Breaking down silos for telco adaptability

Our analysis of five telco case studies highlights the challenge for telcos looking to introduce cross-silo working and how approaches are being adapted to fit the organisation and access business benefits.

Our analysis of five telco case studies highlights the challenge for telcos looking to introduce cross-silo working and how approaches are being adapted to fit the organisation and access business benefits.

Nine change stakeholders describe their experience of telco transformation, providing insights on the change process and learnings for others that are remodelling their organisations for the future.

The world is entering the post-pandemic era of hybrid working. This report dissects enterprise perceptions of hybrid working and argues that operators have a crucial role to play in building a thriving hybrid working environment for enterprise customers.

Change agents know that stakeholders need a picture of the future – or “vision” – to point the way for a transformation. Yet visions can do more to unite and inspire action. How can telcos improve them?

The knowledge and skills required to succeed in the digital environment are ever evolving. Telcos must maintain knowledge flows around the organisation and enhance their capacity to learn in order to keep pace and compete.

Stakeholders have a critical bearing on the success or failure of telco growth plans. What are the key groups, what’s needed to optimise chances of success, and how does the Coordination Age help?

Many telcos have visited the Valley in search of new and “open” innovation opportunities, but the returns often seem fleeting. We talked with a 20-year veteran of the circuit to understand why, and what needs to change if they are to embed and operationalise such innovation.

True E2E automation has not yet been achieved, but network automation is a reality now, and one which telcos must master to survive. What steps are telcos taking to implement network automation, what challenges must be overcome and what benefits can be expected?

Elisa has developed a culture and an approach to business that has seen it grow capital value, deliver dividends, keep customers happy, and attract and develop talent. We outline how, and what other telcos can learn based on our in-depth research, including interviews with CEO Veli-Matti Mattila and the wider team.

Analysis of the results of the first phase of our telecoms industry survey on purpose, leadership and culture shows the status of the industry and key drivers, and uncovers some important barriers to progress.

Telecoms is moving into its third age: the Coordination Age. Why was it so hard for telcos to adapt when content shifted from the physical to the virtual world with the growth of the Internet, and how can they learn from past experience to create new value in the next seismic change in telecoms and content?

Although nearly all operators aspire to deploy autonomous networks and personalised customer services, few have actually implemented advanced analytics at scale across their organisations. Almost universally, telcos are hampered by incomplete and siloed data sets and cultural resistance. What have the industry’s leaders done to overcome these challenges?

The global digital economy is moving into a new age: The Coordination Age. A global need to improve the efficiency of resource utilisation is manifesting in industries and individuals as a desire to “make the world work better”. What role can telcos play in this, and will that ultimately mean the break-up of the telco as we know it?

Strategy is shaped and constrained by company culture, and a company’s culture will negate a strategy if they are not complementary. We examine how TELUS Health has created and maintained an effective culture that has helped to deliver employee and customer engagement, and business results. How does it do it, and what should others learn?

M&A is a key tool in building digital businesses, but is the telco sector investing enough? We examine the key drivers and barriers to telco digital M&A strategies, comparing investment levels to other verticals, and compare and contrast M&A activity with our previous findings.

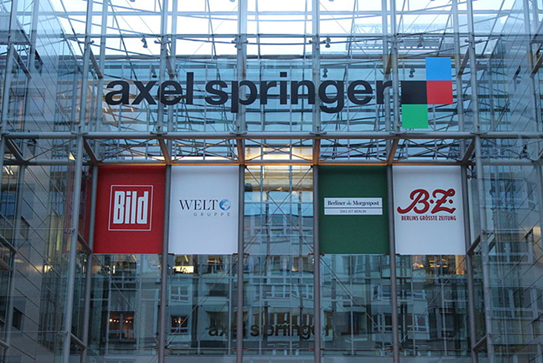

Our latest adjacent market case study analyses Axel Springer’s successful 10 year digital transformation from print to online publisher, and holds many lessons for telcos, not least of which are the pitfalls of under commitment, and the required level of investment in M&A.

Many telcos are trying to change, to become more agile and move from infrastructure- to software-led business models. But change is hard, especially because to be successful they need to adapt their culture and employee skill-sets which is a notoriously difficult task. In our latest report we analyse change strategies used by AT&T, Telkom Indonesia, and three other telcos in the context of insights from neuroscience, and show that change is possible with the right strategy and leadership.