Inside the cloud-native telco

Telcos are getting moving with cloud-native. We have asked executives at seven such telcos about the process and what it has meant for their organisations, skills requirements and ways of working.

Telcos are getting moving with cloud-native. We have asked executives at seven such telcos about the process and what it has meant for their organisations, skills requirements and ways of working.

The maturity of telco automations in the network OSS and BSS varies significantly. Some telcos are reporting significant headcount reductions from mature automations while others are still in the early stages of simple automation deployments. There are important steps telcos must consider if they are to reach maximum automation.

Co-operation with hyperscalers can reap rewards – but only if telcos complete the hard work of cloudification first.

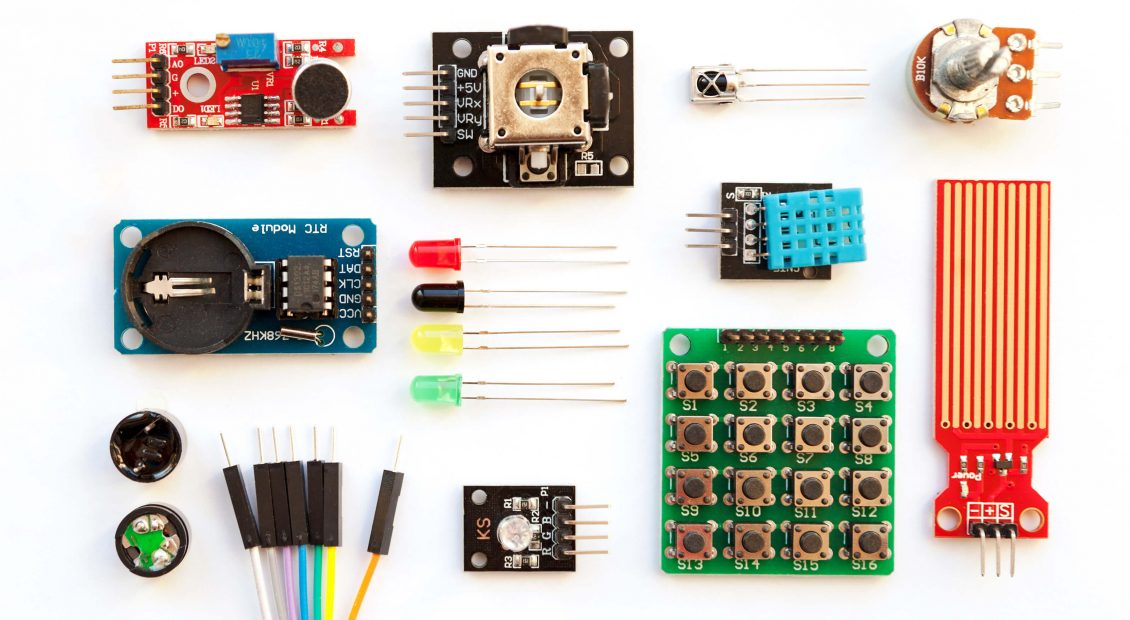

We evaluate the role of disaggregation and cloud native infrastructure and key breakthrough opportunities for network operators.

Telco cloud came with the promise of agility and returns. Our latest in-depth research examines the evidence, why telcos still believe it will deliver, and what needs to be done to achieve that.

As telecoms operations become increasingly softwarised, network functions are getting broken down into their individual parts, and reassembled as an essential part of the IT stack for industry-specific applications and services. In this disaggregated telco value chain, is there anything left that is distinctively ‘telco’?

We evaluate how the concept of agility has changed, its relevance to telecoms and what telco operators are doing to transition to more agile operating models to capture new monetisation opportunities.

STL Partners believes that telco cloud is a crucial enabler for operators’ success in the Coordination Age. In this manifesto we explain why.

Many telcos are trying to change, to become more agile and move from infrastructure- to software-led business models. But change is hard, especially because to be successful they need to adapt their culture and employee skill-sets which is a notoriously difficult task. In our latest report we analyse change strategies used by AT&T, Telkom Indonesia, and three other telcos in the context of insights from neuroscience, and show that change is possible with the right strategy and leadership.

Metrics are an integral component of telcos’ digital and overall transformation. But what metrics are telcos using, and what metrics should they use, to measure the progress and success of their transformation initiatives? STL Partners has looked at metrics in use by three of the most advanced telcos in the world, including AT&T and Telstra, and identified the 20 that matter most.

To date, discussions of the benefits to telcos of NFV and SDN have mainly focused on reducing operating and capital costs, while the impact on future telco revenues has been somewhat sketchy. In order to fill this gap, this report outlines a comprehensive set of potential new “telco cloud” services, and forecasts associated revenue growth.

We see five major trends leading towards the overall picture of the ‘software defined operator’ – an operator whose boundaries and structure can be set and controlled through software. This presents threats as well as opportunities for industry players selling and wanting to sell to telcos.