Breaking down silos for telco adaptability

Our analysis of five telco case studies highlights the challenge for telcos looking to introduce cross-silo working and how approaches are being adapted to fit the organisation and access business benefits.

Our analysis of five telco case studies highlights the challenge for telcos looking to introduce cross-silo working and how approaches are being adapted to fit the organisation and access business benefits.

Nine change stakeholders describe their experience of telco transformation, providing insights on the change process and learnings for others that are remodelling their organisations for the future.

Change agents know that stakeholders need a picture of the future – or “vision” – to point the way for a transformation. Yet visions can do more to unite and inspire action. How can telcos improve them?

Analysis of the results of the first phase of our telecoms industry survey on purpose, leadership and culture shows the status of the industry and key drivers, and uncovers some important barriers to progress.

We’ve identified seven questions that are fundamental to telcos’ forward success, and compiled some of our recent research that helps address them.

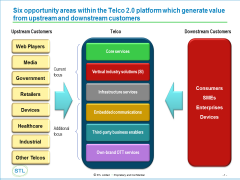

Our top-level review of SAP’s vision of how it will enable telcos to ‘operate at internet speed’ against Telco 2.0 principles and the six key opportunity areas identified in our strategy research report, ‘The Roadmap to New Telco 2.0 Business Models’. We also challenged SAP to build a Proof of Concept implementation of a complex multi-sided business model with a leading European mobile operator within one month. How did it go? (February 2012, Foundation 2.0)

Six Opportunity Areas within the Telco 2 Platform