Login to access

Want to subscribe?

This article is part of: Enterprise Platforms, Network Innovation

To find out more about how to join or access this report please contact us

Free has won market share and customer plaudits alike with its disruptive and original strategy in the French telecoms market. Its parent company Iliad has now developed an ingenious strategy for cloud. Our latest report shows how, and highlights lessons for all operators with ambitions to be more than a ‘pipe’.

Introduction

To understand how disruptive Iliad’s approach to cloud services is, it is useful to consider it within the wider context of operator cloud services and technology strategies.

Although telecoms operators have often talked a good game when it comes to offering enterprise cloud services, most have found it challenging to compete with the major dedicated and Internet-focused cloud providers like Rackspace, Google, Microsoft, and most of all, Amazon Web Services. Smaller altnets and challenger mobile operators – and even smaller incumbents – have struggled to find enough scale, while even huge operators like Telefonica or Verizon have largely failed to differentiate themselves from the competition. Further, the success of the software and Internet services cloud providers in building hyperscale infrastructure has highlighted a skills gap between telcos and these competitors in the data centre. Although telcos are meant to be infrastructure businesses, their showing on this has largely been rather poor.

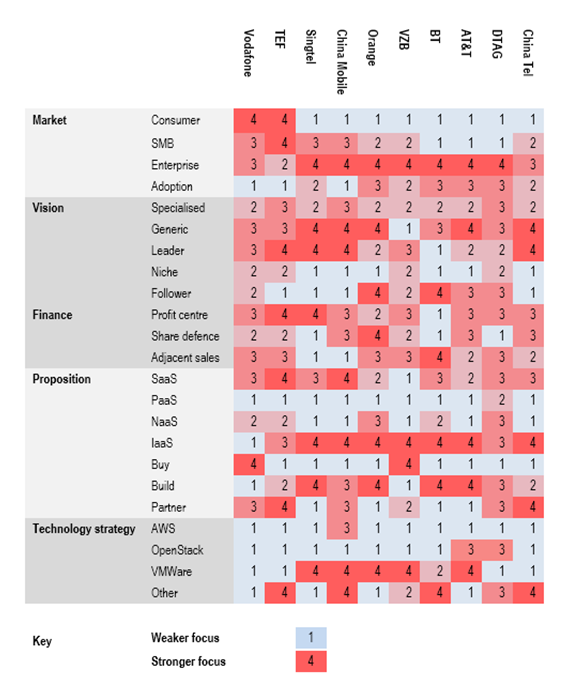

In our earlier 2012 Strategy Report Cloud 2.0: Telco Strategies in the Cloud, we pointed to differentiation as the biggest single challenge for telco cloud services. The report argued that the more telcos bought into pre-packaged technology solutions from vendors like VMWare, the less control over the future development path of their software they would have, and the more difficult it would be for them to differentiate effectively. We show the distinction in Figure 1 (see the Technology section of the heatmap). Relying heavily on third-party proprietary technology solutions for cloud would give telcos a structural disadvantage relative to the major non-telco cloud players, who either develop their own, or contribute to fast-evolving open-source projects.

We also observed in that report that nearly all the operators we evaluated who were making any effort to compete in Infrastructure-as-a-Service (IaaS) or Platform-as-a-Service (PaaS), had opted to resell VMWare technology.

Looking back from 2016, we observe that the operators who went down this route – Verizon is a prime example – have not succeeded in the cloud. The ones that chose to own their technology, building the skills base internally by contributing to the key open-source projects, like AT&T (with its commitment to the OpenStack solution), or who became a preferred regional partner for the major cloud providers (like Telstra), have done much better.

Figure 1: Telco strategies in the cloud, 2012 – most providers go with VMWare-based solutions

Source: STL Partners, Cloud 2.0 Strategy Report

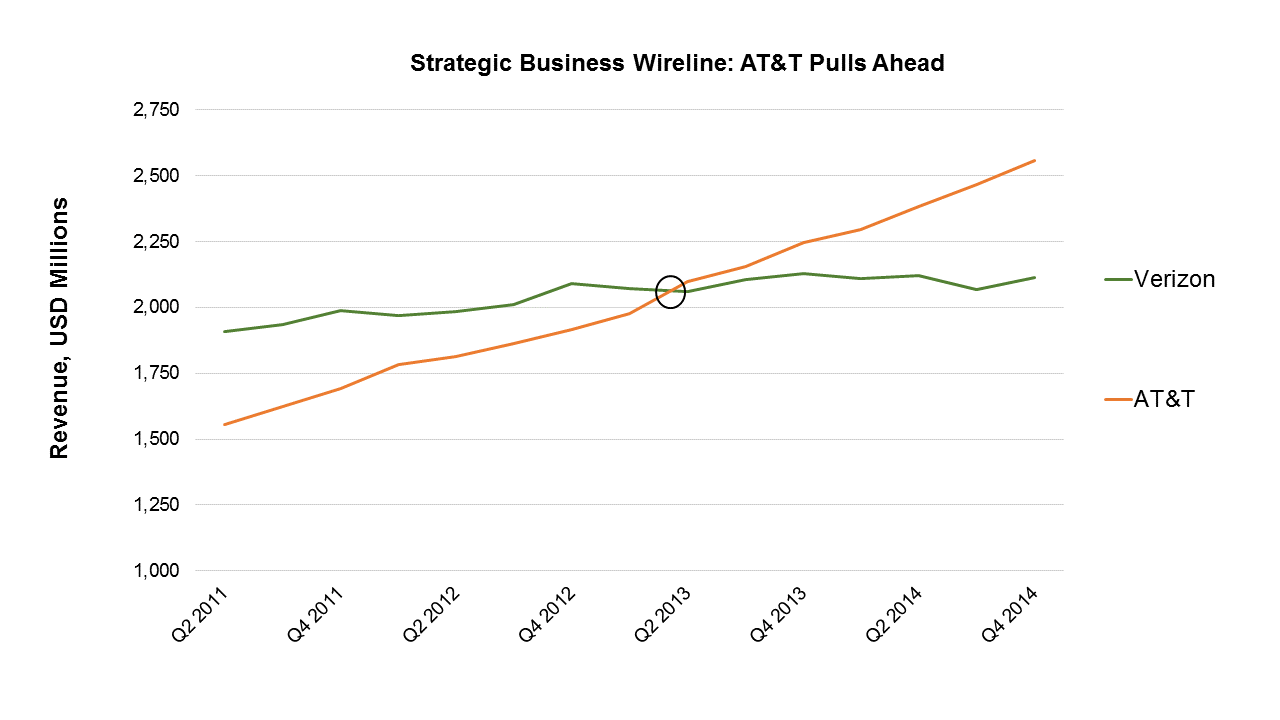

AT&T’s strategy of using the transition to cloud to take control of its own technology, move forward on the SDN/NFV tech transition, and re-organise its product line around its customers’ needs, has helped to set its revenue from strategic business services powering ahead of its key competitor, Verizon, as Figure 2 shows.

Figure 2: Getting the cloud right pays off at AT&T Strategic Business Services

Source: STL Partners

The above is the opening of the report’s introduction, which goes on to outline our views on the cloud market and reprise telcos’ opportunity and progress in it. To access the other 23 pages of this 26 page Telco 2.0 Report, including…

- Executive Summary

- Introduction

- Iliad: A Champion Disruptor

- Cloud at Iliad

- Responding to cloud market disruption: Iliad draws on its hi-lo segmentation experience

- Scaleway: Address the start-ups and scale-ups

- Dedibox Power 8: doubling down on the high end

- Nodebox: build-your-own network switches

- Financial impact for Iliad

- Conclusions

…and the following report figures…

- Figure 1: Telco strategies in the cloud, 2012 – most providers go with VMWare-based solutions

- Figure 2: Getting the cloud right pays off at AT&T Strategic Business Services

- Figure 3: AWS is not just a price leader

- Figure 4: STL Partners’ cloud adoption forecast

- Figure 5: Free Mobile’s growth repeatedly surprises on the upside

- Figure 6: Free Mobile’s 4G build overtakes SFR

- Figure 7: Free Mobile is a top scorer on our network quality metrics

- Figure 8: Free Mobile’s customer satisfaction ratings are excellent

- Figure 9: Specs for ‘extreme performance’ Dedibox server models

- Figure 10: The C1 ‘Pimouss’ microserver

- Figure 11: 18 C1s close-packed in a standard server blade

- Figure 12: Scaleway Hosted C1 Server Pricing

- Figure 13: The case for more POWER8: IBM POWER8 vs Intel x86 E5

- Figure 14: A Nodebox, Free’s internally developed network switch

- Figure 15: A useful business, if no AWS