Digital identity: Four steps to maximising value

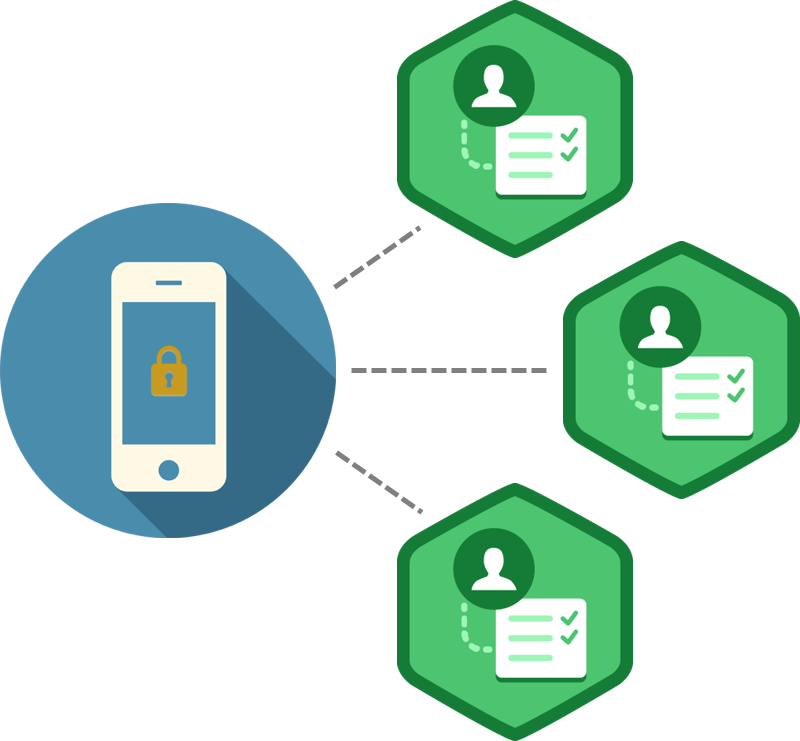

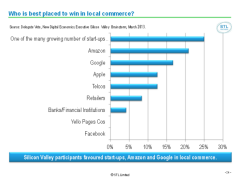

Digital identity has become a critical aspect of modern life, but security and user experience are suffering from market fragmentation and limited visibility or control for end users over how their personal data is used. How can telcos build on their existing services to solve these challenges?