Cloud Services 2.0: Clearing Fog, Sunshine Forecast, say Telco 2.0 Delegates

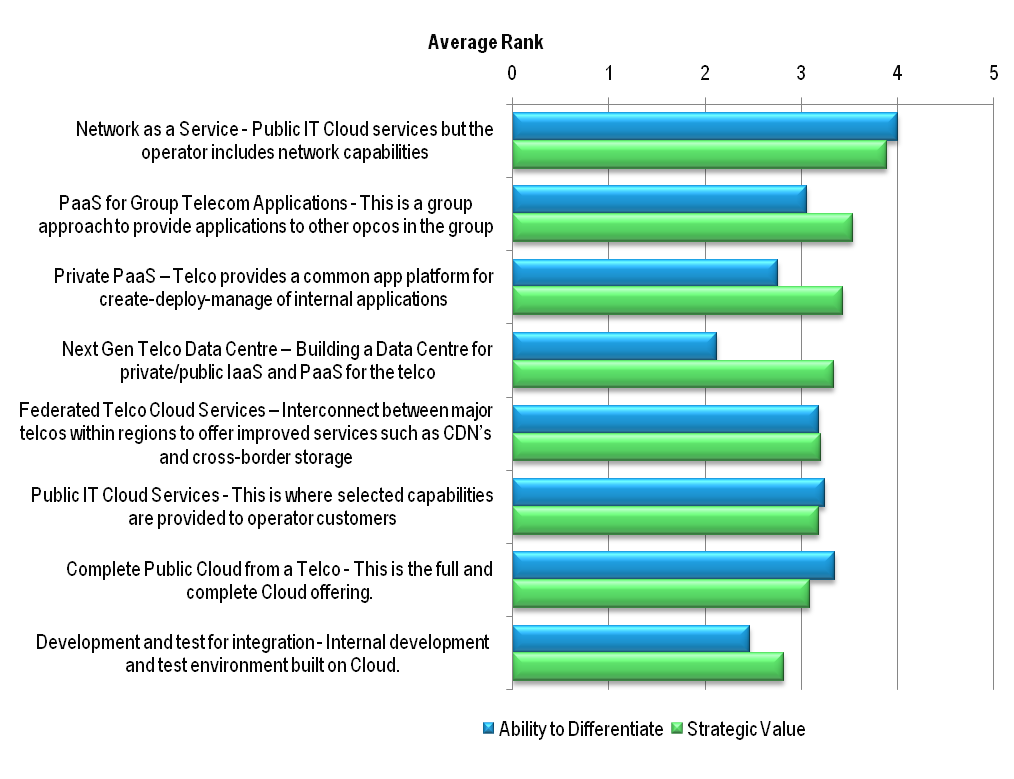

The early stage of development of the market means there is some confusion on the telco Cloud opportunity, yet clarity is starting to emerge, and the concept of ‘Network-as-a-Service’ found particular favour with Telco 2.0 delegates at our recent Brainstorms. (December 2010, Executive Briefing Service, Cloud & Enterprise ICT Stream)