The Telco Cloud Manifesto 2.0

Co-operation with hyperscalers can reap rewards – but only if telcos complete the hard work of cloudification first.

Co-operation with hyperscalers can reap rewards – but only if telcos complete the hard work of cloudification first.

Telco cloud made big promises for the transformation of telecoms. It is a fundamental enabler for 5G and the exciting opportunities ahead. Why hasn’t it delivered yet – and what needs to change?

SDN and NFV deployment is growing deeper but not broader: the long tail lags behind the pioneers.

Widespread use of open source software is an important enabler of agility and innovation in many of the world’s leading internet and IT players. Yet while many telcos say they crave agility, only a minority use open source to best effect. We examine the barriers and drivers, and outline six steps for telcos to safely embrace this key enabler of transformation and innovation.

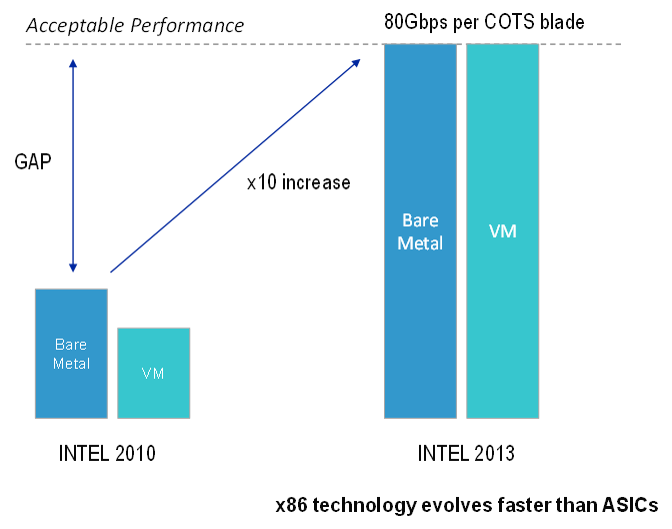

NFV (Network Functions Virtualisation) potentially offers operators benefits of up to 80% network opex reduction and significant improvements in agility, and threatens a shake-up of the vendor landscape. What are the challenges to making it happen, and what do telcos and vendors need to do to succeed?