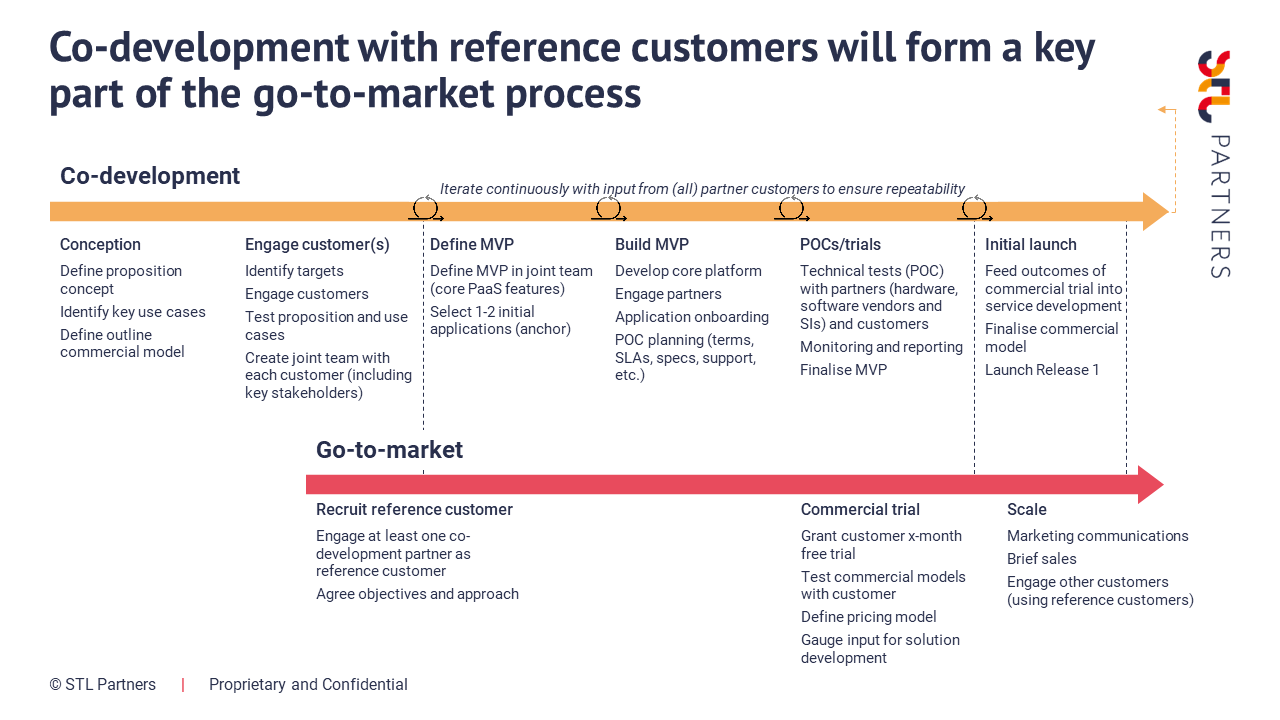

- Detail viable go-to-market strategies

- Scout, engage, and facilitate partnerships

- Develop tools to empower the salesforce

STL provided customised, detailed analysis that addressed our specific needs …. not fixed generic templates we get from others.

Director, Field and Partner Development

Global virtualisation software provider

Building a long list of potential partners

Our key objective for this engagement was to identify “big bets” partnership opportunities that our client could make to help scale and accelerate traction in telco cloud, to help drive stronger engagement with CSPs. As a result, we supported our client in building out a long list of approximately 110 potential partners across a range of different categories, ranging from:

- managed service providers;

- technology consultants;

- general and telecoms industry-specific systems integrators;

- incumbent and challenger network equipment providers;

- …and beyond.

Example deliverables

Example deliverables

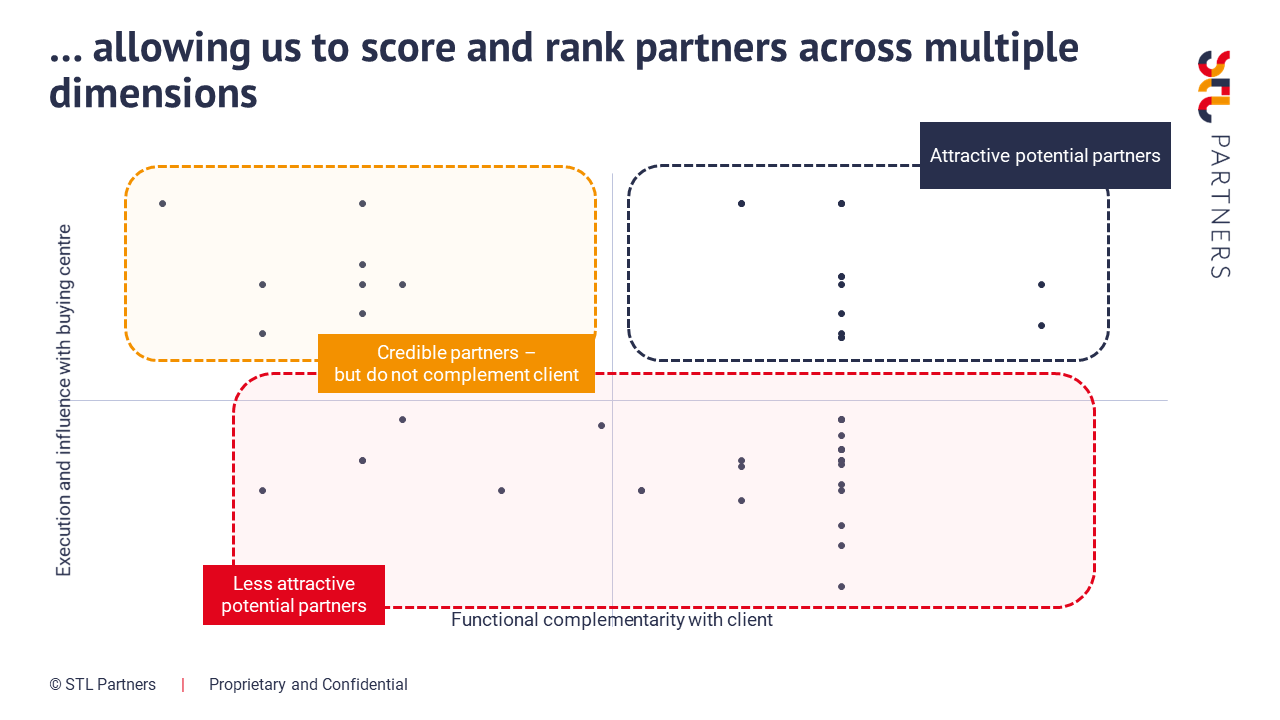

Prioritising based on exclusion and evaluation criteria

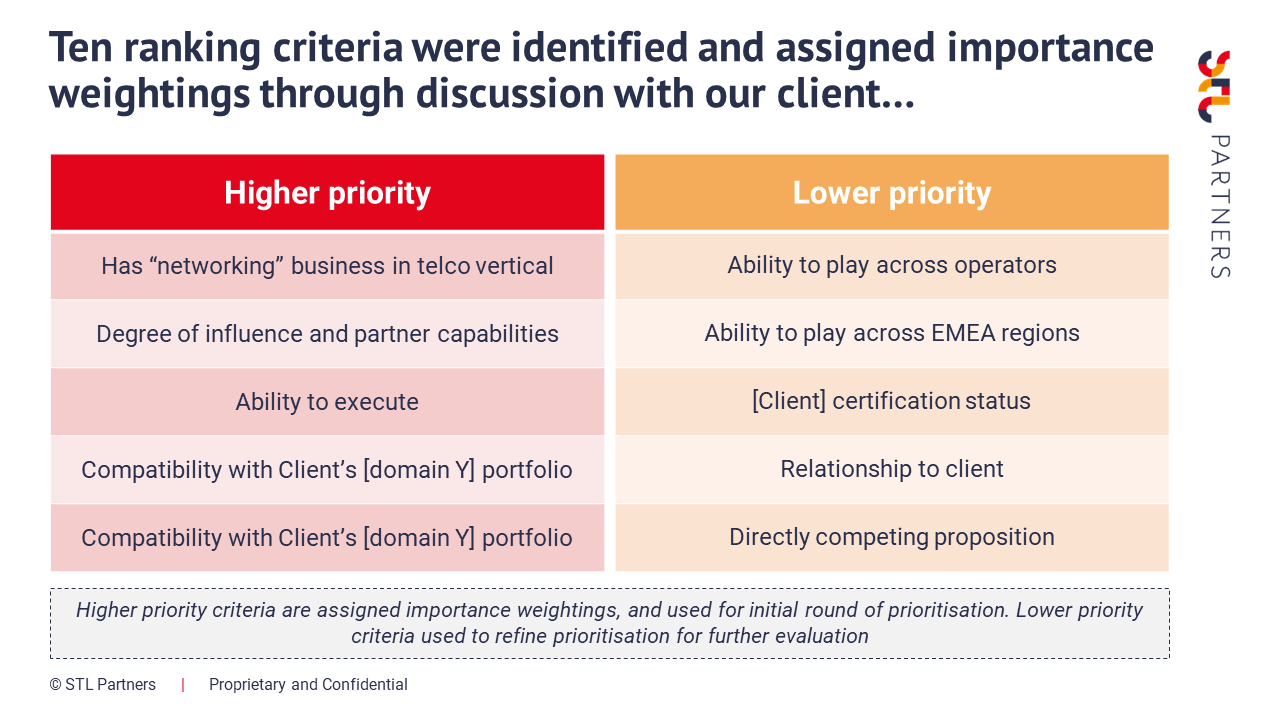

Through a series of workshops, we worked closely with our client to identify different “deal breaker” criteria to take into consideration their key objectives for the partnerships. This included:

- identifying the criteria and defining the key questions that needed to be considered within each criterion

- defining how the factor would be measured and on what scale

- determining the timeframe considered for the factors

For example, one key criterion was focused on the potential partner’s commercial abilities, whether it has strong commercial relationships with and is trusted by CSPs, which needed to be considered on an immediate short-term basis.

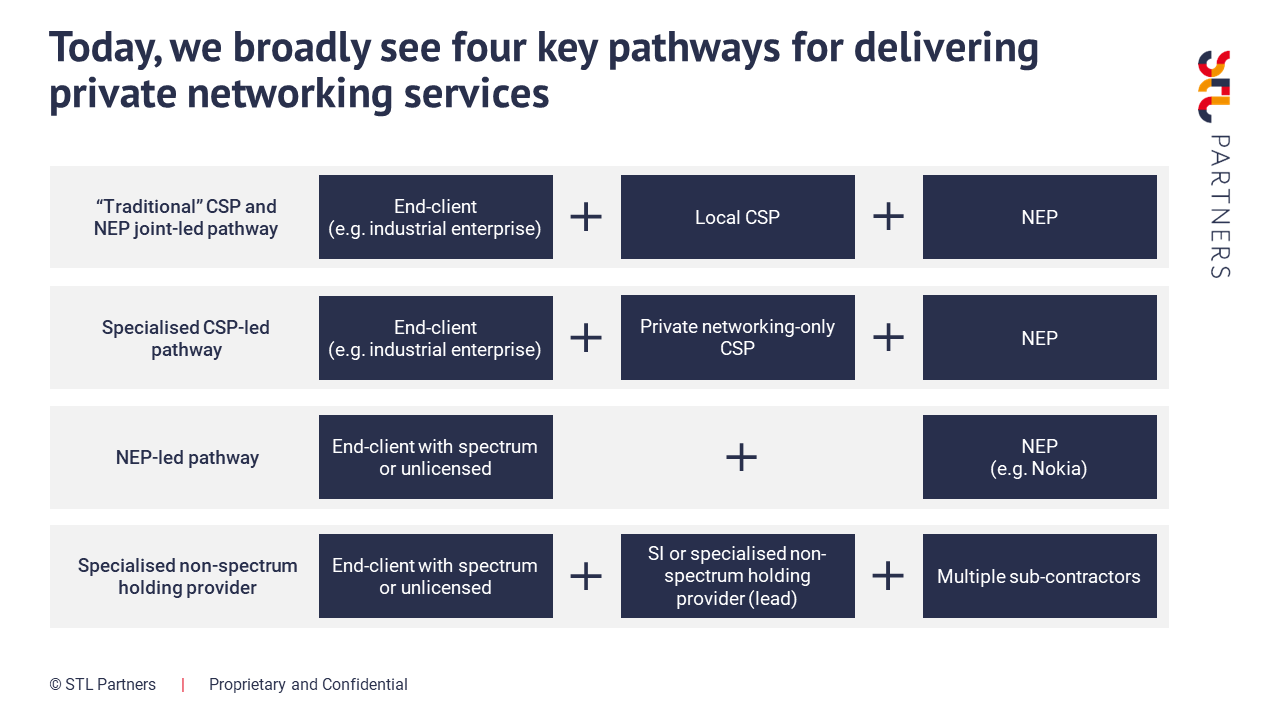

Profiling shortlisted candidates and evaluating potential partnership models

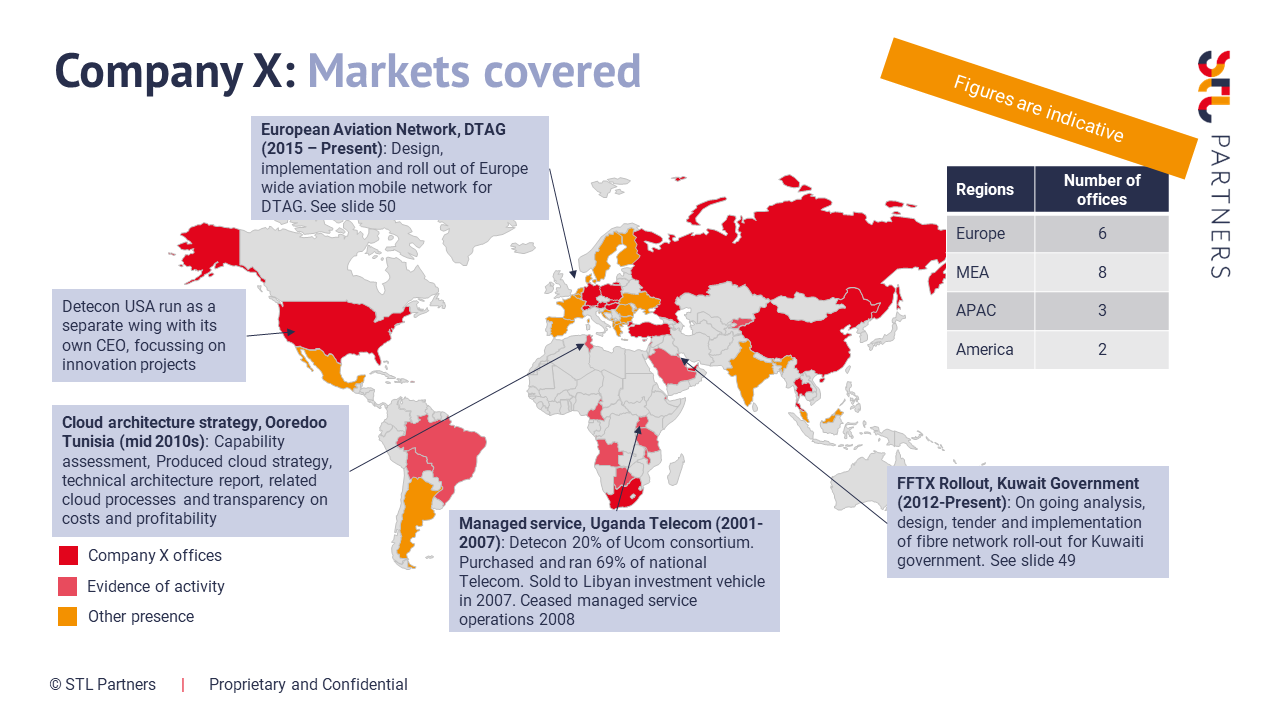

Once we completed and refined the prioritisation exercise, we reached a shortlist of 6 potential partners for our client, which we took forwards to the next stage. This next stage involved building in-depth profiles and analyses to provide the following:

- An overview of the company, including product and service portfolio, markets covered

- An assessment of each shortlisted company’s capabilities and overall partnership value chain capabilities to understand the combined capabilities

- Suggested scope of the partnership, including the potential partnership model and approach, role of each partner, joint value proposition etc.

- Key decision makers and influencers within the company to engage with