What is CBRS (Citizens Broadband Radio Service)?

Citizens Broadband Radio Service (CBRS) enables the use of private networks on the unlicensed spectrum of the 3.5Ghz band (3550 – 3700MHz). In this article we explore how it works by looking at the three access tiers set out for the technology.

What is CBRS?

The Federal Communications Commission (FCC) is a U.S. government agency that regulates interstate and international communications by radio, television, wire, satellite and cable and is the primary authority for communications law, regulation and technological innovation.

In 2015, the FCC developed a framework for shared commercial use of the 3550-3700 MHz band (3.5 GHz band). Citizens Broadband Radio Service (CBRS) was established with a tiered access and authorisation framework to accommodate shared federal and non-federal use of the band. Industry bodies WinnForum and OnGo Alliance collaborated with the U.S. Navy and other incumbents in the band to define the standards and encourage the adoption of the technology. In a nutshell, CBRS can be used for private networks (predominantly LTE/4G today, with plans to support 5G in the near future), as well as for macro extensions (additional wireless capacity for carriers’ macro networks), and fixed wireless access for backhaul.

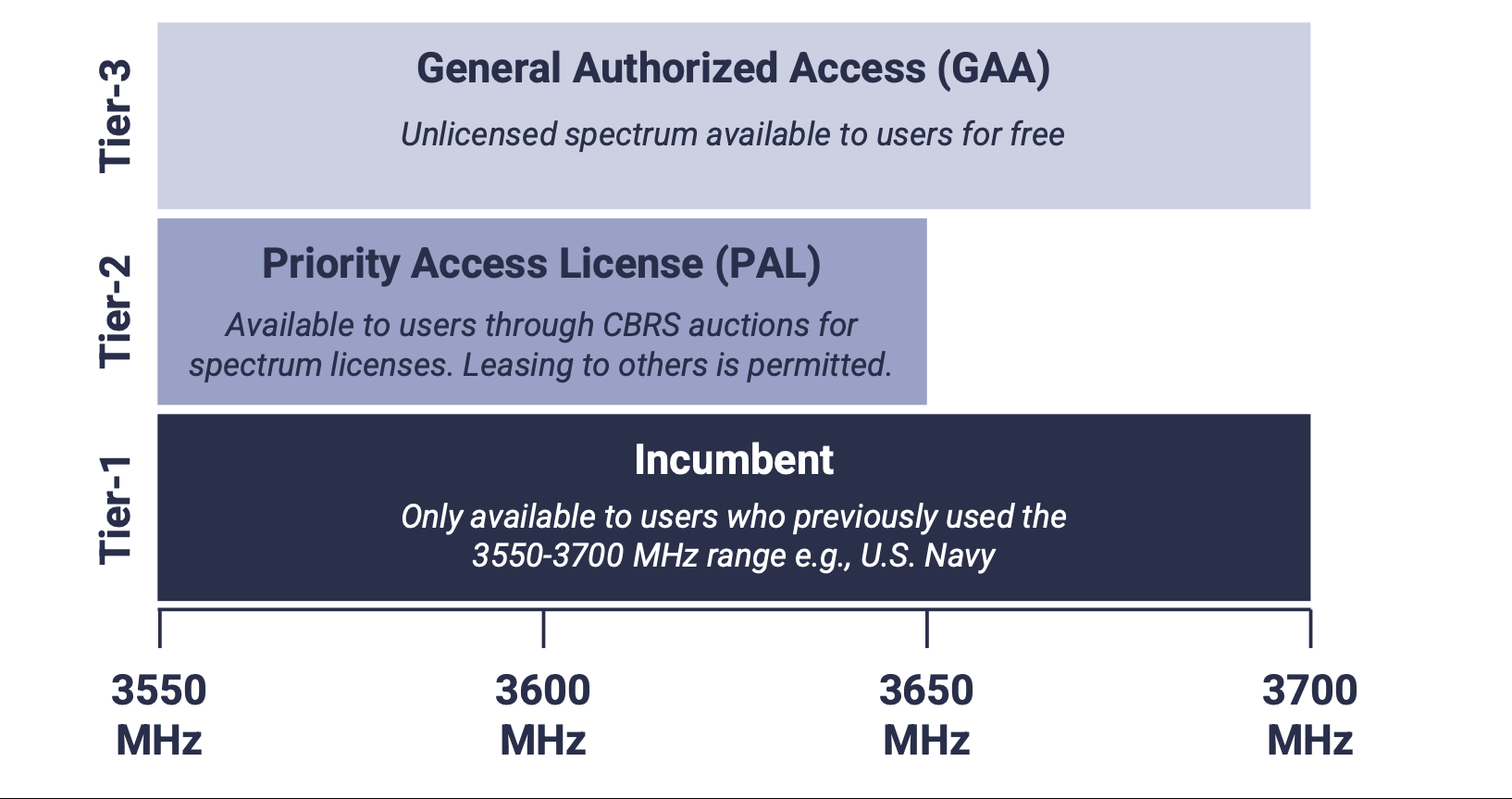

There are three types of CBRS users (CBRS access tiers). To avoid interference, only one user can use a specific channel at a given time. The tiered system explained below determines how users share access to spectrum:

The three tiers for CBRS access

- As could be expected, Tier-1 Incumbent Access users have the most significant privileges and receive protection against harmful interference from Priority Access Licensees and General Authorized Access users. This tier is mainly reserved for the U.S. Navy which has fairly low utilisation of the band in certain locations across the country which means that its impact on other users is limited.

- PALs, on the other hand, must protect and accept interference from Incumbent Access users even though they have to acquire regional priority access licenses to be able to use the band. In fact, the CBRS 3.5 GHz auction for PALs concluded in 2020, raising $4.58B after 76 rounds. The auction was the first in its kind offering mid-band spectrum for wireless carriers’ 5G services. PALs receive protection from General Authorized Access users.

- GAA users have no expectation of interference protection from users in the other tiers or other GAA users within the same group. This tier is degined to permit open, flexible access to the band for the widest possible group of potential users.

The spectrum allocation and management among different users is controlled by a spectrum access system (SAS). SAS managers have been designated to manage this process and include players such as Federated Wireless, Sony, Google, and Amdocs. The way this works is users put in a request in the SAS system to use the band and access is granted if the spectrum is free in the given location. Essentially, SAS vendors have systems that notify them when incumbents need to use the system so that they can redistribute the spectrum and avoid outages.

CBRS has been deployed across a number of industries and for a variaty of use cases in the past few years. Some of the prominent deployments focused on smart cities (e.g., Tuscon, Arizona or Las Vegas, Nevada) and even live entertainment (e.g, NFL stadiums, 7 Cedars Casion). We have explored CBRS, its latest developments and the most significant debates around this technology in this article and the associated live session.

Examples of CBRS deployments

Download this article as a PDF

Read more about private networks

Private networks insights pack

Our pack will provide you with a summary of insights from our private cellular networks practice

Innovative private network deployments from 2023

Activity in the private networks space is accelerating. This article features innovative private network deployments in 2023.

Is there still a market for private LTE?

With all the talk of private 5G, is there still a market for private LTE? This article will investigate the existing market for private LTE and what place it has in the private networks market in future.

Are automated vehicles really a killer use case for 5G?

STL Partners spoke to leading automated vehicle manufacturers to find out more about their connectivity needs.