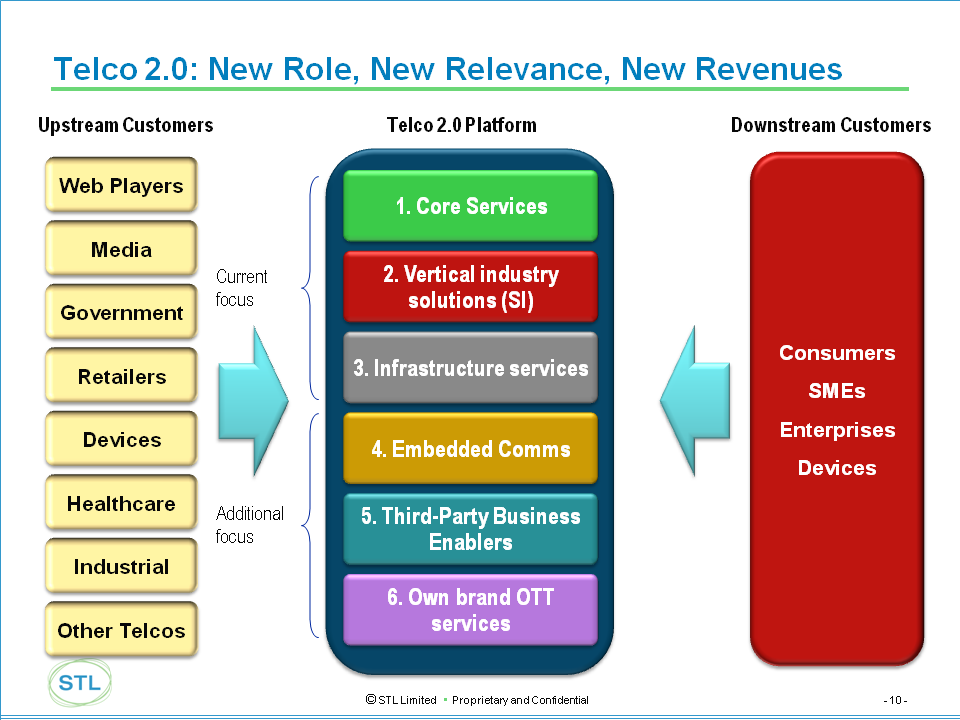

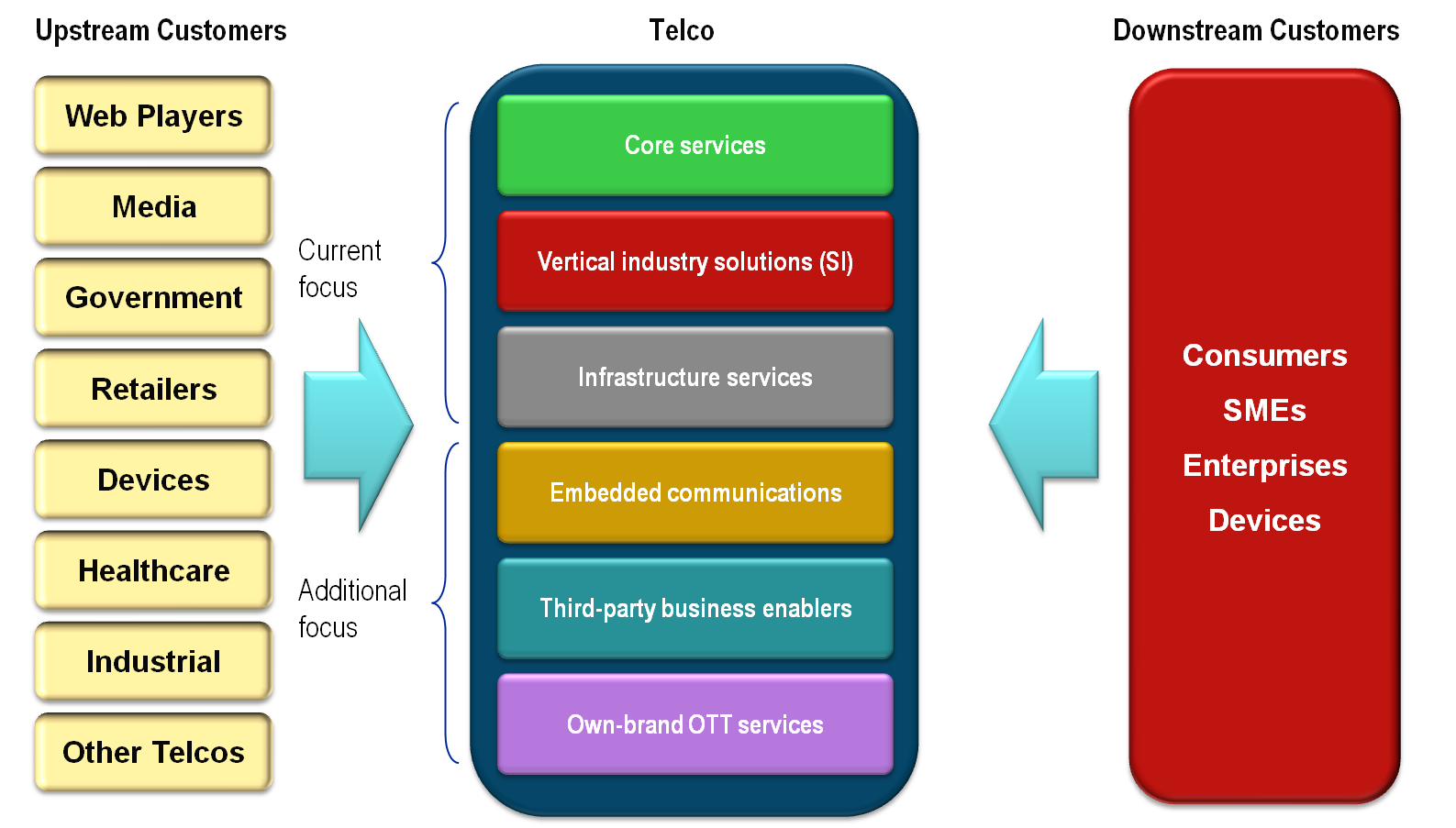

How the Coordination Age changes the game

Telecoms is moving into its third age: the Coordination Age. Why was it so hard for telcos to adapt when content shifted from the physical to the virtual world with the growth of the Internet, and how can they learn from past experience to create new value in the next seismic change in telecoms and content?