What is digital health? 5 Application areas telcos should focus on

What is digital health and where is the opportunity for telcos?

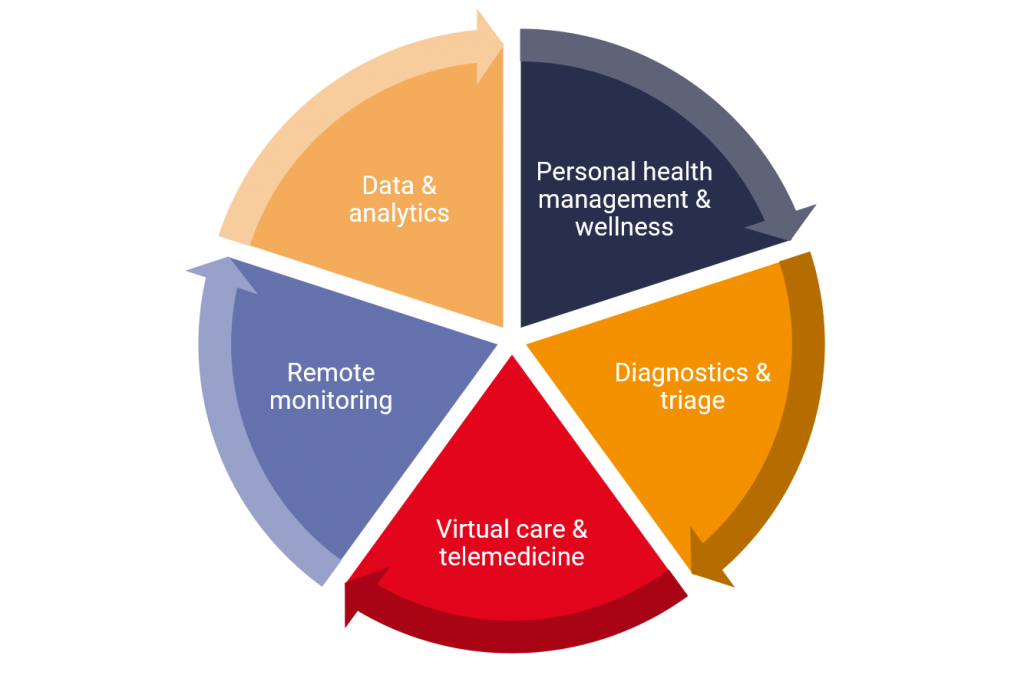

Healthcare is a huge industry and the adoption of new technologies such as IoT and AI will transform every part of it, from how new prescription drugs are researched and tested to enabling patients to manage their own health more effectively. Within this vast market, to help define the digital health opportunity, we have identified the five key areas in digital health telcos can make the biggest impact – through support with more flexible and powerful connectivity services, or further up the value chain:

- Personal health management and wellness

- Diagnostics and triage

- Virtual care and telehealth

- Remote monitoring

- Data and analytics

In this article we detail the 5 application areas, highlighting real examples of digital health use cases and the potential role of the telco. We cover more on the opportunity for telcos in digital health, and how to address that opportunity, in our recent articles “The digital health opportunity for telcos” and “Four strategies for telcos in healthcare”.

While many digital health application providers start by playing in one of these five segments, as the digital health market matures we are beginning to see more integration across the five areas as companies seek to address the full patient journey. For example, in August 2020 US-based virtual consultations provider Teladoc announced plans to acquire chronic care management provider Livongo.

5 main application areas in digital health

Figure 1: Five digital health application areas for telcos

Personal health management & wellness

- Fitness trackers, e.g. Fitbit, Apple Watch

- Assisted living sensors, e.g. wearables for elderly to track location, detect falls and raise alarms

- Personal health records, e.g. Apple health kit

- Prescription management apps, e.g. prescription reminders & tracking to improve adherence

- Maternity & family apps, e.g. tracking baby growth, immunisations, medications, etc.

- Health management apps, e.g. smoking cessation, weight management, etc.

These solutions are not linked into formal healthcare delivery and primarily work on a B2C business model approach. While some doctors might recommend use of fitness trackers or health management apps to their patients in order to encourage healthier lifestyles, today the data from these services is very rarely pulled into healthcare providers’ EMR/EHR systems.

The consumer focus of these solutions means that telcos will likely find it challenging to compete with the agility and investment capabilities of global consumer brands such as Fitbit and Apple that are leading in this segment.

However, assisted living is one particular area where we believe telcos could play a stronger role, either as a channel for digital health companies seeking to reach new customers, or supporting digital health companies with enablement tools, such as high quality location tracking, in-built or fallback connectivity. See our report Coordination the care of the elderly for more detail on applications and telco business models.

Diagnostics and triage

The aim of these applications is to improve access and availability of medical information, in order to direct patients to the best healthcare resource in the first instance, in turn reducing the burden particularly on primary care providers.

- Phone / website information tools, e.g. NHS 111 in the UK

- AI-enabled diagnostic software, e.g. Babylon Health symptom checker, apps to assess skin abberations/dermatological issues

- At home testing kits, e.g. for COVID or sexually transmitted infections

- Referrals to specialists

This area is unlikely to be a strategic priority for telcos pursuing digital health opportunities, as these applications do not require particularly robust connectivity or other enablement tools telcos are well positioned to provide, and on their own are unlikely to deliver much value.

However, telcos aiming to build a presence in the digital health market should plan how to incorporate diagnostics and triage into their broader application mix, since they form a crucial step in the patient journey – and potentially will act as the link between consumer focused wellness solutions and formal healthcare services.

Virtual care & telehealth

The goal of these applications is to overcome time and geography barriers in delivering healthcare services, mainly for primary care. An area of growing interest within this field is the use of telehealth technologies to support education among healthcare professionals.

- Phone / video consultations

- Asynchronous care, i.e. sending in symptoms and receiving feedback or treatment at a later time

- Online appointment bookings

- Online / digital prescription services

- Use of augmented reality and/or virtual reality (AR/VR) for educational and/or treatment purposes, e.g.

- VR distraction therapy to treat anxiety or provide interactivity to immobile/elderly people

- AR/VR for training medical staff on new skills or providing support during rare procedures

- AR/VR and haptics to support remote surgery teams (where remote surgeons are consulting/supporting a local team that is actually performing the surgery in near real-time)

- Connected ambulance

- Low cost diagnostic devices that plug into smartphones, e.g. ultrasound devices like Butterfly

This is where many telcos entering the digital health market have chosen to focus in terms of applications, in particular on video consultations owing to their dependence on high quality connectivity, broad relevance across the healthcare market from GPs to hospitals and specialist services such as physio. We believe that video consultations are more likely to provide the foundations of a digital health business for operators in developing markets, where access to care is more difficult than in developed markets, and where operators benefit from relatively stronger brand power and reach across their national footprints.

That said, newly emerging fields such as the use of AR/VR in healthcare workflows are highly connectivity dependent and therefore may be valuable entry points for operators in more advanced healthcare markets.

Data & analytics

The aim of these applications is to gather data from across the healthcare system in order to improve access, and inform healthcare policy and delivery best practices

- Personal / universal health records, e.g. a system to make patient records from all health organisations available in a single place to patients, and to healthcare providers with patient consent (see our article where we explore how blockchain is an enabling technology for universal health records)

- Population level health analytics (e.g. understanding prescription trends at a national level, best practice in treatment of chronic diseases, tracking of delivery of population level services such as cancer screening)

- Workflow management tools, e.g.

- improving processes in hospital or across multiple healthcare organisations, such as Google Streams

- using AI and analytics to optimise workflow, for example to prioritise patient visit schedules for mobile clinicians/nurses

Many telcos see supporting the development of some form of healthcare data exchange is an attractive long term prospect, since they perceive this approach to be more closely linked to their existing business model than developing one or a few digital health applications.

While we agree that telcos are well positioned to play a coordination role in healthcare, given their existing skills, reach across government, enterprise and consumers, and their national presence, it is a not an easy or a quick win. The experience of TELUS and Telstra, who are playing this role to varying degrees, demonstrates that this should be a long term ambition, that requires deep knowledge and relationships across the healthcare industry to execute.

Remote monitoring

We define remote monitoring as digital health applications where the data collected from sensors and cameras feed into EMRs/EHRs, and trigger specific notifications or actions for healthcare providers, e.g. alerting clinicians and doctors of a patient’s deteriorating health before they require an emergency hospital visit.

- Drug adherence, e.g. devices and apps to track medication schedules, reminders, potentially included as sensors inside pills in the future

- Chronic disease management, e.g. sensors / apps to monitor key vital signs or use of health questionnaires to support patients with diabetes, COPD, heart failure, etc.

- Palliative care / high risk post-surgery care, e.g. daily questionnaires and vitals monitoring to assess recovery or risk levels

- In-hospital monitoring, e.g. connected sensors on in-patients so nurses can monitor a larger number of patients at once, with alerts for ones requiring urgent attention

In our research on the potential impact of 5G on the healthcare sector, based on surveys with healthcare professionals to understand efficiency and improved health outcomes they believe different digital health use cases could deliver, remote monitoring came out as by far the most valuable application area. However, the key challenge in remote monitoring is proving the business case, since implementation costs are still relatively high, and proving a negative (i.e. that a patient avoided a hospital visit) is difficult in practice.

Growth across the application areas: The impact of COVID

The modelling above, which estimated the potential impact of 5G-enabled digital health use cases, was conducted in 2019. The caveat of this is that the base assumptions and growth rate do not account for the impact of the COVID-19 pandemic.

Though we touch on the qualitative impact of COVID in our recent article “How COVID is changing digital health…”, we will be exploring the quantitative impact across these five application areas, including whether the digital health boom will be long lasting or begin to plateau and decrease, in our upcoming research “Assessing the post-COVID digital health market value”. If you would like more information on accessing this research, or the coverage of the model, please do not hesitate to get in touch.

Digital health insights pack

This 24-page document will provide you with a summary of insights from our healthcare research and consulting work:

- Key trends in the healthcare industry

- The role for telecoms: applications and business models

- Strategies for success: where to start

- How STL Partners can support you

Request the free digital health insights pack by clicking on button below:

![]()

Read more about digital health

Webinar

Telcos in health webinar

In this session Amy Cameron and Yesmean Luk looked at the opportunities for telcos in health. As a growing industry, with a national focus and significant digitisation challenges, healthcare is an attractive vertical for telcos seeking to build new revenues beyond core communications services.

Research

TELUS Health: Innovation leader case study

Healthcare is an attractive vertical for telcos to address with digital solutions. Although many telcos have made attempts to capture this opportunity, TELUS stands out as an example of the value of a long-term commitment to healthcare. In this case study, we examine TELUS’ strategy in health, evidence of its success, and draw out lessons for other telcos