Telstra: Battling Disruption and Growing Enterprise Cloud & ICT

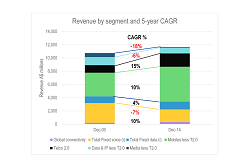

When Amazon Web Services (AWS) landed in Australia in 2012, everyone expected carnage for Australian carriers. Telstra’s Network Applications & Services division, though, is growing fast and making some interesting moves. How did Telstra do it, and what else can be learned from its successes and its latest moves into the Healthcare market?