Case study overview

STL Partners works with clients to define and prioritise use cases to take forward for further development and proof of concept. We advise on potential partners, business models and go-to-market strategies, as well as provide technical documentation on how the solution would work in practice.

See how STL Partners supported a major telecoms vendor:

- Identify and prioritise blockchain use cases;

- Detail promising use cases, including case studies, potential partners and roles for operators;

- Provide internal strategic guidance on POC.

Consulting services overview

Get in touch to find out how we can help you:

- Identify and prioritise key use cases

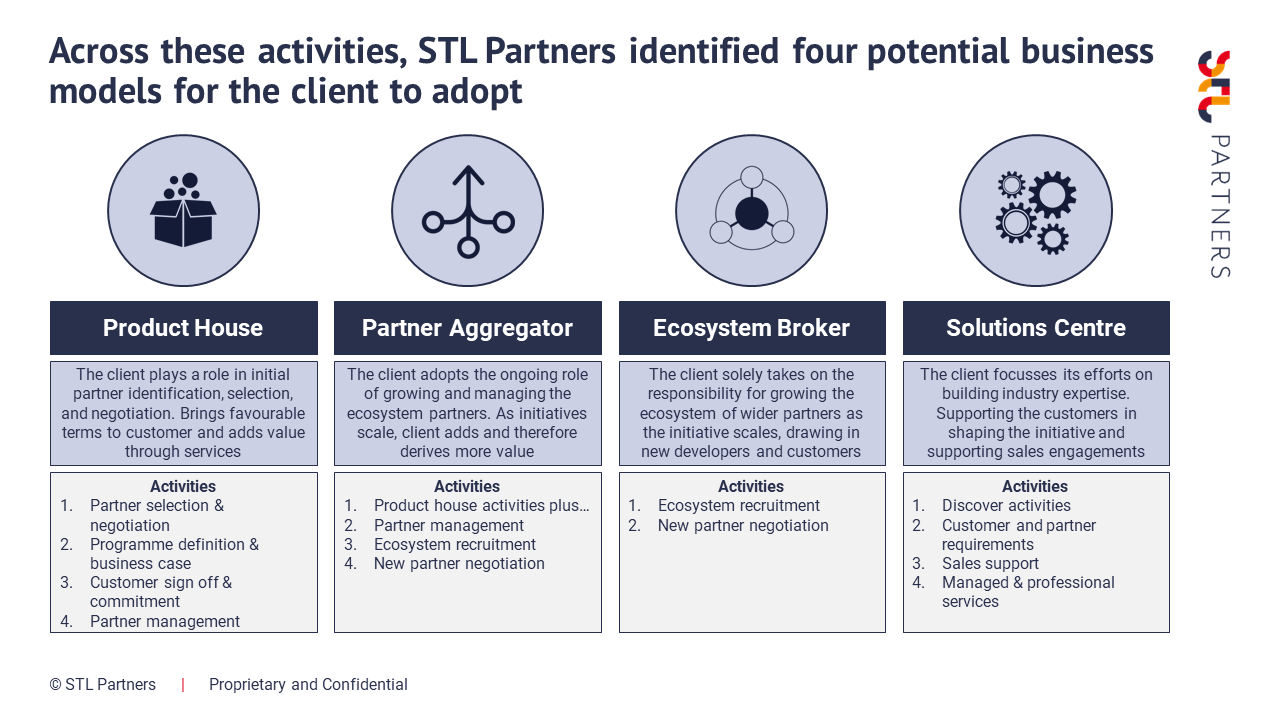

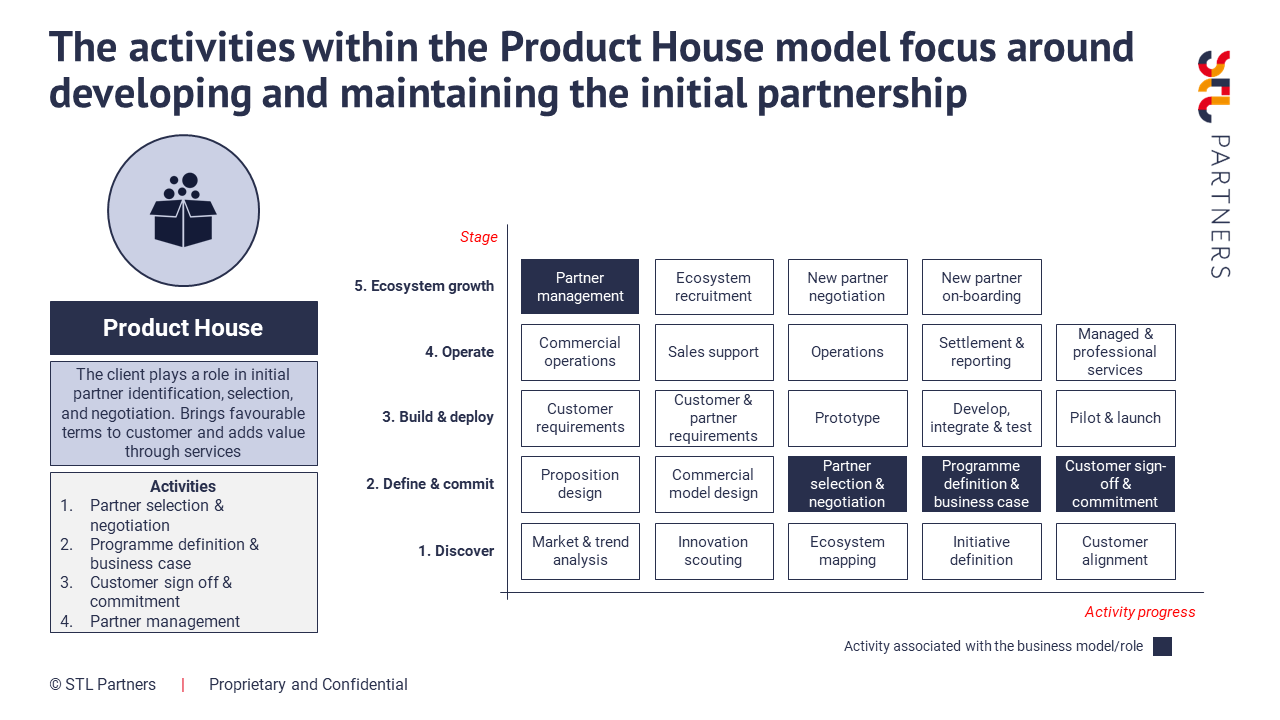

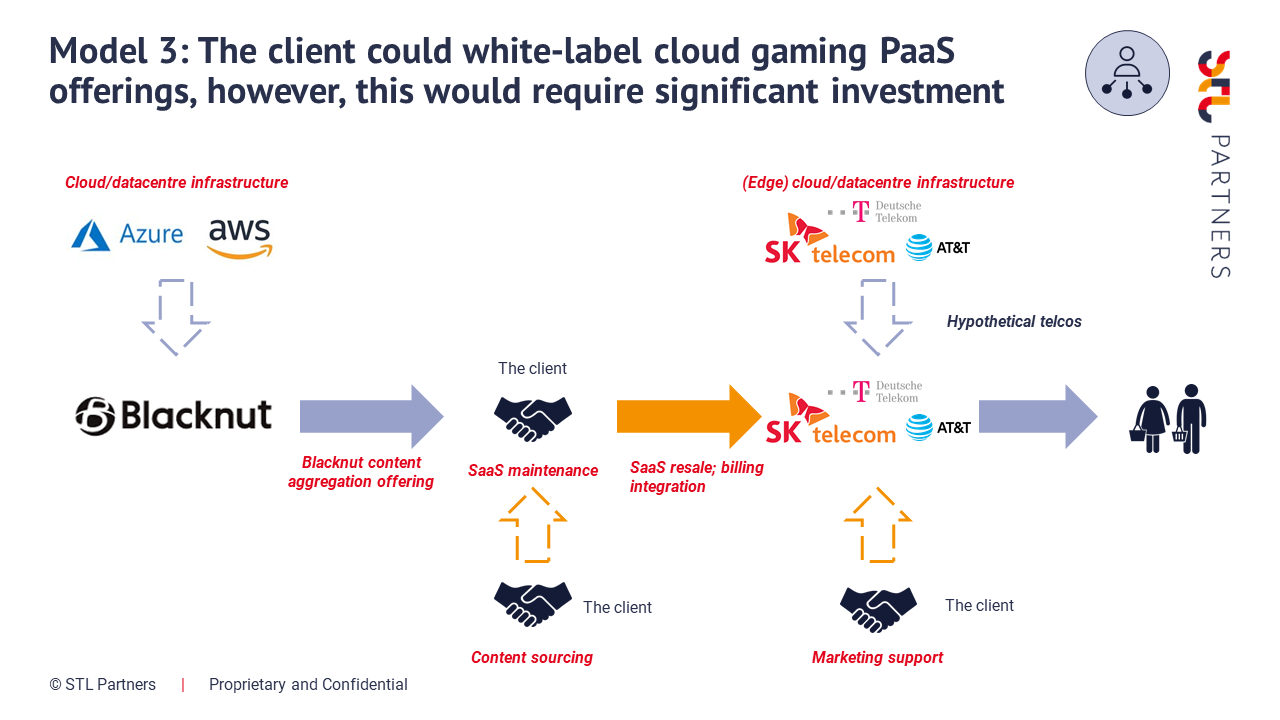

- Define the viable business models

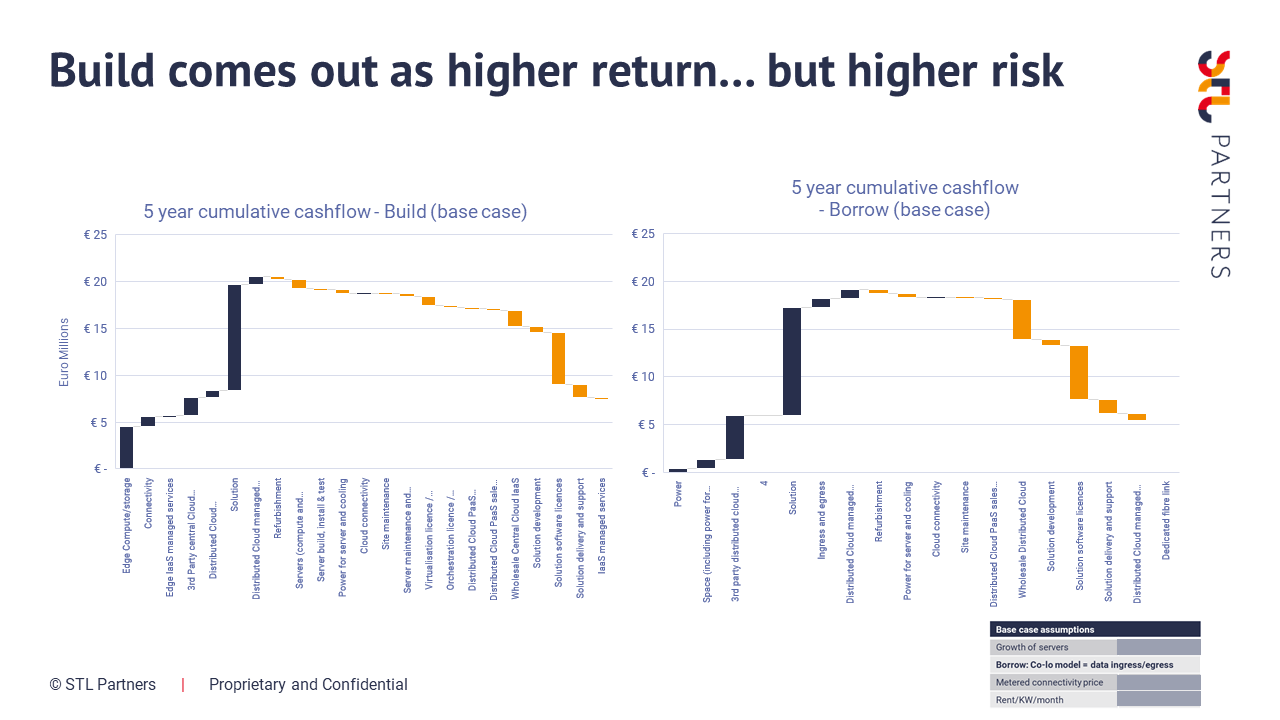

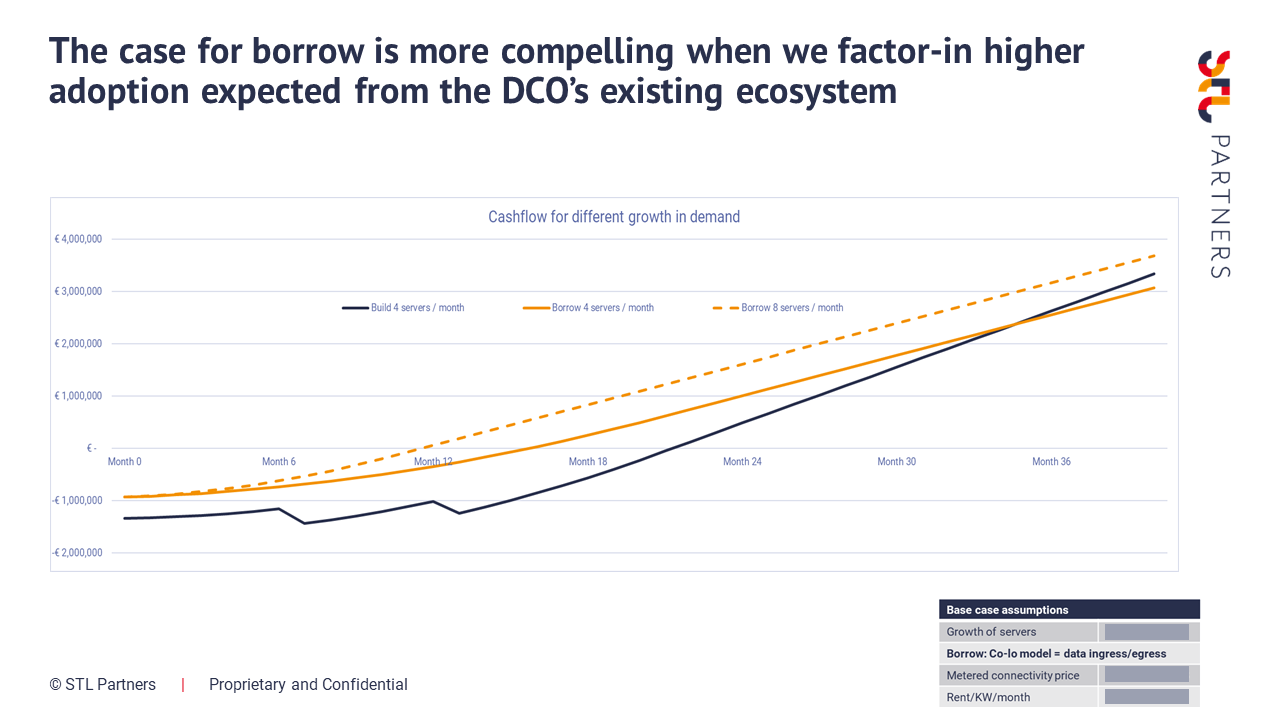

- Model the business case for new initiatives

Identify and prioritise blockchain use cases

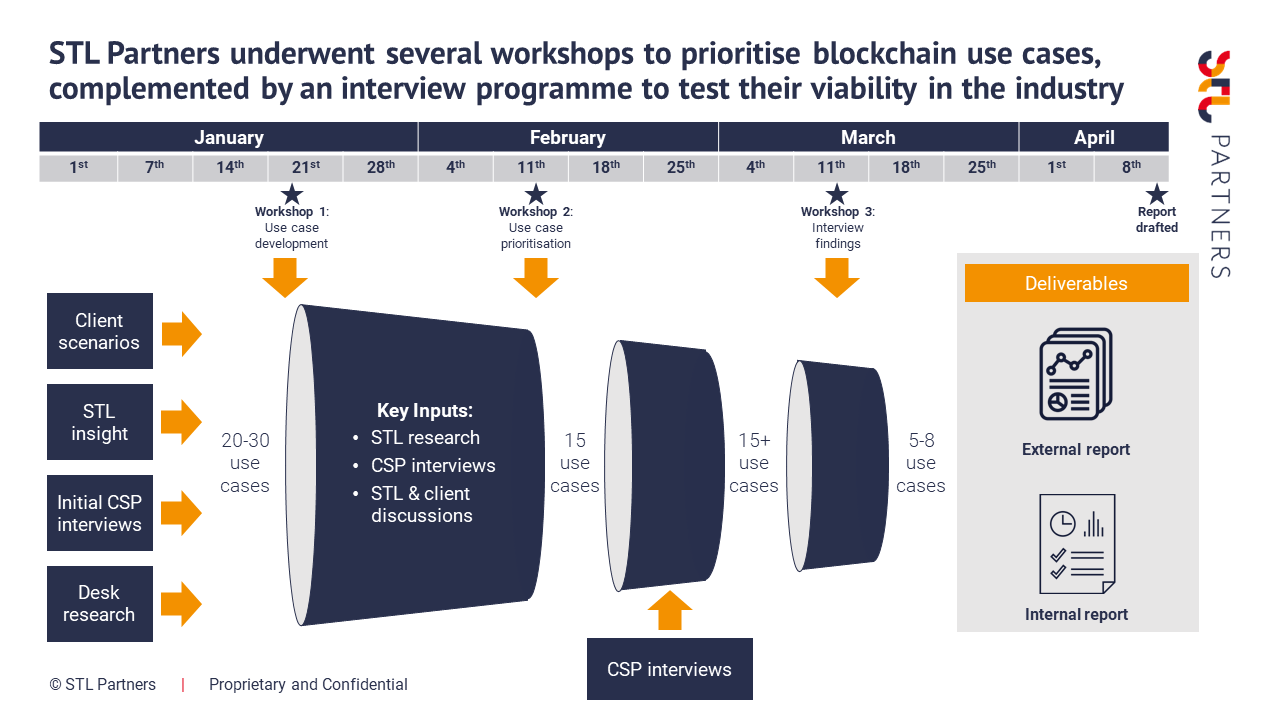

We underwent several workshops to prioritise blockchain use cases, complemented by an interview programme to test their viability in the industry. The rigorous process combined ideation sessions, run by STL Partners in close collaboration with the client, with ongoing primary research to test the use cases with the market.

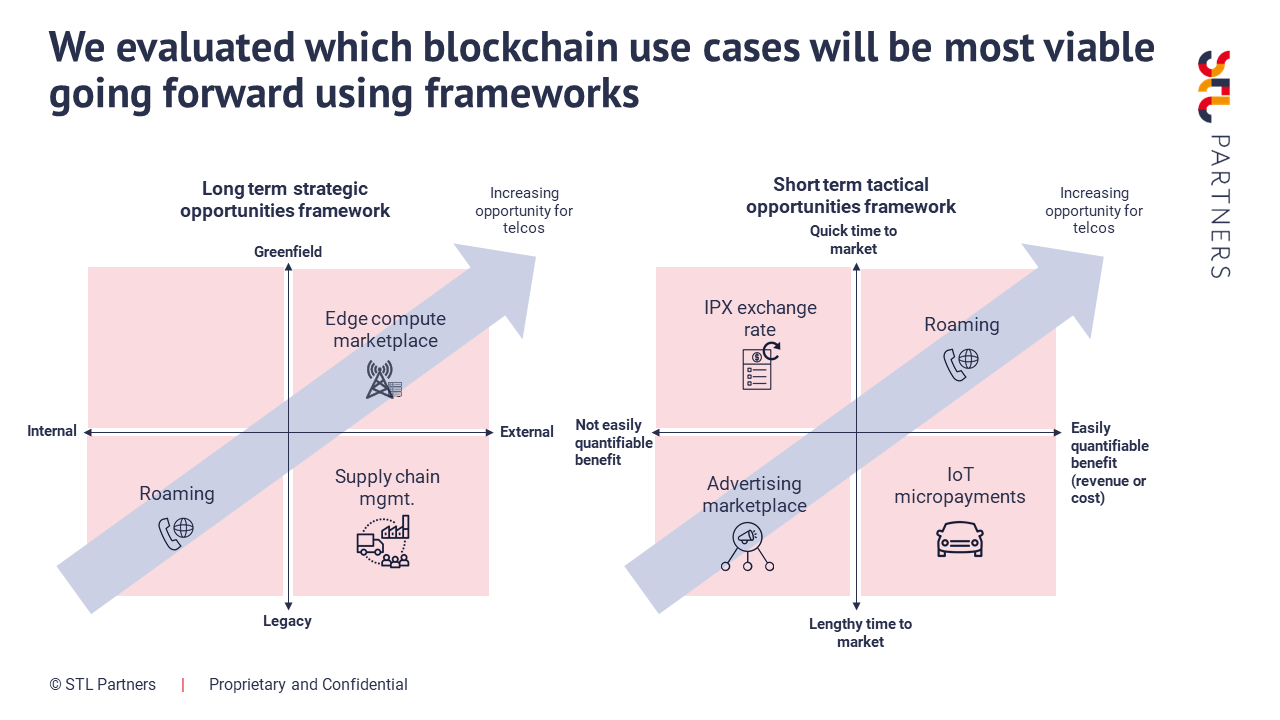

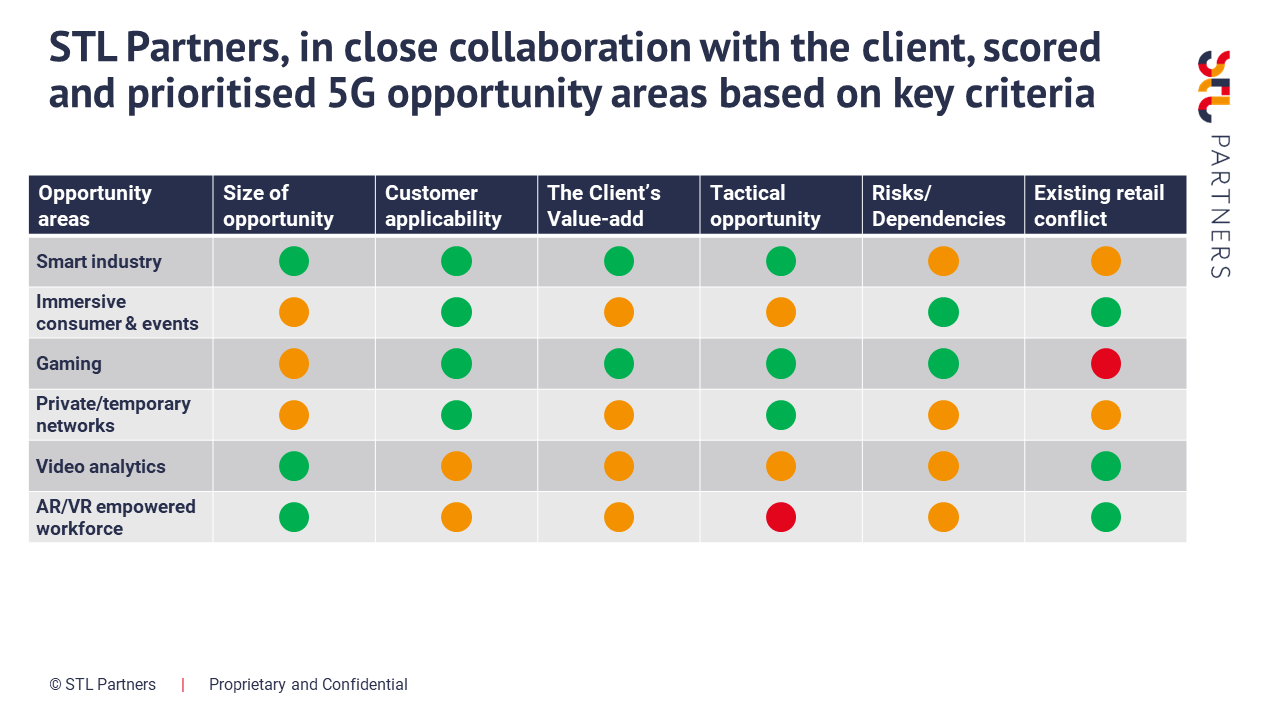

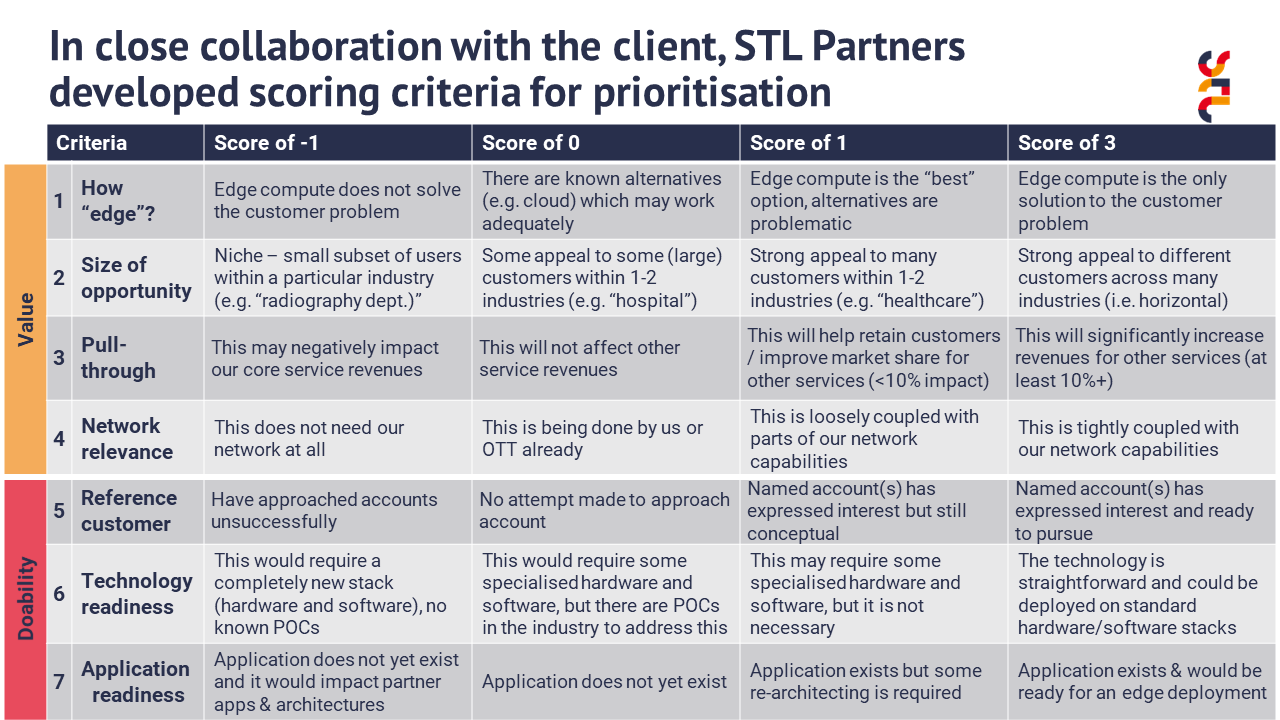

To prioritise the use cases we scored each against a set of key requirements including:

- Clarity of business model for our client

- Ease of implementation for the use case including barriers to change

We then discussed the output of the scoring in a workshop, using dynamic visualisations to test which use cases should be prioritised for the next phase of the project.

Example deliverables

Example deliverables

Detail promising use cases

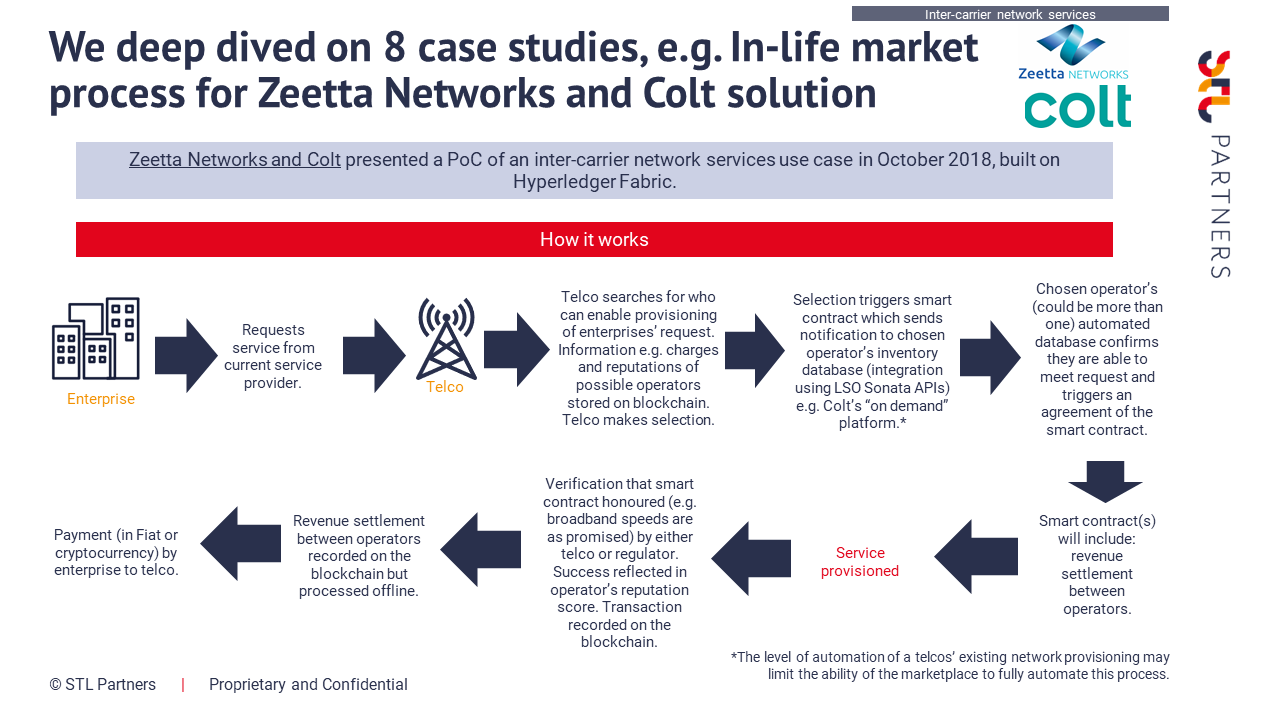

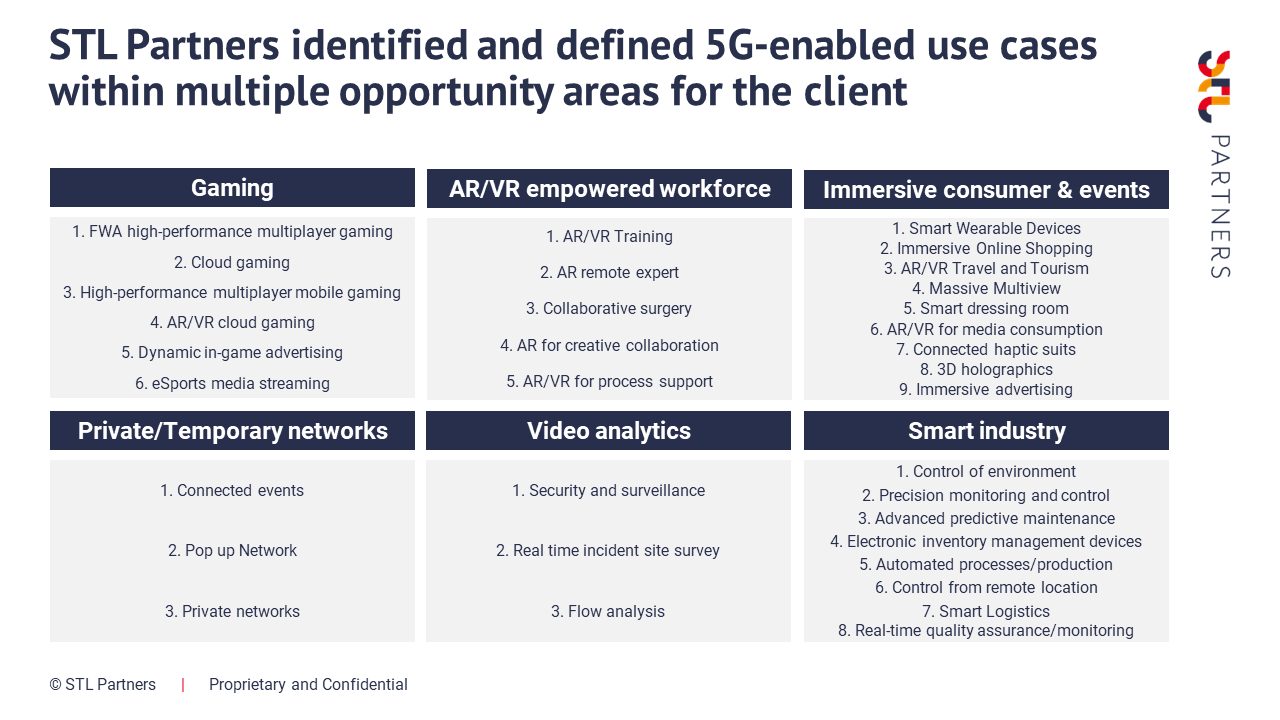

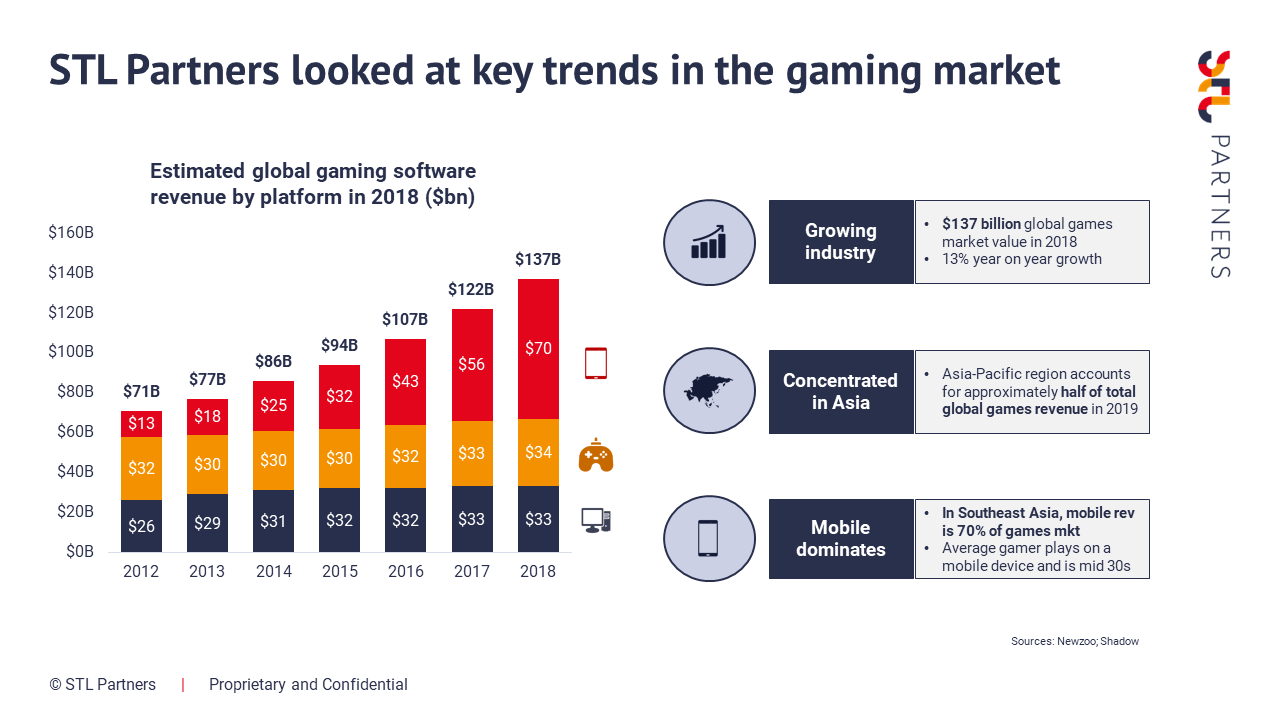

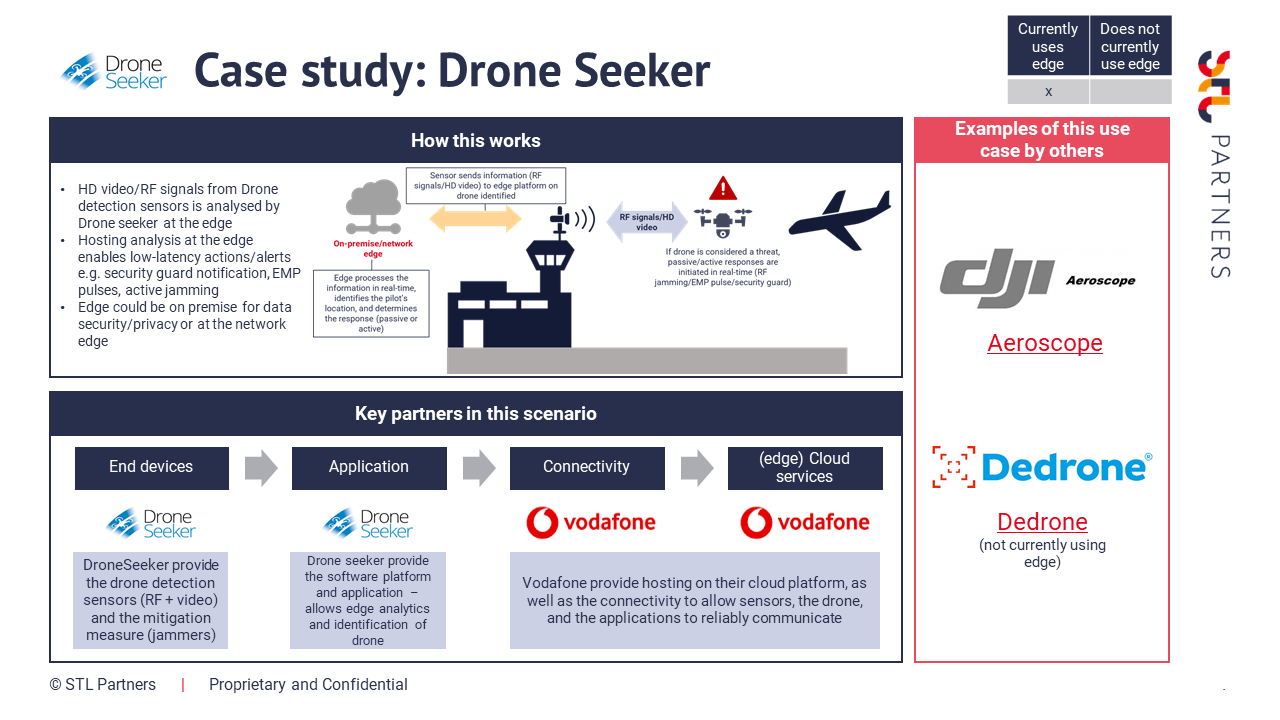

STL Partners researched 8 of the most promising use cases in more detail. We identified examples of POCs or in-life deployments of the use case, the value proposition for all parties, and the key drivers for adoption of the use case.

We then published two reports on behalf of our client. The first defined the market situation for blockchain, explored the role of telecoms operators, and outlined more than 35 viable use cases. The second deep-dived on the 8 most promising use cases and explored the benefits and the partnership models for them.

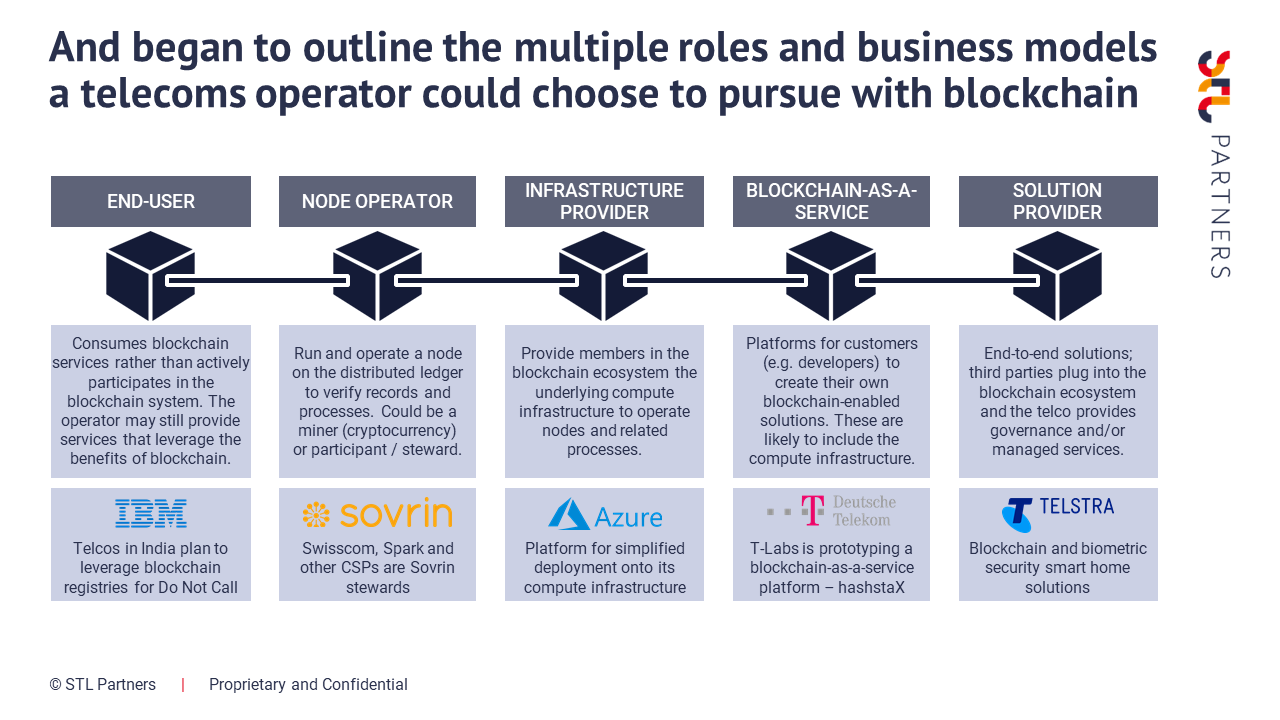

Provide internal strategic guidance on POC

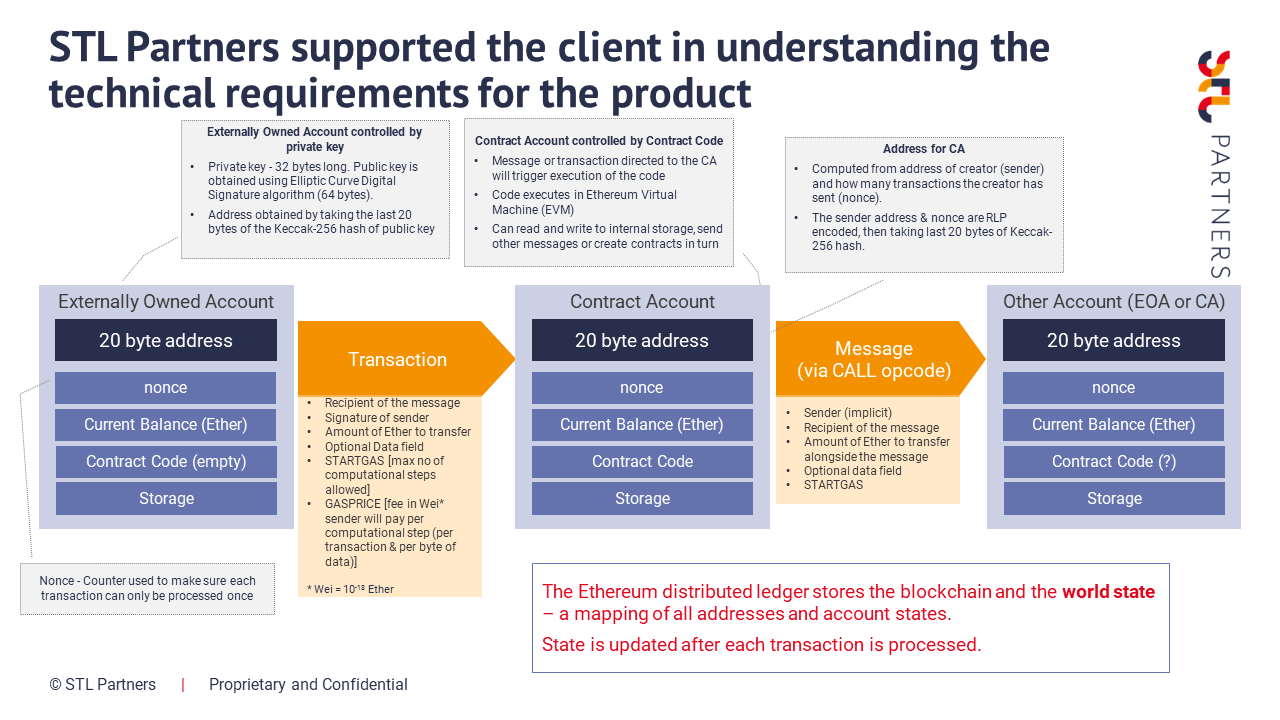

STL Partners worked with our client to define the technical requirements for a POC and identify potential partners.