Cisco, Microsoft, Google, AT&T, Telefonica, et al: the disruptive battle for value in communications

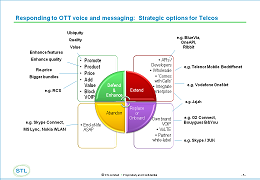

Disruption is taking place across the voice and messaging space – not just with telcos. Established vendors and de facto technology standards are also being challenged. For example, Cisco, the market leader in enterprise telephony, finds itself being disrupted in key markets by other vendors offering more horizontally integrated solutions. This report provides an overview and insight into a number of vendors and technologies in the voice and messaging markets, including telco platforms and services, and LTE, RCSe, and WebRTC. Three telco case studies (Vodafone, Telefonica and AT&T) are also provided, examining their activities, products and results.