Full Report – Entertainment 2.0: New Sources of Revenue for Telcos?

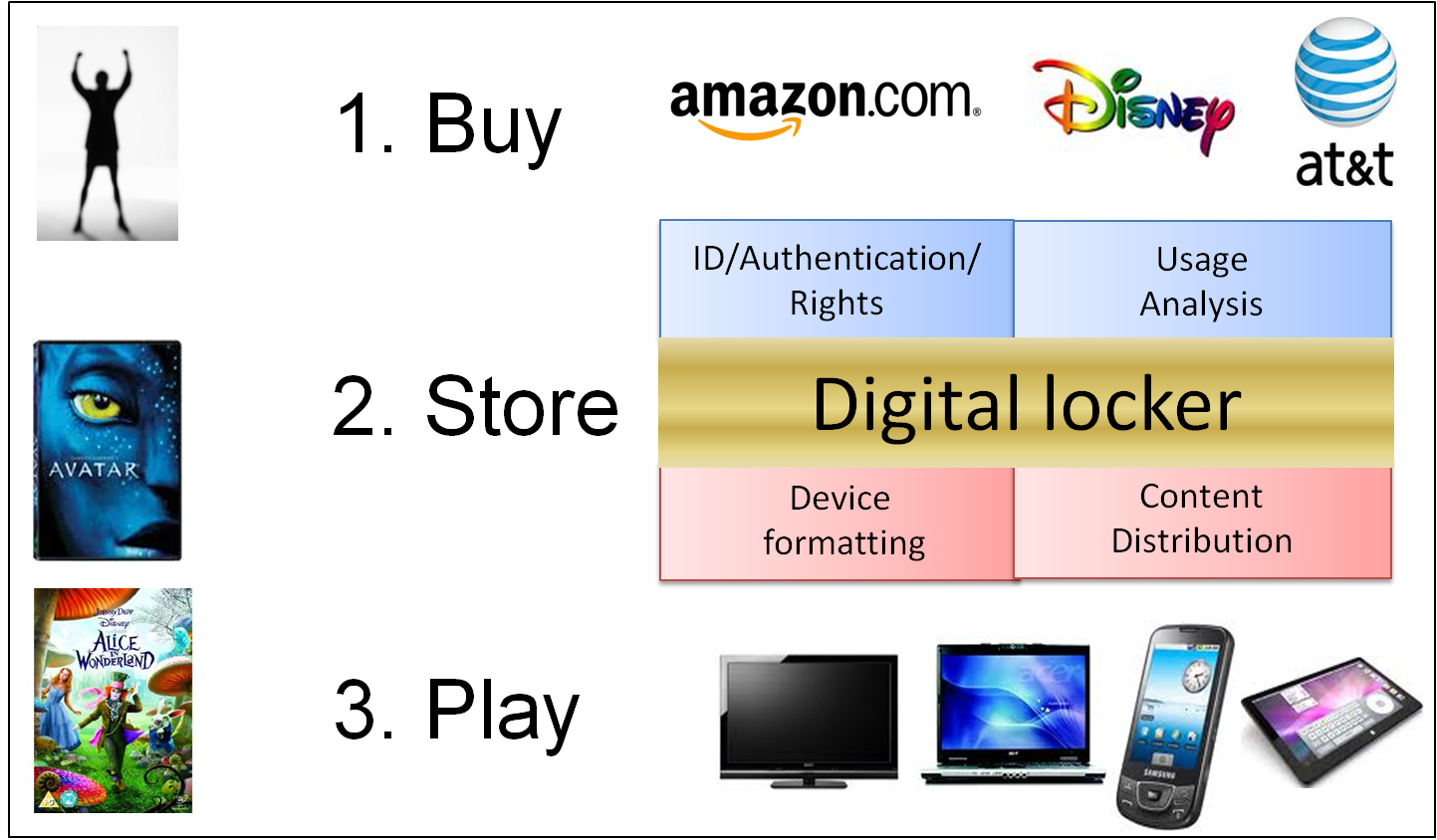

Telco assets and capabilities could be used much more to help Film, TV and Gaming companies optimize their beleaguered business model. An extract from our new 38 page Executive Briefing report examining the opportunities for ‘Hollywood’ and telcos. (Executive Briefing, August 2010)