Faster than Facebook: how to speed up digital transformation and disruptive innovation

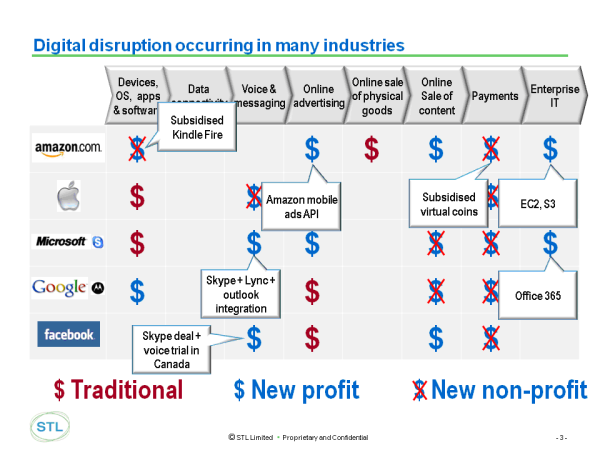

Digital transformation is now impacting every industry, and one of the hardest organisational challenges is developing small-scale innovations fast and managing them in large and mature organisations. Here are our recommendations and key findings from the OnFuture EMEA 2014 cross-industry brainstorm, including a summary of Facebook’s internal recipe for speedy success. (June 2014, Executive Briefing Service, Transformation Stream.)

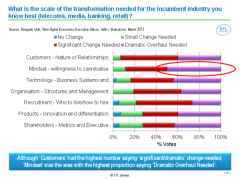

Existing Business remains the biggest obstacle to innovation