5G for business: An update on telco pioneers

Telecom, Verizon and Telstra have looked to expand their 5G networks and to provide businesses with more opportunities to take advantage of 5G. But new developments have not been ground-breaking and adoption of 5G, while growing, is off a low base.

Changes in 5G business propositions

Last year we published a three-part series taking an in-depth look at how early adopters SK Telecom, Verizon, and Telstra had evolved their approaches to 5G commercialisation since launch. This article will focus specifically on how they have grown their 5G business and enterprise propositions since the publication of those reports.

Each of the three operators has pursued a slightly different 5G strategy, reflected in the way they have enhanced their offering of 5G for business over the course of 12 months. SK Telecom has continued to promote its 5G cloud offerings and to develop its 5G-enabled smart factory solutions. Verizon has looked to expand its network coverage by adding mid-band (C-band) 5G to its spectrum ranges and is also emphasising MEC solutions. While Telstra continues to promote 5G as a part of its ‘advanced network’ foundation (though there is evidence that 5G, specifically, is enabling Telstra to broaden its solution portfolio, e.g. it has launched a new on-premise dedicated 5G network for business).

SK Telecom

Enterprise is one of five “business groups” that SKT has recently prioritised to “maximise corporate value” (drive revenues). Specific SKT Enterprise Group plans include:

-

- To build data centre capacity, with integrated MECs at new sites.

-

- To leverage 5G MEC, AI technology and hyperscaler collaboration to grow the cloud business (it will make equity investments to expand this internationally).

-

- To extend services in select verticals – Smart Factory, Finance and Security – combining its own AI technology and its digital infrastructure (5G, Cloud and IoT).

-

- Its commercial 5G offerings available on the market broadly reflect these priorities.

5G cloud products

SKT continues to promote “5GX Cloud” as the lead 5G solution area on its website. Its suite of solutions includes 5GX Public Edge (leveraging hyperscaler partnerships) and 5GX On-Site Edge (a private MEC environment for companies that require extra secure real-time data processing or cost-efficient high-capacity data transfers). 5G and MEC are explicit as the foundations for these propositions.

Recently, SKT has teamed up with Dell Technologies to launch an enterprise 5G MEC solution called “Petasus”. It combines SKT’s 5G MEC solution and Dell PowerEdge servers. The solution provides network virtualisation features designed specifically for MEC, as well as associated operational tools. SKT promotes MEC as an essential technology for application areas such as smart factories and autonomous driving (due to its ability to enable ultra-low latency communication).

5G vertical services

SKT has been building a portfolio of offerings under the 5GX Smart Factory banner. Since the previous report it has added the following solutions:

-

- TV live caster: A 5G-enabled HD video control solution capturing feeds from smartphones, drones and cameras. It can be used for safety management, remote tech support and live broadcasting from public and industrial sites.

-

- Die-Casting Manager: A service for die-casting facilities where thermal monitoring equipment is used to monitor operations for early problem detection and optimisation of production conditions.

-

- Welding Quality Inspection Manager: A solution leveraging Acoustic Emission (AE) sensors, Machine Vision cameras and AI to determine not only external welding defects but also internal problems with industry-leading accuracy. This enables enterprise customers to reduce costs, increase work efficiency and maintain high production quality.

-

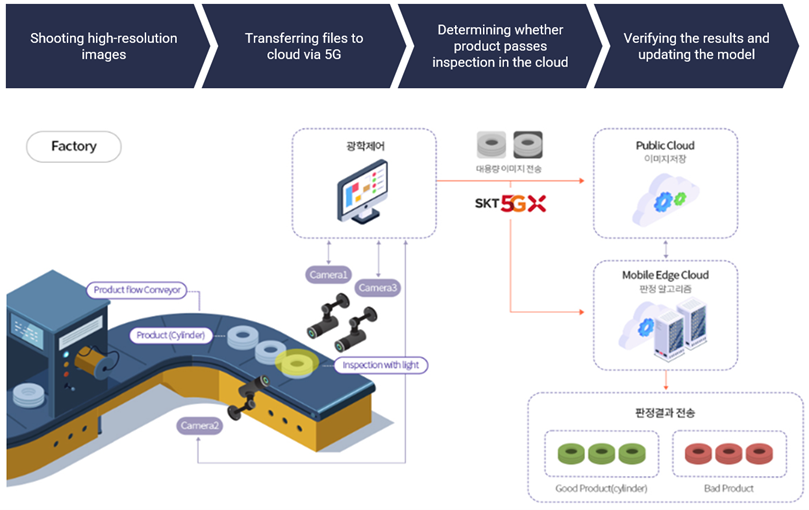

- Machine Vision Solutions: Quality inspection solutions using 5G, AI and MEC tech to detect defects in the appearance of a product using AI-trained models and take appropriate action on the production line based on the results.

Figure 1: SKT Machine Vision Solution

Source: SK Telecom

Corporate actions regarding the finance and security verticals appear less 5G-inclusive at this stage. While it is leveraging AI with Kookmin Bank in the finance vertical, there does not appear to be a role for 5G in this space yet. SKT announced its intentions to become the market-leading “ICT-based convergence security specialist in Korea” in 2021 when its SK Infosec entity merged with ADT Caps. It plans to “create a safer society and lead the future security industry by combining 5G, AI and Big Data analysis technologies with convergence security and quantum cryptography technology”. STL will be watching this space.

Verizon

Over the last year, Verizon’s approach to commercialising 5G for business appears to have progressed. It has been building out its network and seems to be focusing on two main areas for monetisation: fixed wireless access and 5G Edge. It also promotes 5G’s suitability for public/ emergency services provision, though specific solutions are not evident.

5G mid-band

The most significant development that has taken place for Verizon has been the addition of mid-band (C-band) 5G to the spectrum ranges that make up its 5G Ultra Wideband (UWB) proposition. Verizon launched 5G on mmWave spectrum due to its promise of high speeds and low latency, but quickly came in for criticism as it was difficult to secure coverage given that mmWave network signals struggled to negotiate buildings and other infrastructure. This significantly limited 5G adoption.

Mid-band spectrum has become the entry point for most 5G implementations since Verizon’s launch as it offers speed and latency performance improvements over 4G, whilst being easier to propagate. Verizon’s mid-band purchase is intended to address the problems with Verizon’s UWB and expand 5G coverage.

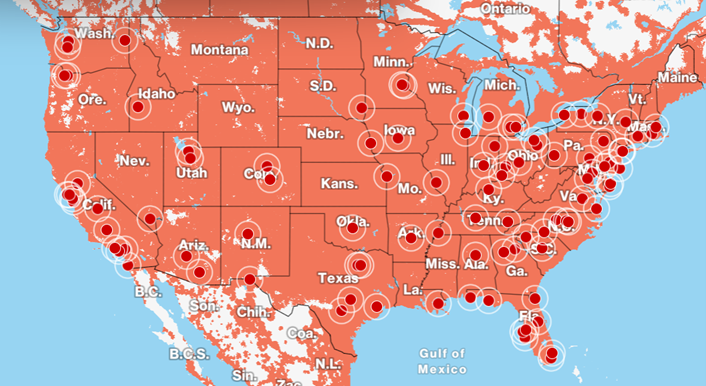

The mid-band spectrum has been deployed more quickly than anticipated. By January 2022, Verizon announced that 100 million people were covered by its 5G UWB. It is expecting that 175 million people will be covered by the end of 2022 – a year ahead of schedule.

Figure 2: Verizon 5G coverage map May 2022

Source: Verizon

5G UWB FWA

Verizon is currently promoting a 5G UWB fixed wireless solution as an alternative to fixed line business broadband. Its extended UWB footprint has increased its addressable market. It is trying to win market share from fixed line players with a commitment to keep its pricing unchanged for 10 years.

5G Edge

5G Edge is a focus for Verizon (the cloud opportunity appears more closely scoped than at SK Telecom). There are two variants of 5G Edge services: Public and Private MEC.

Public MEC

Verizon has expanded its 5G Edge Public MEC (Multi-Access Edge Computing) capabilities over the last year. Public MEC leverages AWS Wavelength and brings AWS compute and storage services to the edge of Verizon’s wireless network. In August 2021 it was available in 10 locations across the US and, as of January 2022, it was available in 17 locations.

Verizon provides examples of how businesses are utilising 5G Edge Public MEC to demonstrate how it can be used and to promote uptake. For example, Aetho (the company behind Beame AR telepresence solutions) is using Verizon 5G Edge with AWS Wavelength to offer students and prospects of Morehouse College virtual tours of its campus and remote learning tools. It is unclear how many companies are taking advantage of 5G Edge Public MEC, and how accessible it is to the average company.

Private MEC

Verizon has added to its Private MEC offerings since STL’s report was published in April 2021. On 31st August 2021, Verizon announced it was offering businesses an on-premise private edge compute solution that enabled ultra-low latency and allowed real-time enterprise applications.

5G vertical services

One vertical that Verizon is focusing on is the Public Sector. Specifically, it appears to be concentrating on 5G-enabled solutions for first responders. Developments are underway in the 5G First Responder Lab, a collaboration between Verizon and ResponderXLabs. Verizon says that its 5G UWB will support a range of next generation capabilities for public safety, including; real time intelligence, critical training preparedness, next-generation communications, remote asset operations and augmented reality (AR) on-the-job support.

Verizon has recently formalised its strategy to target stadium and venue customers with 5G enabled solutions to enhance the fan experience and public safety. It has started to promote a Crowd Analytics solution (which uses Public MEC capabilities) to enable better customer experience at venues and stadiums, for example analysing guest traffic to help reduce waiting times in key areas. This is likely to be a B2B play, where the services are provided by the telco to the event organiser/ broadcaster. The strategy leverages Verizon’s private 5G technology and supports its private networks, mobile edge compute and business solutions vectors of growth.

A further vertical service is Verizon’s 5G Edge Automated Guided Vehicles Management solution. This is designed to facilitate robotic fleet management for customers such as manufacturers and warehouse and logistics operators. It leverages on site 5G connectivity (private 5G network) and private mobile edge computing (the MEC is at the company location).

Telstra

Telstra’s approach to 5G for business remains to position it as part of Telstra’s “integrated solution stack based on network foundations”. In general, 5G is not singled out as a prominent component of any offering, but it is listed as an option for those businesses with specific requirements. For example, Telstra’s Adaptive Mobility connectivity plans are marketed as 5G-compatible, with “add-ons” like the Adaptive Mobility Accelerator leveraging 5G if the device and coverage allow, though it is not 5G-dependent. There is no change in this regard since last year’s report.

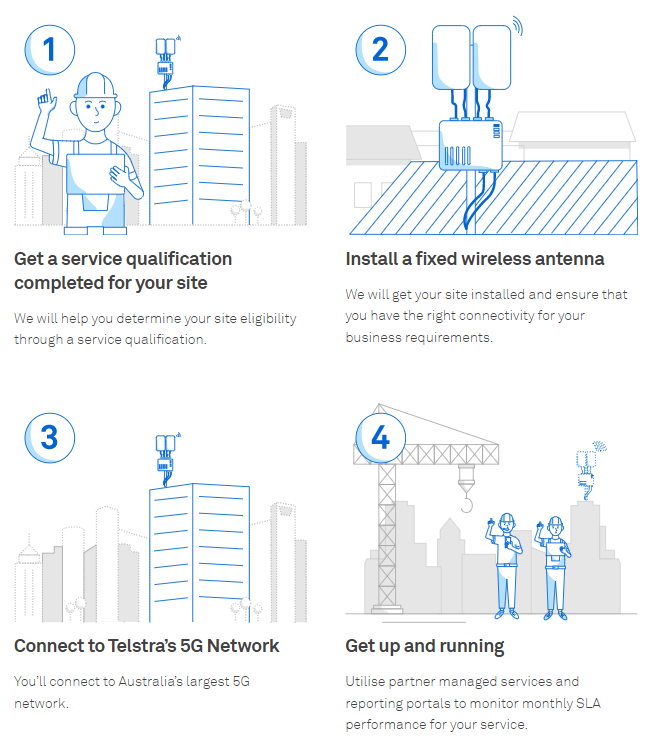

5G FWA

Telstra promotes its Enterprise Wireless offering as bringing together “our investment in our 5G network rolling out in selected areas, simplified mobility plans, enterprise grade endpoints and managed services.” It has introduced an Enhanced Enterprise Wireless version of the service, which includes service level agreements and managed services, allowing the customer to connect to “dedicated enhanced infrastructure”. This Enhanced version is one of the few examples where a service is 5G-dependent.

Figure 3: Enhanced Enterprise Wireless

Source: Telstra

Private 5G for business

Telstra has begun offering a “dedicated private network” solution. In January 2022, Telstra and Ericsson announced the first deployment of an on-premise dedicated 5G network for business that leverages its “single-server dual mode core”. The core facilitates both LTE and 5G Standalone (SA) simultaneously, which means that 5G SA capabilities can be accessed to offer a “wireless connectivity platform for enterprise than can deliver low latency, enhanced resilience and the capacity to meet even the most demanding business operation requirements” when relevant devices are available. This should bring the full benefits of 5G for business to fruition.

5G edge

Telstra does not emphasize 5G in its cloud propositions, though it is mentioned as a connectivity option. It is also mentioned in connection with multi-access edge computing solutions.

-

- Telstra has started trials of Australia’s first 5G-enabled edge compute solution for businesses, in collaboration with Ericsson. The solution is being explored in the Telstra Retail store environment, where a smart video solution is issued to simplify operations and enhance customer experience.

Telstra promotes its ability to tailor cloud offerings through its “technology services”/consulting entity, Telstra Purple. This may result in an increased consideration/inclusion of 5G as part of a cloud solution.

Conclusions: Incremental changes are evident, with MEC initiatives dominating

The portfolios of early adopters of 5G have not been radically revised over the course of the year or so, but they have each looked to improve their 5G business offerings. The improvements they have made have largely been in line with their initial 5G strategies. SK telecom has expanded its range of technologically advanced 5G solutions to address specific use cases. Verizon has looked to redress T-Mobile’s dominance in terms of 5G network coverage. Telstra has positioned itself as capable of addressing customer’s unique needs through its deployment of flexible technology solutions that can be tailored to enterprise needs.

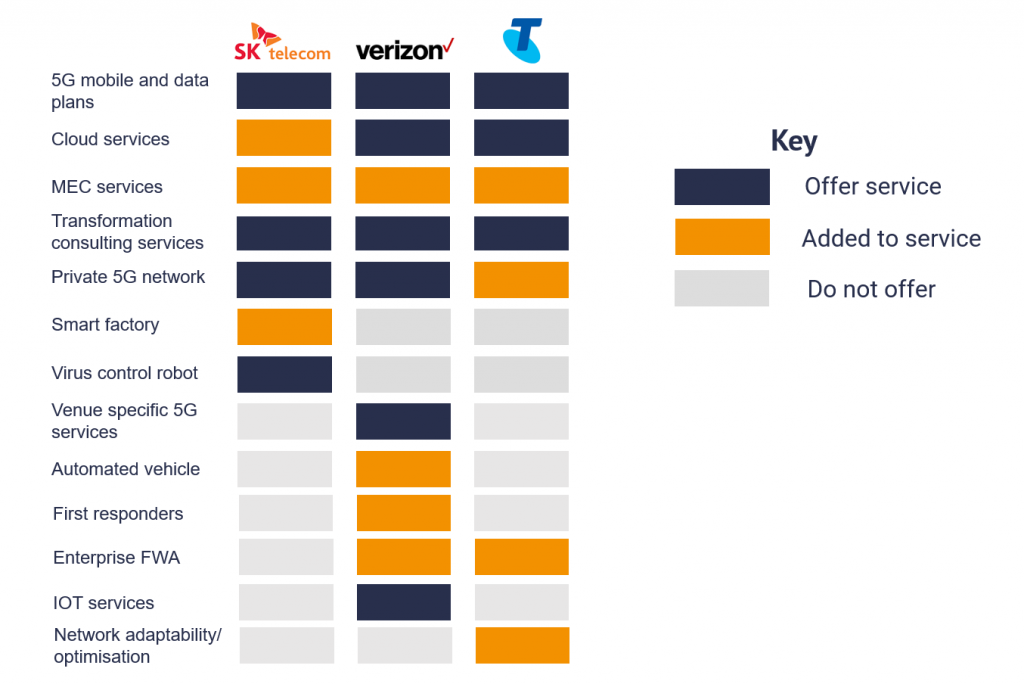

Figure 4: How telcos are commercialising 5G for business

Source: STL Partners

One area that has seen significant developments is MEC. All three operators have expanded their MEC offerings and have clearly identified this as an important source of revenue in years to come. 5G-includive vertical solutions have become more prominent over the last 12 months, further contributing to 5G monetisation. Operators are also focusing on developing and monetising their private network solutions, which is something we will continue to follow closely.

Download this article as a PDF

Read more about growing enterprise revenues

Growing Enterprise Revenues overview pack

Our overview pack explores how the telecoms industry can leverage new business models to meet enterprise customer needs

5 innovative telehealth apps for 2022

Demand for telehealth apps has been increasing rapidly in recent years as healthcare continues its move towards digitisation, with COVID-19 only accelerating this trend. 2020 alone saw 90,000 new telehealth apps added to the market, so finding a niche is crucial. Below we outline 5 telehealth apps which exemplify different potential niches in the market.

Vonage: What is Ericsson’s end game?

If Ericsson is able to successfully leverage Vonage’s developer ecosystem to drive the use of 4G and 5G APIs, then it could play an interesting role as a strategic partner and channel for operators as a means of accessing developer communities.