Cashing in on the end of cash

The global shift away from cash opens up a variety of potentially lucrative opportunities for telcos. What should telcos do to capitalise on the synergies between telecoms and financial services?

The global shift away from cash opens up a variety of potentially lucrative opportunities for telcos. What should telcos do to capitalise on the synergies between telecoms and financial services?

Successful innovation for telcos is important but has proved elusive. We look at some successes and more failures to draw out the common factors required for innovation to succeed.

Can the partnership between Google and telcos strike the balance between interoperability and speed of development needed to challenge Facebook and Tencent in conversational commerce?

Mobile World Congress 2017 seemed busier and more diverse than ever – so congratulations to our partners at the GSMA. In previous years there has been an announcement or keynote that provides a unifying theme, but not so this year, although behind the scenes we identified a fundamental driving force. Our report of this year’s Congress analyses themes of transformation, 5G, IoT, AI and others, and distils the key messages from Barcelona.

Mobile messaging is fast becoming a key platform for digital commerce, mounting a challenge to Google Search, Amazon’s Marketplace and other two-sided platforms. As Facebook gears up to take advantage of this opportunity, some of the world’s largest telcos are working with Google to develop and deploy multimedia communications services that will work across networks and will replace SMS. But will it be too little, too late?

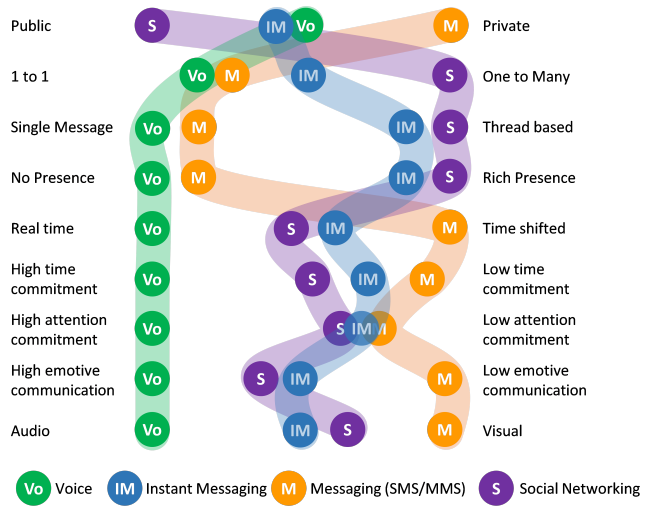

Consumer and enterprise communications behaviours are changing significantly around the globe as new solutions meet core needs more effectively and change customer expectations. This extract from our latest major report provides insight to the changes, and describes effective strategies that meet these evolving needs for both incumbents attempting to defend existing services and innovators seeking to disrupt and create new value. (December 2013, Executive Briefing Service)

Psychological and social advantages of voice, SMS, IM, and Social Media Dec 2013

Our new research shows how telcos can slow the decline of voice and messaging revenues and build new communications services to maximise revenues and relevance with both consumer and enterprise customers. It includes detailed forecasts for 9 markets, in which the total decline is forecast between -25% and -46% on a $375bn base between 2012 and 2018, giving telcos an $80bn opportunity to fight for. It also shows impacts and implications for other technology players including vendors and partners, and general lessons for competing with disruptive players in all markets. It looks at the impact of so-called OTT competition, market trends and drivers, bundling strategies, operators developing their own Telco-OTT apps, advanced Enterprise Communications services, and the opportunities to exploit new standards such as RCS, WebRTC and VoLTE. (November 2013, Executive Briefing Service). Future Value of Voice and Messaging Cover Small

Voice & Messaging 2.0: Strategic Threats and Opportunities, Presentation by Phil Laidler, Director, Consulting, STL Partners. Which of the disruptors – Apple, Facebook, Google, Skype – is the biggest menace? Presented at EMEA Brainstorm, November 2011.

Strategic options for telcos – resisting the disruptors in voice