Free Mobile: A Prototype for Disruption?

Free.fr’s entry to the French mobile market has achieved extraordinarily rapid market share gains and resulted in comprehensive disruption. An analysis of its technology, tactics, and business model, and a high-level assessment of the applicability of its approach to other markets. (February 2013, Executive Briefing Service, Dealing with Disruption Stream).

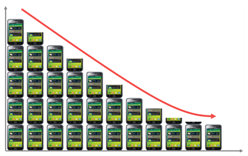

Monthly ARPU in France & EU Markets Feb 2013