From Telco to Techco

Telco to techco – what does it mean?

The concept of changing from a telco to a techco (a telecoms operator to a technology company) has recently become popular.

It is a new way to reflect a long-standing desire of telcos to change. Many telco CEOs and boards would like to make the companies they run more capable of growing and adapting to changes in their environments. They would also like to embrace concepts developed in techcos, such as agile methods, that allow more rapid change.

Why change from telco to techco?

The desire to change from a telco to a techco has a number or drivers.

First, techcos are usually more highly valued by investors and stock markets than telcos. The chart below shows that the combined market value of leading telcos is significantly less than that of techcos in comparison to their revenues. Put simply, that means the shares in techcos are usually worth relatively more that shares in telcos.

Source: STL Partners

This is because investors think that techcos are more likely to grow than telcos and will therefore worth more money in the future.

Secondly, techcos are typically able to change and develop more quickly. This means that they can adapt to their market environment more quickly and find new opportunities and combat new threats better.

This is sometimes described as being strategically agile. This is desirable because it means an organisation can address opportunities and threats faster.

How do you change from telco to techco?

Changing from telco to techo has a number of related components.

Capex and opex: Spending differently to grow

Financially, telcos have tended to spend more in capital expenditure (capex). This means things like networks – towers, cables, radio antennas, etc, and less on operational expenditure (opex) in areas like new service development.

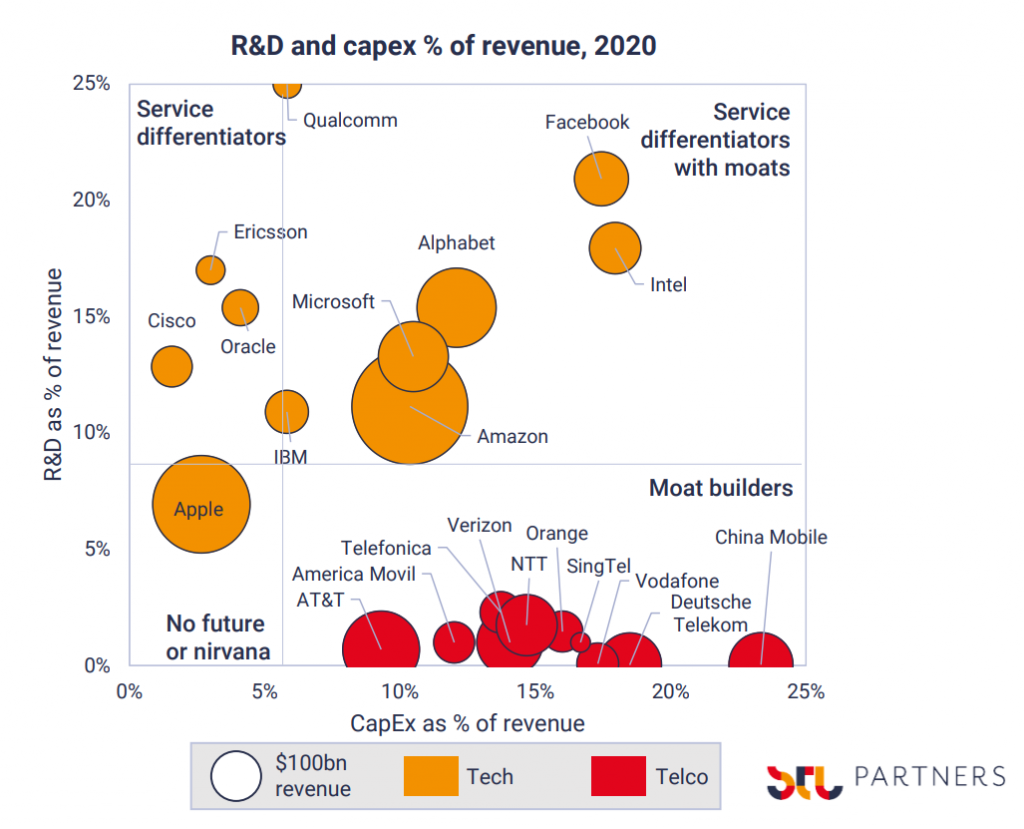

The chart below shows the relative spending by telcos (in red) and techcos (in yellow). The telcos are at the bottom of the chart and spend a similar proportion on capex to techcos – about 10-20%.

However, telcos spend much less on research and development (opex) – significantly less than 3%. Techcos typically spend 10-25% on this.

So telcos are spending a lot on building their networks and relatively little on creating new things to sell. Unfortunately for the telcos, all that network spending is not generating much or any new growth revenues.

Source: STL Partners

Another consequence this spending pattern is that telcos have become very dependent on their technology partners to develop new things for them. This has reduced their own scope to innovate and grow independently.

These are some of the reasons why STL says that telco CFOs (Chief Financial Officers) need to drive business model change. They need to drive more telco investment in the activities and areas that create the new value – on R&D and service development investments.

Telco cloud helps – but it’s only a start

Cloud and software developments are typically accounted for as opex. Hence becoming more telco cloud focused has shifted some telco expenditure into opex.

However, telcos need to do more than replace traditional telco network capex with telco cloud opex spending. Yes, telco cloud investments will help them become more flexible in the long term. But they also need to invest in service development opex to create new things.

This has proved something of a challenge for telcos so far, as many have struggled to successfully work out what new things to do. Understandably, most customers aren’t too keen to spend any more money on telecoms. So what else can a telco do – and sell – that is worth paying for?

Purpose and proposition: serving new needs

This leads to a fundamental question: what is a telco’s purpose – what is it for? What new needs is it going to solve for its customers?

To resolve this requires another change: telcos need to redefine their purpose – what are they trying to achieve in their markets? Connectivity is important and a given, but it is not sufficient to create growth. This is particularly true in markets where penetration is already high and competition is mature. So what else should telcos do?

STL Partners believes that the answer to what new purpose to serve can be found in The Coordination Age. This analysis shows that:

- All customers are today seeking to get better use of their resources (time, land, money, carbon, etc.)

- And that connecting technologies (e.g. 5G, fibre, AI, automation) are an integral tool to enable this.

Telcos cannot serve all the possibilities. They will have to choose which propositions to develop to serve different markets, whether consumer or enterprise.

Transformation and Innovation

Accompanying this evolution of purpose and the development of new propositions to support it, is a need to evolve how telcos operate. This is often talked about as transformation. Serving new needs takes new knowledge and skills, as well as the new skills in advancing technologies (like 5G and AI) that make the new things possible.

Telcos also need to employ new operational concepts like agile development. This an approach to innovation pioneered by techcos and software companies.

Working with Ecosystems

Plus, telcos need to work in new ecosystems – groupings of related companies that together help to deliver new outcomes to customers. Healthcare provides a good example of an ecosystem. It takes pharmacies, doctors, nurses, paramedics, pharmaceutical companies, hospitals, health authorities and insurance companies (plus many others) acting in a coordinated way to deliver healthcare.

Telco to techco – how much does it matter?

To conclude, changing from telco to techco is really another way of saying ‘telcos need to transform’. It is a little more descriptive because it gives a hint of what a telco might need to be, but it is still just another soundbite to try to advance the change agenda.

In STL Partners’ view, it is another attempt to chivvy the industry on a little – a call to change and a partial vision at least. But the realisation of true change needs much more as we outline here and in our research overall:

- a change of financial priorities

- a new and grounded purpose

- new propositions to deliver to that purpose

- and new ways of working.

You can also see Andrew Collinson, Amy Cameron and Dean Bubley discussing this with Harry Baldock of Total Telecom in the video below. From the look of the still photo here they made it an enjoyable experience.

Read more about Transformation Leadership

Transformation Leadership insights pack

This document will provide you with a summary of our insights from our Transformation Leadership work.

The benefits of GitOps in telecoms

As telcos continue to rollout 5G, they are adopting software engineering approaches, like DevOps and CI/CD to improve how they run the networks and innovate. Some are exploring the potential of specific practices, such as GitOps, to elevate their processes. Here we address what GitOps is, how it is different to DevOps, and why large telcos like Deutsche Telekom and Orange are interested.

Telco skills in demand: key trends in hiring patterns

Telcos require access to new skill sets to manage transformed networks and operations, as well as to offer and scale differentiated services to customers. This article identifies which skills are in-demand in the telecoms industry and leverages LinkedIn data to illustrate how hiring patterns are changing.

Navigating digital identity: understanding what it is and its importance for telcos

Digital identity solutions constitute a promising revenue stream for telcos, yet few have been able to fully capitalise on this opportunity. So why did the coordination between SK Telecom, KT, and LG Uplus prove so successful?