US Wireless Market: Early Warning Signs of Change

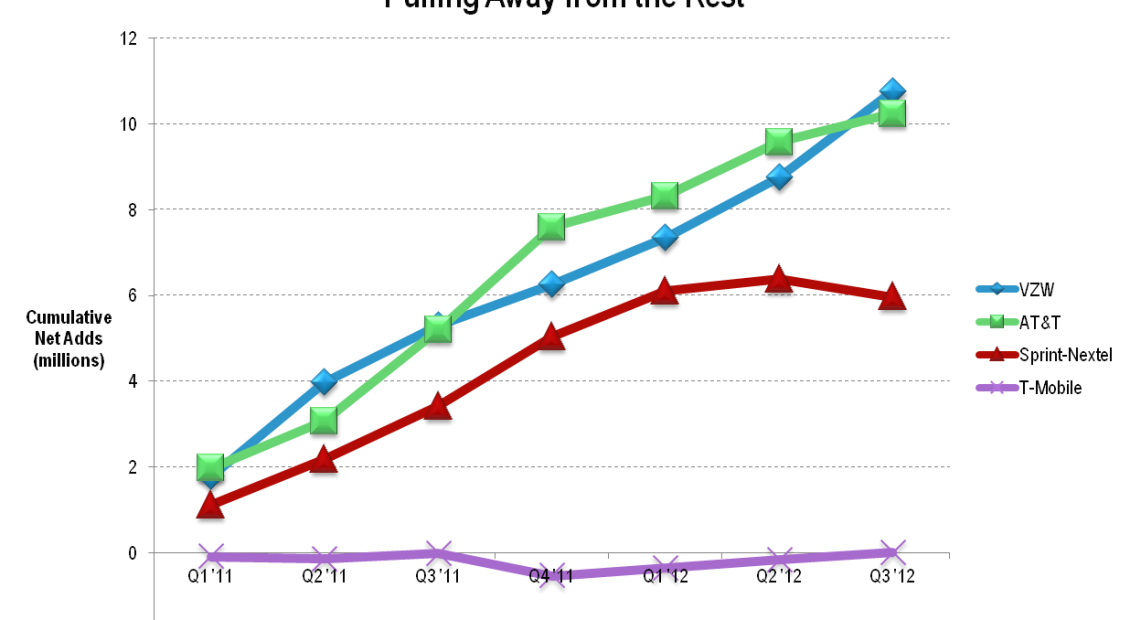

We see early-warning signs of new changes afoot in the influential US mobile market in both growth and competitive market dynamics. Verizon Wireless was the biggest winner from the market’s recent growth. But now things are slowing and challenger T-Mobile is breaking into the premium segment. What are the lessons?