Telco Network Energy Efficiency: The Role of the RAN in Future Energy Consumption

With sustainability increasingly front of mind for stakeholders, operators are looking to the RAN for telco network energy efficiency solutions to support their journey to net zero. This article details both the need for such solutions and what is on offer in the current marketplace.

RAN Energy: How the Radio Access Network Contributes to 1% of Global Energy Consumption

According to various estimations, telecoms operators are responsible for roughly 1-2% of global CO2 emissions (eg Orange puts this at 1.6%). In addition, in a telecoms network most of the energy consumption comes from radio access network (RAN) with one GSMA study finding that the RAN was responsible for roughly 73% of the energy consumption for operators taking part in this study. Even accounting for the share of the telecoms industry’s carbon emissions which are not produced as a result of electricity consumption, combining these two figures it remains easy to see that the RAN is likely to be responsible for around 1% of global energy consumption. This is a staggering proportion when considering that industries such as aviation and shipping, which are responsible for 1.9% and 1.7% of global emissions respectively, receive far greater media coverage about their detrimental impact on our environment.

How 5G Impacts Telco Network Energy Efficiency and Increases Energy Costs

In addition to this static baseline for the current impact of telcos on global carbon emissions, there are several drivers which are set to increase telcos’ energy consumption, and in turn their carbon emissions. In particular there are several impacts related to the ongoing global rollout of 5G, across both deploying 5G in new markets and the densification of networks within existing markets. This move to 5G is likely to increase energy consumption in two key ways. Firstly, the increased data transfer speeds offered by 5G networks are enabled by higher frequency bands, which in turn require more energy to transmit data. In addition, 5G networks require more dense networks than 4G networks, to counter their shorter range and greater propensity to be obstructed. To overcome this, 5G networks (particularly those utilising millimeter wave spectrum) require a denser network of antennas and small cells, which in turn requires more energy to operate at an aggregate level as the number of sites increases.

These technical drivers both exist assuming constant levels of data traffic. However, in reality a key driver of the rising forecasts of 5G network energy consumption is the increase in data traffic, with Ericsson placing the increase in mobile data per smartphone at a CAGR of 21% from 2022 to 2028. This is primarily driven by the increased prevalence of high-speed 5G networks stimulating the demand for streaming large amounts of data over these new networks, in particular video streaming for both consumer and enterprise use cases.

Telco Power Savings: Addressing Increased Energy Consumption Amid Net Zero Targets Inspires Innovation

However, these proposed drivers of increased network energy consumption are not without counteracting forces. Operators have always sought to enhance telco network energy efficiency to combat telco energy costs and reduce energy consumption from a cost point of view, since energy costs represent a large proportion of their opex (STL Partners estimates that RAN energy costs currently take up nearly 50% of total RAN opex[1]). With the surge in ran energy demands, this has been a pressing concern, especially due to the rise in telco energy costs from the 5G buildout (see above) and other concerns such as sustainability rising up the agenda of execs across the industry and increased energy prices. For these reasons, energy consumption in the RAN is a key consideration and an area in which operators are keen to invest now in return for reduced cost both now and in the future.

[1] This and other cost estimates of operators’ RAN capex and opex are part of the assumptions for our open RAN ROI tool.

Innovations in RAN Energy: Pioneers Leading the Charge

Leading vendors, conscious of the importance of telco power savings, range from giants like Ericsson and Huawei to niche ISVs. They are all seeking to innovate with solutions targeting telco network energy efficiency. Ericsson is one example of an NEP innovating in this space, with solutions such as their ‘Micro sleep Tx’, software, which aims to automatically enable and disable the radio’s main power amplifier and other hardware blocks during fixed idle periods. When combined with AI-backed sleep modes on various components of their RAN stack, such as their MIMO offering, this works to minimise the amount of time that components are switched on and actively consuming energy, while ensuring they can rapidly switch back on when required and perform necessary tasks with no significant delay. Power improvements in the radio units will be the most significant factor overall in reducing energy consumption in the RAN since it is the radios are which require the most energy in access networks, as opposed to in the DUs and CUs.

Transitioning from Legacy to Open RAN: A Path to Telco Energy Saving and Reduced Network Consumption

The ongoing move towards open RAN also has the potential to be beneficial for RAN energy consumption in the coming years, although currently open RAN energy performance is not on a par with legacy solutions which run on optimised silicon dedicated to RAN workloads. Open RAN will help to open up the market to new entrants in the form of innovative specialist vendors who are able to focus their efforts on a specific software solution within the RAN (radios as well as CUs and DUs), as well as facilitating some of the generic cloudification benefits which also have the potential to be drivers of energy consumption reductions, such as:

- Consolidation of hardware – in particular, the centralisation of baseband units has the potential to reduce considerably the volume of physical equipment that operators need to deploy and operate at a base station, leading to a reduction in on-site energy consumption and a less than proportional increase of energy consumption at the given centralised location due to economies of scale and cloud economics, with particular benefits found in areas where base stations are powered by a comparably polluting generator as opposed to the electricity grid.

- Improved development agility – a more rapid and iterative approach to software development can enable the introduction of more energy-efficient software incrementally and more quickly. This can result in a decreased time to market for new, efficiency optimising solutions, ensuring energy consumption benefits can be realised more quickly.

- Increased flexibility and scalability – the increased flexibility and scalability offered by an open RAN deployment can be leveraged to enable AI-backed smart workload location software to ensure workloads are located across the network in a way which optimises for energy consumption.

VMware & Vapor IO’s recent partnership is a great example of how open RAN and ISV innovation can enable energy consumption reductions. Specifically, Vapor IO’s Kinetic Grid is combined with VMware’s Adaptive Policy engine to enable workload placement to be optimised for various priorities, including minimising energy consumption and emissions.

Another illustration of the industry’s commitment to telco energy saving measures is the collaborative efforts between Vodafone, Keysight Technologies, Wind River, Intel, and Radisys – who were able to reduce open RAN energy consumption by 9-12% at high and low traffic times, respectively, in lab testing using Keysight’s O-RAN Energy Savings solution, in another example that collaborative efforts enabled by open RAN can positively influence energy efficiency. Although this is yet to be scaled up to a large scale deployment, the early signs are positive that collaborating on open RAN solutions can enable significant energy consumption savings.

Charting the Future: Enhancing Telco Network Energy Efficiency for a Sustainable Telecom Industry

Of course, open RAN is not without its own challenges, both in terms of achieving performance parity in energy efficiency as well as other attributes. However, there are promising indications that future RAN architectures may enable some energy efficiency gains, and in turn help to reduce the significant proportion of telecoms emissions which come from the RAN. Operators should place significant emphasis on future RAN architectures as an area in which they can make significant gains in their internal sustainability credentials, and in turn increase their credibility with consumers, employees and government alike.

1&1 Drillisch AG: forging ahead with Open RAN

The greenfield German telecoms operator 1&1 Drillisch AG announced plans to speed up the deployment of its own Open RAN technology, aiming to provide at least 1,000 5G base stations by 2022. But it will probably take until the beginning of 2023 before the network can go live and existing customers can be migrated to its own infrastructure.

What is the RIC, and why should CSPs care?

As CSPs move towards O-RAN, the RAN Intelligent Controller (RIC) will be a key component in enabling transformation. In this article we explore what the RIC is, how far along the industry is with adoption, and how the RIC will benefit CSPs.

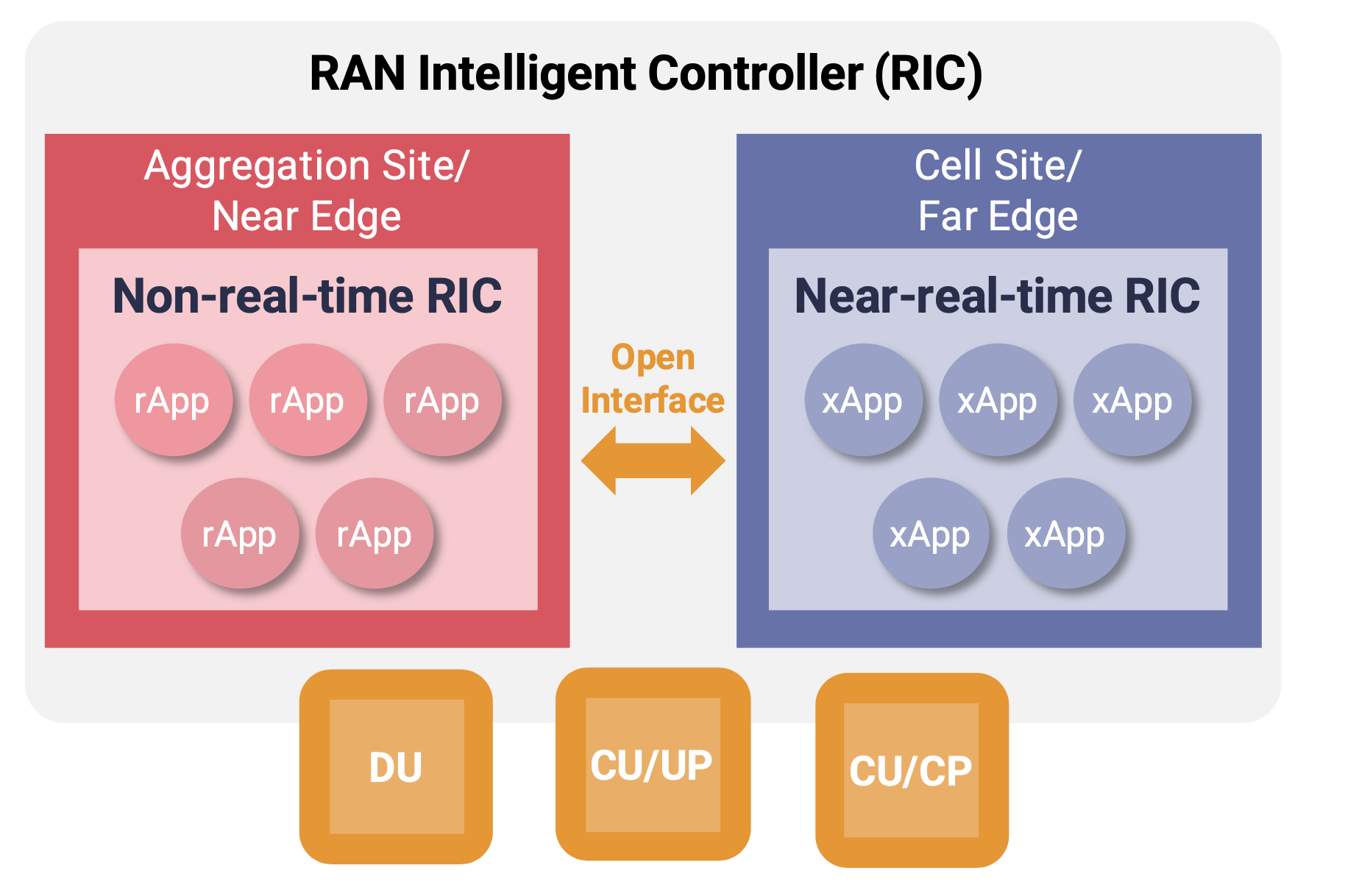

RIC, xApps, rApps: A Comprehensive Guide to the Key Players

As the radio access network continues to evolve towards more open architecture, opportunities for innovation in the Open RAN space have proliferated. One of the central components within Open RAN architecture is the RAN Intelligent Controller (RIC), which provides an open hosting platform for innovative xApps and rApps. We highlight 12 key players in this space.