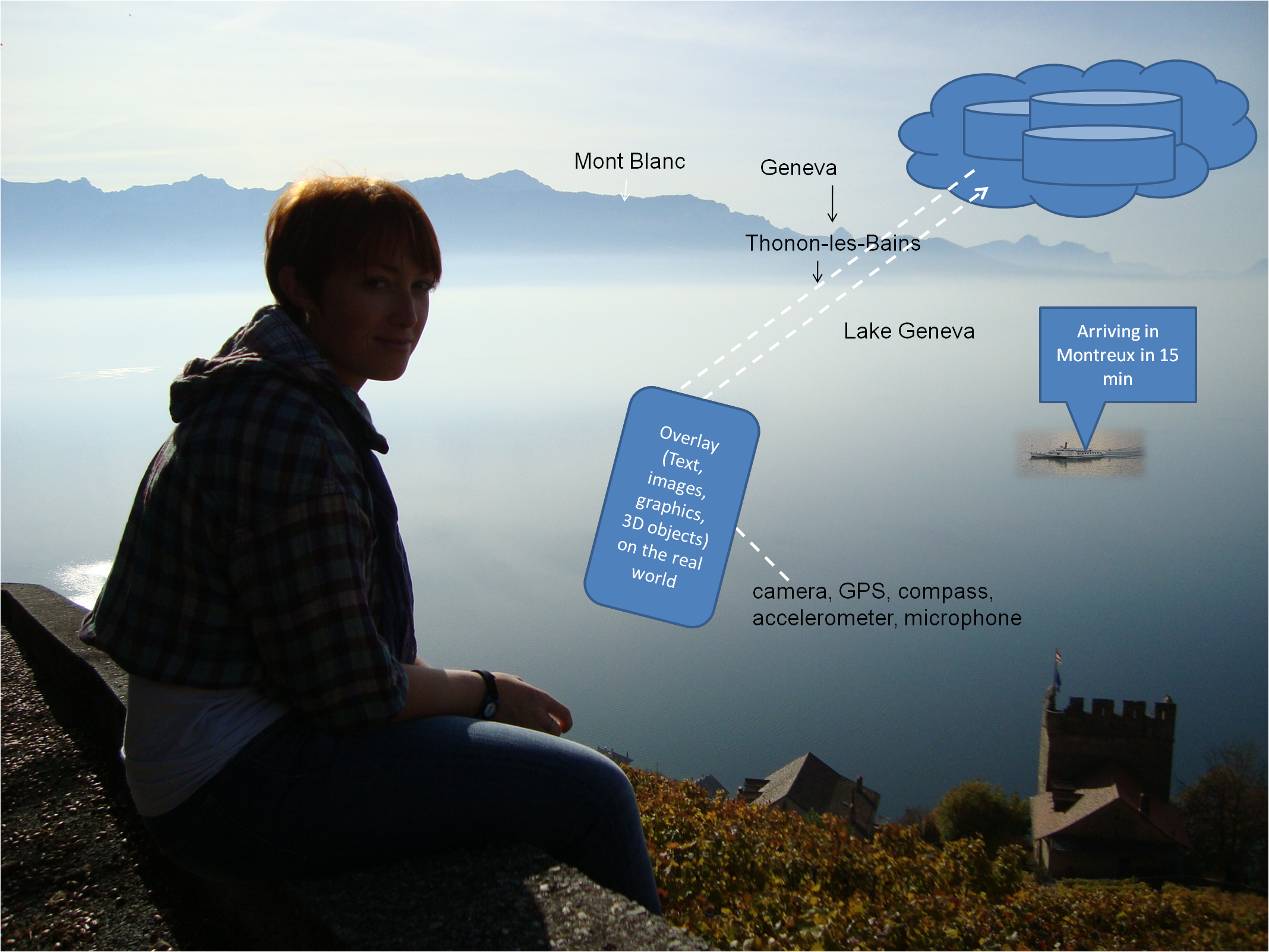

Is augmented reality a game changer for mobile networks?

Consumers and employees are beginning to adopt wearable devices that can live stream video to image recognition systems and expert advisors. Over time, these devices will place new demands on cellular networks.