M2M 2.0: Out-Smarted? (Arkessa Presentation)

M2M 2.0: Out-Smarted? Presentation by Paul Green, Arkessa, at the EMEA Executive Brainstorm in November 2011.

M2M 2.0: Out-Smarted? Presentation

Defining the future telco — and what it means for operators and their partners

M2M 2.0: Out-Smarted? Presentation by Paul Green, Arkessa, at the EMEA Executive Brainstorm in November 2011.

M2M 2.0: Out-Smarted? Presentation

M2M 2.0: Smart Home – Enabled by Mobile. Presentation by Svetlana Grant, GSMA, at the EMEA Executive Brainstorm in November 2011.

M2M 2.0: Smart Home – Enabled by Mobile Presentation

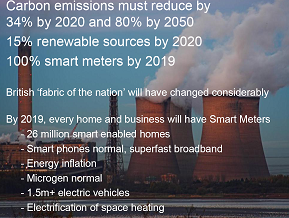

M2M 2.0: The Future of Energy, Presentation by Chris Chung, Head of Emerging Technologies, British Gas. The energy revolution is upon us, and M2M will be a critical part of it. Presented at EMEA Brainstorm, November 2011.

26 million smart-meters by 2019

M2M 2.0: HGI Standards Activities for M2M Services, Presentation by Corrado Rocca, Board Member, HGI. Overview of progress in standardisation for M2M and connected home technologies. Presented at EMEA Brainstorm, November 2011. HGI Standards at a Glance M2M

M2M 2.0: Business model innovation in M2M, Presentation by Mike Short, Vice-President, Telefonica Europe. Overview of Telefonica’s plans for M2M services across Europe. Presented at EMEA Brainstorm, November 2011. Summary: e-health M2M

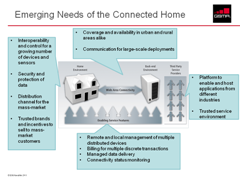

M2M 2.0: Hubbing the connected home, Presentation by Stephen Cunningham, CEO, Landis & Gyr. Describes L+G’s technology strategy for the connected home. Presented at EMEA Brainstorm, November 2011.

M2M EMEA home hub

M2M 2.0: Service Enablers Across Multiple Home Hubs. Presentation by Robin Duke-Woolley CEO, Beecham Research, at the EMEA Executive Brainstorm in November 2011.

M2M 2.0: Service Enablers Across Multiple Home Hubs Presentation

M2M 2.0: Service enabler strategies across multiple home hubs. Presentation by Kim Bybjerg, Head of M2M Northern Europe, Vodafone, at the EMEA Executive Brainstorm in November 2011.

M2M 2.0: Service enabler strategies across multiple home hubs Presentation

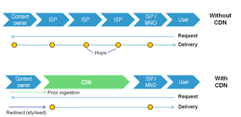

Content Delivery Networks (CDNs) such as Akamai’s are used to improve the quality and reduce costs of delivering digital content at volume. What role should telcos now play in CDNs? (September 2011, Executive Briefing Service, Future of the Networks Stream).

Should telcos compete with Akamai?

The recent spate of deals (Google/Motorola, Nortel, Microsoft/Nokia) are the start of a long ‘Cold War’, where all parties are heavily armed, and risk destroying each other (and themselves) with overly aggressive legal actions. Telco 2.0 partners Arete Research analyse implications for the mobile device space and clarify some misunderstood issues. (September 2011)

Enterprise cloud computing services need great connectivity to work, but there are opportunities for telcos to participate beyond the connectivity. What are the opportunities, how are telcos approaching them, and what are the key strategies? Includes forecasts for telcos’ shares of VPC, IaaS, PaaS and SaaS. (September 2011, Executive Briefing Service, Cloud & Enterprise ICT Stream)

Apps & Telco APIs Figure 1 Drivers of the App Market Telco 2.0 Sept 2011

Our in-depth look at the UK’s highly competitive digital TV market which reflects many global trends, such as competition between different types of content distributor (LoveFilm, YouTube, Virgin Media, BBC, BSkyB, BT, etc.), channel proliferation, new devices used for viewing, and the increasing prevalence of connected TVs. What are the key trends and who will be the winners and losers? (August 2011, Executive Briefing Service)

Chart from Connected TV Figure 2 telco 2.0

Content Delivery Networks (CDNs) are becoming familiar in the fixed broadband world as a means to improve the experience and reduce the costs of delivering bulky data like online video to end-users. Is there now a compelling need for their mobile equivalents, and if so, should operators partner with existing players or build / buy their own? (August 2011, Executive Briefing Service, Future of the Networks Stream).

Telco 2.0 Six Key Opportunity Types Chart July 2011

A summary of the six Telco 2.0 opportunities to transform telco’s business models for success in an IP-based, post PSTN world: Core Services, Vertical Solutions, Infrastructure Services, Embedded Communications, 3rd Party Enablers, and Own Brand OTT Services. It includes an extract from the Roadmap to New Telco 2.0 Business Models, updates on latest developments, and feedback from over 500 senior TMT industry execs. (July 2011, Executive Briefing Service, Transformation Stream).

Telco 2.0 Six Key Opportunity Types Chart July 2011

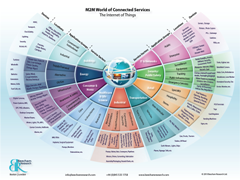

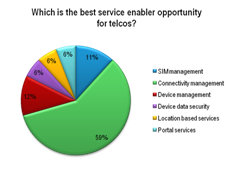

Our latest report on M2M 2.0 covers: M2M market growth, structure and dynamics; business models; the best role(s) for telcos; and leading thinking from Deutsche Telekom, Vodafone, Telenor, KPN and Swisscom. It describes how ‘Service Enablers’ are key to the telco opportunity in M2M in addition to connectivity. (July 2011, Executive Briefing Service)

M2M Pie Chart Service Enablers July 2011

RIM’s shares have plummeted in value over the last four months, prompting an eruption of finger-pointing in the media and speculation of its demise or acquisition. In this analysis we examine whether the doom-mongers are right and what RIM’s recovery strategy might be. (July 2011, Executive Briefing Service)

Apple iCloud logo in analysis of impact of iCloud/iOS on digital ecosystem

Our research focuses on how telcos and their partners can embrace industry disruption.

Learn more1