AI-LINK Network Q&A: Enabling better outcomes with private 5G and AGVs/AMRs

We recently sat down with Letian (Lee) Rong, Chief Marketing Officer at AI-LINK Network, to get his perspective on the maturity of the enterprise private 5G market globally and learn more about recent developments and deployments in the space. AI-LINK focuses on bringing end-to-end 5G and edge solutions to enterprise customers.

Introduction

AI-LINK is a product and service provider focusing on industrial IoT and customized end-to-end 5G connectivity. We interviewed Letian (Lee) Rong, Chief Marketing Officer at AI-LINK Network, to discuss the maturity of the enterprise private 5G market and AI-LINK’s recent deployment of AGVs/AMRs in China. Below are highlights from the interview.

How have you seen the private cellular market progress in the last 1-2 years?

Things are moving forward, but still relatively slowly. It takes some time to get to a point where we are utilising new communication technologies like private 5G, for example to enable next generation automated guided vehicle (AGVs) and/or autonomous mobile robot (AMR) systems. But we’re already passing the point where customers don’t yet know what private 5G was. A few AGV/AMR companies (including in Europe) have done scaled projects, not necessarily with a dedicated private 5G network but you may have a virtualised private 5G, with the UPF and MEC for the customer but have a shared 5G core at the operator side. Still not quite dedicated private 5G, but nevertheless, it’s about the experience you gain through these types of deployments. On the other hand, we do see that private 5G is gradually gaining traction and scalability globally, picking up the pace.

A few things have changed in the last 1-2 years. First, the volume and density of barcode-scanning AGVs in warehouses has been growing at a much more rapid during the COVID-19 pandemic. For example, there’s a huge increase in ecommerce or online shopping in Japan. This has pushed enterprises to modernise the back-end warehouse logistics and drive transformation across the whole value chain.

You have recently completed a commercial launch of a private 5G deployment connecting 100+ AGVs with JD Logistics. Could you explain how this solution works?

During the ‘618’ (18th June) period, the second largest shopping day in China, this warehouse needed to process 110,000 shopping orders during a peak 24-hour sales period – this can reach up to an order of magnitude higher compared to the average during off peak periods. With JD Logistics, we launched a scaled commercial deployment of private 5G smart warehouse, with 172 AGVs deployed in a warehouse of 6,600 square meters, 100 of them connected by 5G and 72 by Wi-Fi.

With this deployment, we were able to show the following outcomes comparing private 5G and Wi-Fi side by side:

- The system is 5% more efficient in terms of fewer AGV breakdowns, more uptime spent delivering items at a faster speed, less downtime spent charging given the efficiency

- Assuming a peak of 110,000 items, you are able to deliver 5,500 more items in the same given time

From an implementation and operational standpoint, what have been some of the key tangible differences in enabling AGVs with private 5G versus Wi-Fi?

Previously, with Wi-Fi, you needed to deploy one access point for every 200-300 square meters. If we divide 6,600 by 300, that would work out to at least 22-33 access points required. The installation adds up to a fairly significant cost when you set up so many Wi-Fi access points on the ceiling. Having that many access points to manage is also challenging, particularly when an incident happens. It would also be more difficult to locate the point of failure, because you have a lot more points of access points to investigate and triage where the problem is. Oftentimes these Wi-Fi APs deploy a daisy chain connection – one connected to the next one – rather than a ‘star connection structure’. The seamless handover between access points, which is particularly important given you have moving AGVs, is challenging.

But we only used 4 5G nodes to cover the whole 6,600 square meters but 3 is probably sufficient. We still have the hardware redundancy installation. For each ‘hub’, we have 2 5G baseband units and x86 servers with the 5G core running so that in the case of a hardware failure happening, you are able to switch immediately to the other set up. This was particularly important as in the peak periods, the warehouse may even be running 24/7 for a few days.

https://www.youtube.com/watch?v=-Bflyh_VR7o

We often talk about having an anchor use case for private 5G and building on top of that, what are your thoughts on how this applies to your experience?

So far, we have only scratched the surface at the moment in looking at how private 5G can be used to improve and enhance AGV systems. There is so much more scope to expand this. This can include:

- replication of this AGV deployment to other warehouses that are very similar or almost identical to this one,

- greater integration between private 5G and edge compute to further streamline the overall solution,

- expansion of the deployment beyond just looking at AGVs

We recently also partnered with Keysight for an end-to-end performance validation, during which we were able to emulate more than 200 AGVs in a dense environment. So, 100 to us in the JD.com use case was only half of the scale or the capability of our system.

Another feature we are looking into right now is related to power saving. We have already tested the terminal and for next steps we’re going to look for less turn charging. More efficiency finishing the same task and less breakdown can reduce the power consumption. We do see that collectively, the 5G based AGVs are spending less time charging compared to Wi-Fi.

When you have a reliable, low latency wireless link with very little network jitter with private 5G, there are many ways to streamline the overall system to have AGVs running faster and in a more stable fashion but AGVs are just part of a bigger picture. When you have orders coming in through the warehouse management system (WMS), that connects to the robot controlling system (RCS). That system connects to the system that manages the navigation of the AGVs from point A to point B, then from points C to D etc. These are all interconnected processes that are typically not well aligned at the moment. The scheduling of each AGV used to take roughly around 200-300 milliseconds but you can decrease that scheduling period and do this much faster by having this underpinned by a more reliable 5G link.

Speaking of the interplay between private 5G and edge, is the processing happening primarily on the device edge (AMRs) or the on-premises edge?

We have been exploring this for a while but it may still be a bit too early. Firstly, from the supply side, the ecosystem is not quite there yet in terms of the maturity, cost and performance of solutions out there. We have done some PoCs though to offload the processing power onto the (on-premises) edge to our edge server.

Secondly, from the demand side from AMR solution providers, many have mentioned that it is still too early to have that much data processed. However, this will be the future as the complexity of AMR systems increases and more innovations start to happen.

We are already starting to see more intelligent AMR systems, including ones that are equipped with more cameras and others that are equipped with a robot arm that can do more than just moving goods from A to B. If you have these types of more advanced AMR systems, it becomes very compute intensive so it becomes not economically feasible to have all of that compute sitting on the AMR itself so in the future, we will likely see more AMR systems deployed with an on-premises edge computing solution.

What suggestions or steps would you recommend to enterprises who are interested in private cellular?

The timing is better than ever to start trialling private 5G because the ecosystem is becoming increasingly mature in terms of 5G readiness as well as the actual terminals. For example, in the last six months, the price of terminals has definitely come down and the performance is much more stable. We have been looking at a particular Digital Transmission Unit (DTU), which is essentially a smaller CPE to integrate onto the AGVs/AMRs.

A year ago, this was nowhere near mature, the price wasn’t cheap and the performance wasn’t great but now with our recent lab tests, it has changed a lot. So now I think it is a good time for enterprises to experiment. For many developed countries such as Japan, with the TCO of a private 5G network, you can almost break even compared to Wi-Fi and it is a much superior connectivity solution. As the costs continue to come down as the capabilities increase, why not trial it out?

Many thanks to Dr. Rong from AI-LINK for this interview:

Download this article as a PDF

Read more about private networks

Private networks insights pack

Our pack will provide you with a summary of insights from our private cellular networks practice

Is there still a market for private LTE?

With all the talk of private 5G, is there still a market for private LTE? This article will investigate the existing market for private LTE and what place it has in the private networks market in future.

Private networks in hospitality and venues

We look at the utilization of private networks in hospitality and venues, examining the added value they bring to the customer experience.

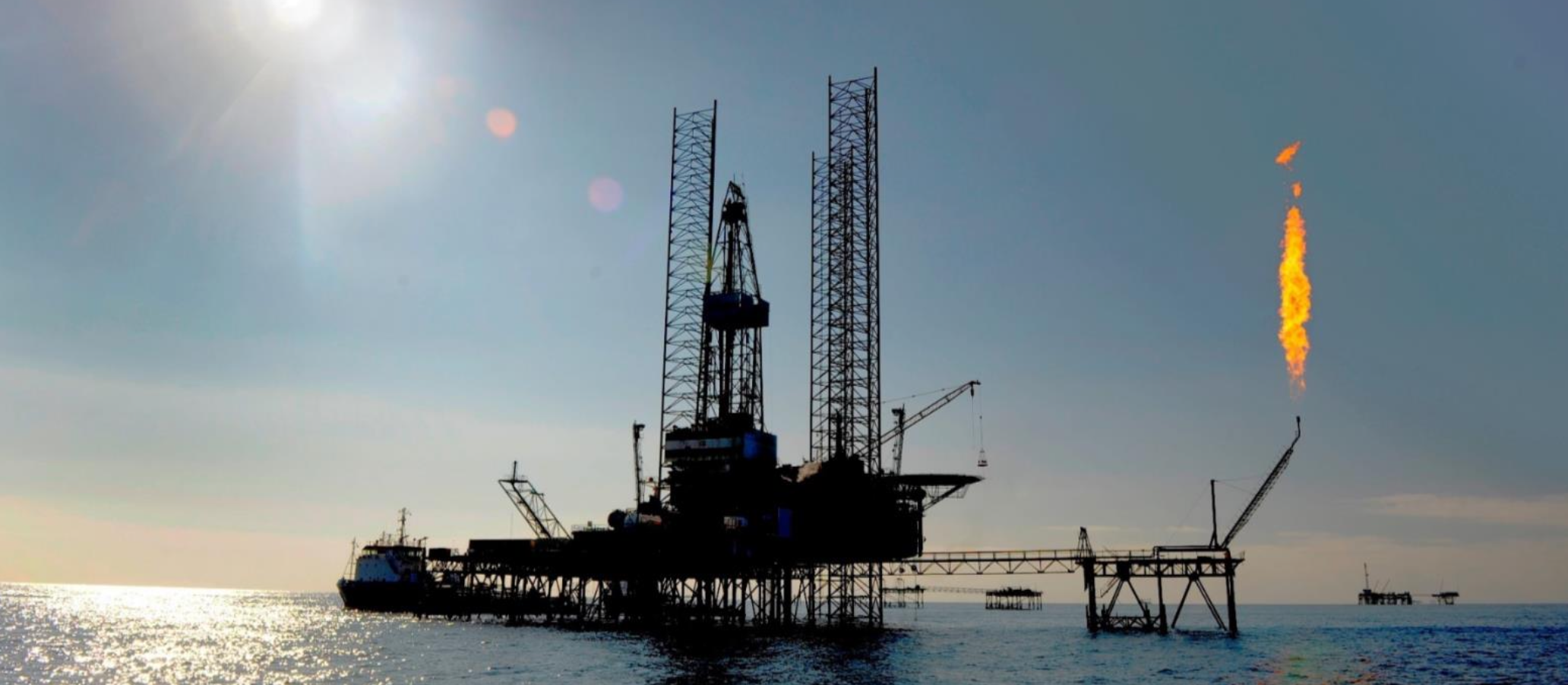

Private networks use cases and deployments: Oil & gas

This article explores the role of private networks in the oil and gas industry, looking at key use cases and example deployments.