Telco 2030: New purpose, strategy and business models for the Coordination Age

How telecoms industry CEOs can reignite growth, align investors, employees, customers and governments, and reinvigorate the industry for the next decade.

How telecoms industry CEOs can reignite growth, align investors, employees, customers and governments, and reinvigorate the industry for the next decade.

Telefónica’s systematic and sustained push into personal data management holds valuable lessons for other telcos about building trust and credibility. The report also covers personal cloud / data plays by NTT DOCOMO and financial services company Mint.

Our research into 47 global operators reveals divergence in telcos’ levels of digital customer engagement. In this report, we examine three strategies that emerge (Digital Nascent, Multichannel and Omnichannel) and the key factors for success, drawing on lessons from case studies in banking, retail and hospitality.

The findings of a senior exec summit we ran last week in Asia present a fascinating snapshot of the global telecoms industry. They highlight views on the key goals of and barriers to transformation, and point to some key actions needed to move forward.

Metrics are an integral component of telcos’ digital and overall transformation. But what metrics are telcos using, and what metrics should they use, to measure the progress and success of their transformation initiatives? STL Partners has looked at metrics in use by three of the most advanced telcos in the world, including AT&T and Telstra, and identified the 20 that matter most.

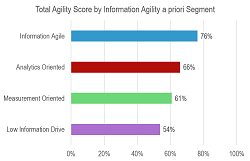

How agile are telcos today, what are the barriers and opportunities, and what can be done to improve agility? We look in depth at the findings from the Telco 2.0 Agility Challenge, and identify some key steps for telcos and partners to take, including specific organisational strategies to be ‘Agile by Design’ and the need for an ‘information intensive’ culture.

Digital initiatives are an important part of the telecoms growth story. However, because they are so different to the traditional telecoms business, they require different performance metrics: a digital dashboard. In this report, we examine the importance of metrics in shaping business performance, explore the contribution of metrics to 3 telco digital success stories, and reveal how a cutting-edge approach to metrics is driving digital execution at Telkom Indonesia.

STL Partners’ industry transformation analysis, including a recent global survey of telco executives, suggests operators’ digital ambitions are rising fast but, given 9 substantial implementation challenges, too little is currently being done to engender successful industry-wide business model transformation. We also look at the lessons from NTT DoCoMo, one of the operators that has made the most overall progress towards a ‘digital’ model.