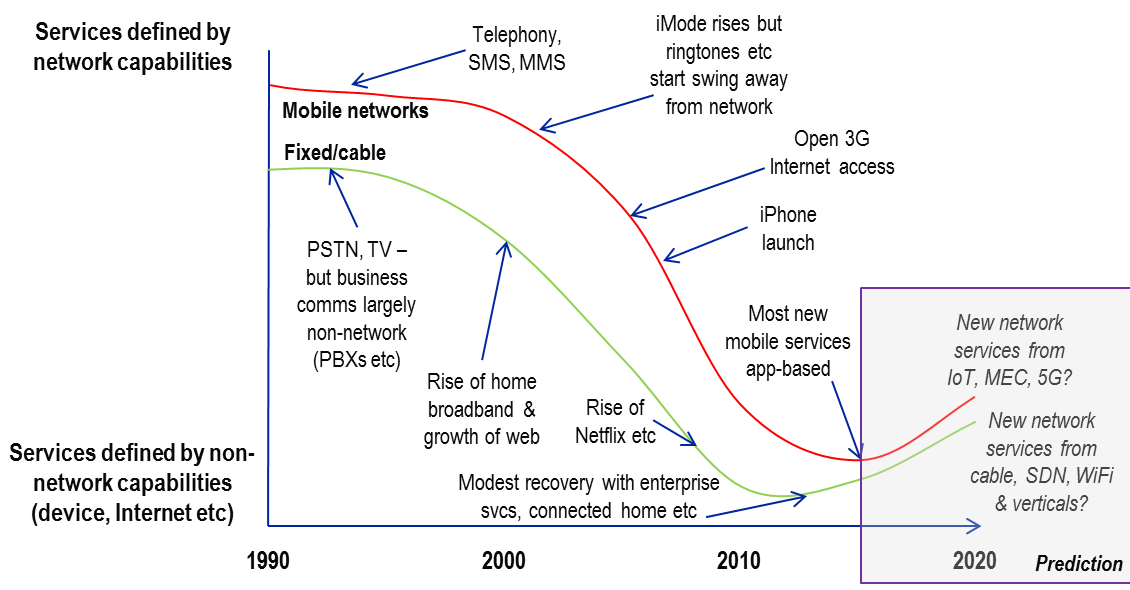

Do network investments drive creation & sale of truly novel services?

Enthusiasm for creating novel so-called “digital” services is pervasive in the telecoms industry. There is a major shift afoot in the way telcos create, integrate, sell and manage value-added propositions. But how much is enabled by – or dependent on – the network itself? In recent years, most investment has been solely for improved connectivity, but there are signs that future network capex might drive new service opportunities directly, rather than just by empowering 3rd parties.