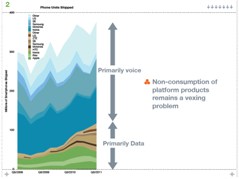

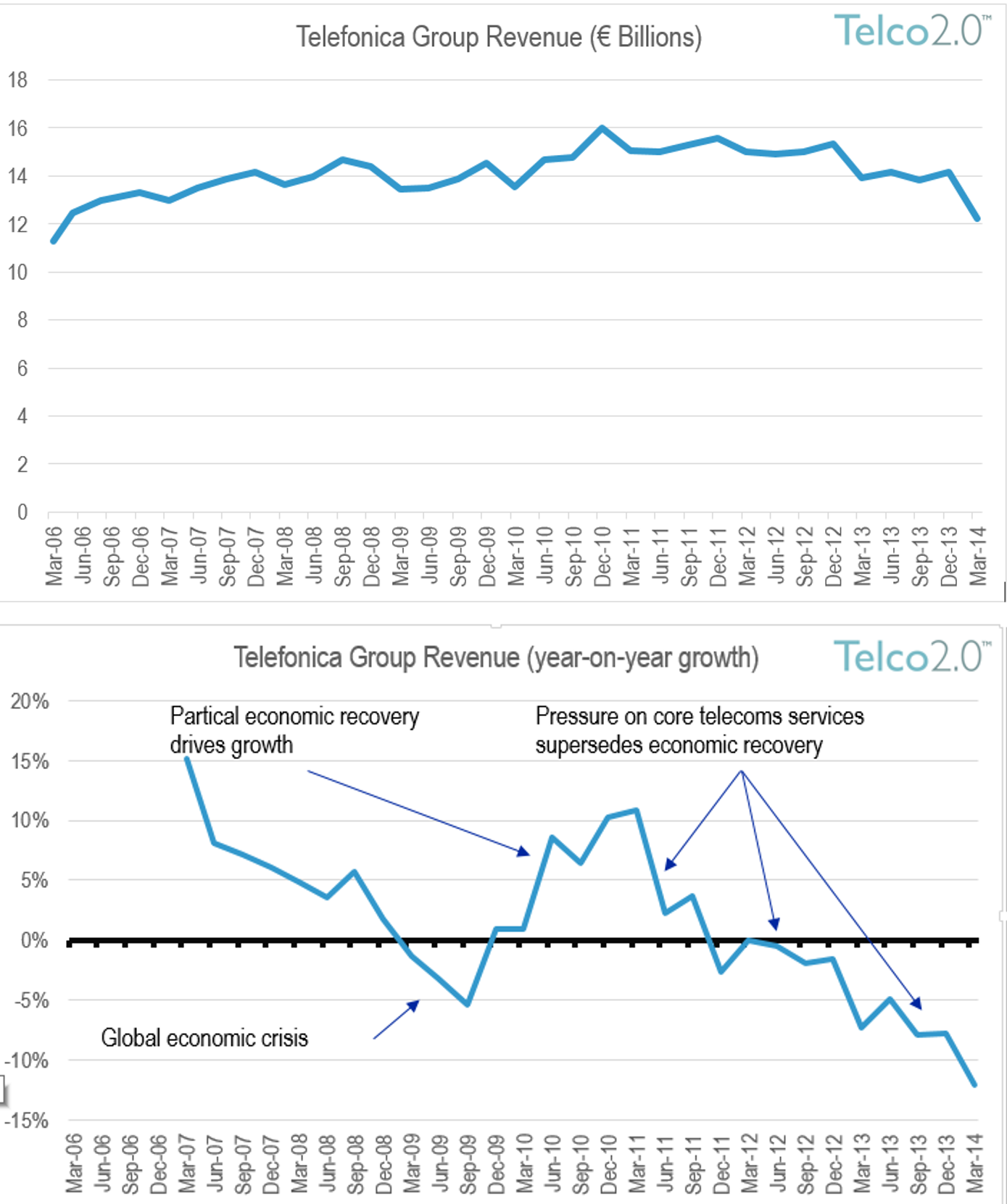

Telco 1.0: Death Slide Starts in Europe

The latest results for Telefonica are grim, showing a 12% y-o-y revenue decline, following Orange and Deutsche Telekom’s 4% drops. This signals unequivocally that transformation is now a necessity not a luxury for European operators – and the rest of the world is not far behind. Longer term recovery is possible but not a certainty – what are the key steps? (May 2014, Foundation 2.0, Executive Briefing Service, Telco 2.0 Transformation Stream.)

Enterprise Mobility Framework December 2013