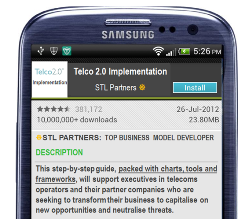

A Practical Guide to Implementing Telco 2.0

How can communications services providers (CSPs) transform their businesses from Telco 1.0 (infrastructure-led stasis) to Telco 2.0 (sustainable innovation-led growth)? An essential, step-by-step guide to the implementation of new Telco 2.0 business models, providing telecoms executives and their partner companies with a systematic approach to capitalise on new opportunities and neutralise potential threats. The report outlines robust frameworks and methodologies for selecting the right Telco 2.0 strategy for each organization, identifying and implementing the key opportunities, and avoiding expensive and time-consuming mistakes. (December 2012, Telco 2.0 Transformation Stream) Telco 2 Implementation Cover