How to be Agile: Agility by Design and Information Intensity

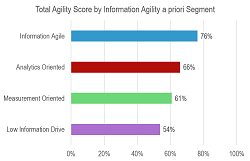

How agile are telcos today, what are the barriers and opportunities, and what can be done to improve agility? We look in depth at the findings from the Telco 2.0 Agility Challenge, and identify some key steps for telcos and partners to take, including specific organisational strategies to be ‘Agile by Design’ and the need for an ‘information intensive’ culture.